A top crypto strategist says that one Ethereum (ETH) competitor may be setting the stage for another explosive move to the upside.

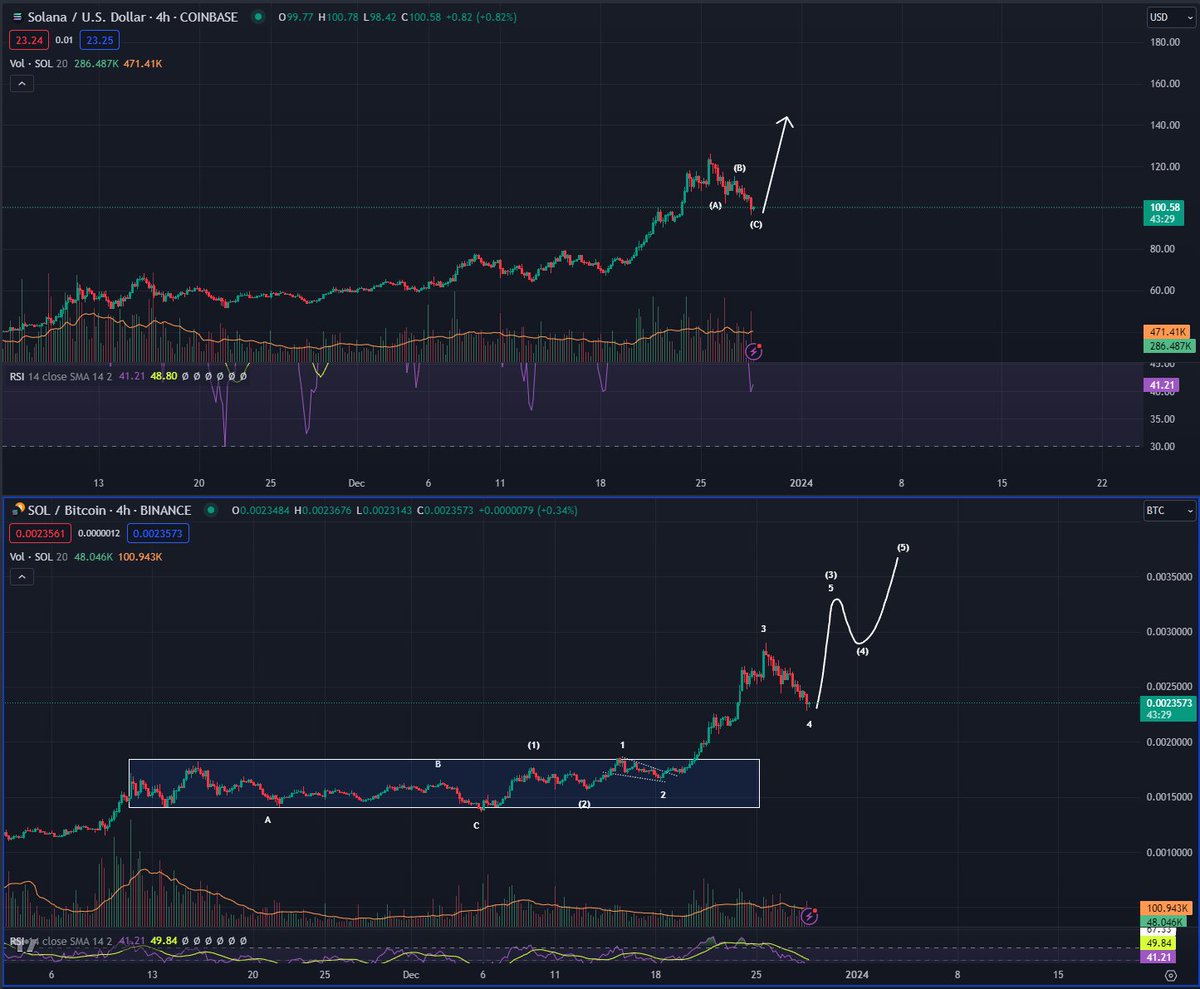

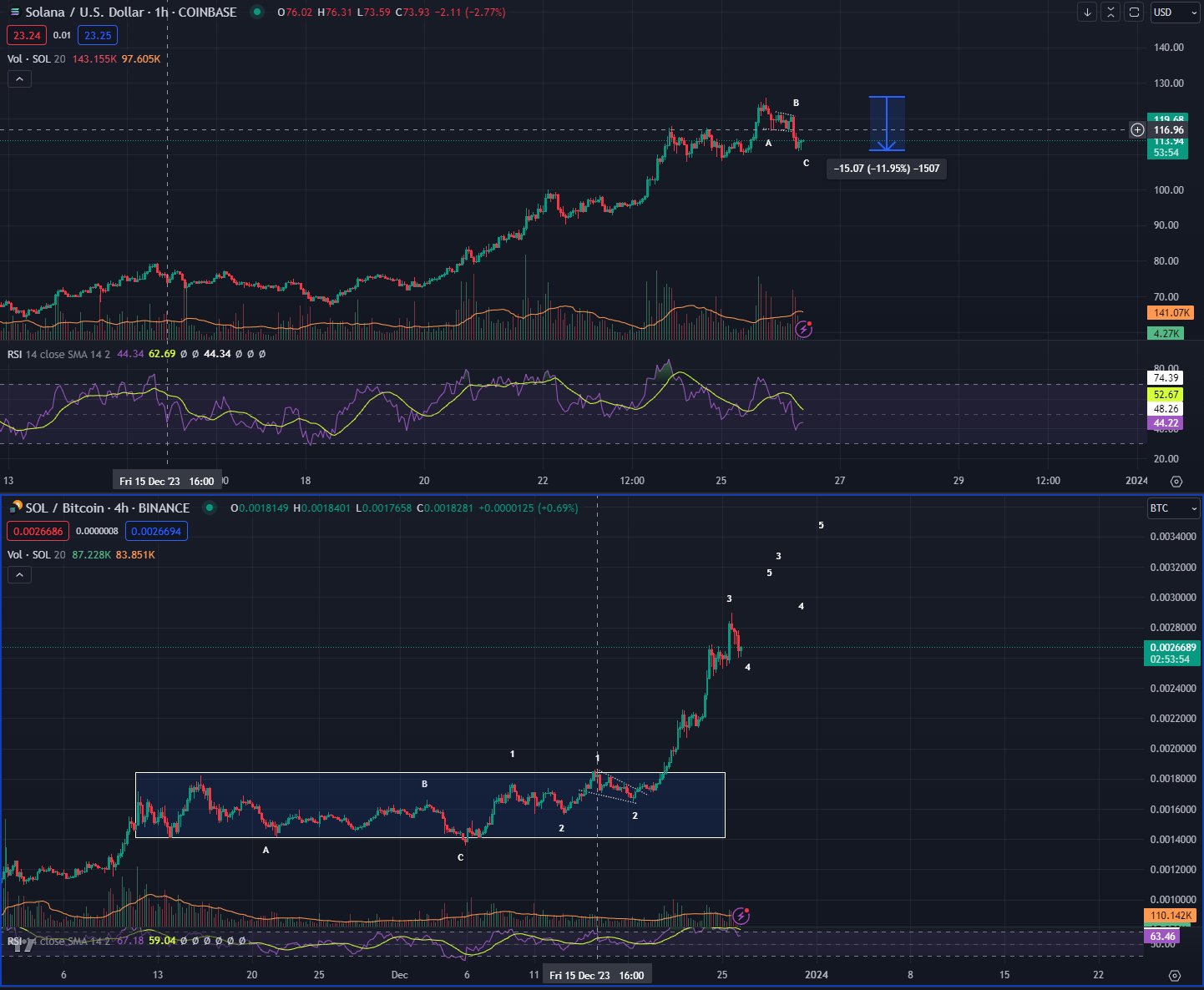

Pseudonymous trader Bluntz tells his 233,800 followers on the social media platform X that Solana (SOL) appears to be in the midst of an ABC corrective pattern.

Bluntz utilizes the Elliott Wave theory in his technical analysis. The theory attempts to predict future price action by following crowd psychology that tends to manifest in waves. A bullish asset tends to witness an ABC correction wave before igniting the next leg up, according to the theory.

“Love seeing the SOL obituaries on the TL (X timeline). Can’t wait to see the 20 million hedged tweets people will manage to rustle up from somewhere vaguely insinuating they called it when SOL turbo reverses to $140.”

Solana is trading for $104.42 at time of writing, after starting off the year trading for under $10.

The trader has remained bullish on Solana as SOL began dropping from a recent high of nearly $124. As SOL retraced to the $113 level, the trader predicted SOL would eventually move to new local highs. However, it subsequently dipped temporarily below $100.

“Nice little 12% dip there on SOL in a monster uptrend with a few more legs to go imo (in my opinion) on the BTC pair and USD pair. Don’t fight the trend.”

The trader also suggests that the ETH layer-2 scaling solution Arbitrum (ARB) is about to take off after an ABC corrective wave.

“ARB looks amazing here. In fact, so many charts do right now. We’re so back.”

Arbitrum is trading for $1.44 at time of writing, down 10.5% in the last 24 hours.

Generated Image: DALLE3

dailyhodl.com

dailyhodl.com