Skale Network (SKL) price bounced back this week as demand for the token and other cryptocurrencies continued rising. The SKL token jumped to a high of $0.0930 on Monday, which was about 375% above the lowest point in October.

Skale Network activity doing well

Skale Network is one of the fastest-growing players in the blockchain industry. It is a zero gas Ethereum Virtual Machine (EVM) with that helps developers accelerate their dApps. It also saves users money in gas fees.

Skale Network has been used by all types of developers in industries like Decentralized Finance (DeFi), gaming, and infrastructure. Some of the most notable developers in the ecosystem are Capital DEX, ReHold, and NFT Labs.

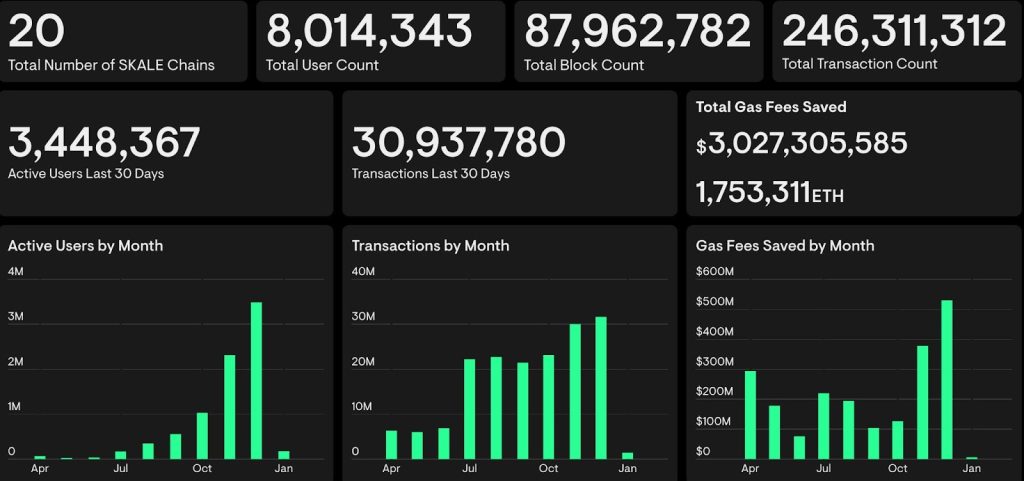

The most recent data shows that the network continued growing in December. According to its stats page, the number of active users rose to over 3.5 million in December from 2.3 million in the previous month.

Further data shows that the number of transactions in the past 30 days stood at over 30.9 million. That was an increase from the previous month’s 30 million. Most importantly, Skale continued saving its customers loads of money in gas fees. Total gas fees saved rose to over $529 million during the month.

Skale Network stats

Skale Network token also rose as other cryptocurrencies regained steam. Bitcoin surged to above $45,000 for the first time in over two years while the total market cap of all coins jumped to more than $1.8 trillion. Other tokens that did well on Monday were the likes of Lisk, Raydium, Sei, and Avalaunch.

Skale Network price forecast

SKL chart by TradingView

The daily chart shows that the SKL price bounced back on Tuesday as its statistics continued rising. It rose to a high of $0.9230, which was its highest point since May 2022.

This rebound happened after the coin retested the crucial support level at $0.069, its highest swing in November last year. In most cases, a break and retest is one of the most popular continuation patterns.

Skale Network price also rose above the 50-day and 25-day Exponential Moving Averages (EMA). Similarly, the Relative Strength Index (RSI) and MACD indicators continued rising.

Therefore, the outlook for Skale is bullish as the January Effect starts. This is a situation where assets tend to do well in January as investors return to work.

The post Skale Network (SKL) price suddenly wakes up as transactions rise appeared first on Invezz

invezz.com

invezz.com