Bitcoin (BTC) recently experienced a price retracement, trading as low as $42,100, which moved the whole cryptocurrency market. Under a bearish sentiment, some cryptocurrencies have been heavily shorted, threatening short-squeeze events on December 29.

Notably, Bitcoin’s dominance suffered the most as altcoins were able to guarantee lower losses than the market leader. Amid signs of an altseason, an increased volume of short positions could ignite massive liquidations — driving the price upwards.

In particular, Finbold spotted two cryptocurrencies on CoinGlass’s dashboard that triggered our short squeeze alert. Cardano (ADA) and Radix (XRD) have a significantly higher volume, favoring shorts over long positions.

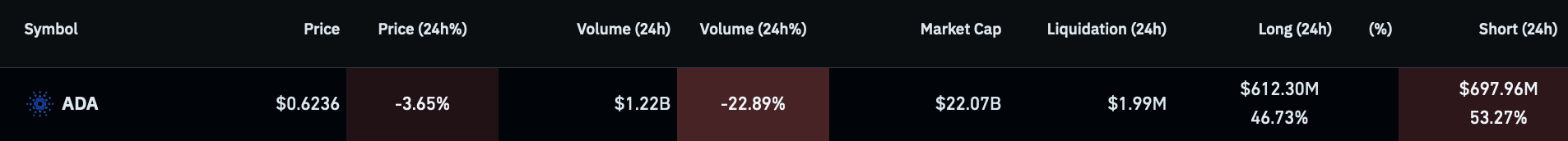

Short squeeze alert for Cardano (ADA) on December 29

The first short squeeze alert is for Cardano, one of the market’s oldest and most solid Ethereum (ETH) competitors. With a $22.07 billion capitalization, its native token trades at $0.623 by press time, down 3.65% in 24 hours.

Meanwhile, ADA’s derivative volume is at $1.22 billion daily, down 22.89% in the period, but slightly weighting to the $697.96 million (53.27%) opened short positions.

Interestingly, ADA is still looking for a break-out from a symmetrical triangle, as reported by Finbold on December 27. Holding above the technical pattern could start the expected short squeeze towards $0.78 per token. At the same time, these shorts liquidation could be the necessary impulse to make the break-out possible — in a chicken-egg situation.

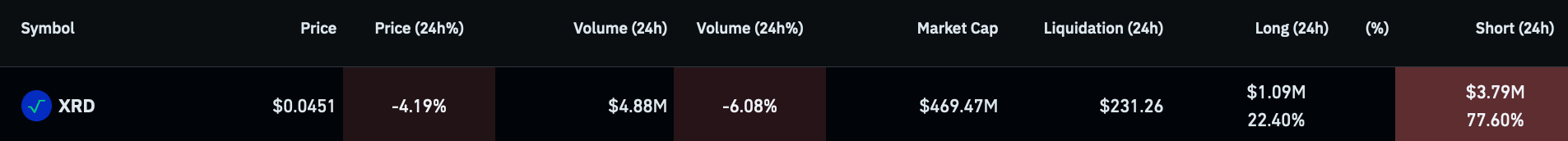

Radix (XRD) could skyrocket on December 29

An even more shorted cryptocurrency is Radix, an innovative Ethereum competitor focused on DeFi.

Essentially, XRD short positions accrue for 77.60% of its $4.88 million 24-hour volume. A pivotal bullish sentiment could liquidate over $3.79 million from short-seller traders for a massive short squeeze.

In the meantime, Radix’s native token is trading at $0.0451, down 4.19% on the day. Investors must remain cautious of XRD’s high volatility, considering it is a low-capitalization cryptocurrency.

However, there are no guarantees that these cryptocurrencies will go through a short-squeeze liquidation event. Cryptocurrency traders must research for themselves and consider each project’s fundamental aspects to make profitable financial decisions.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com