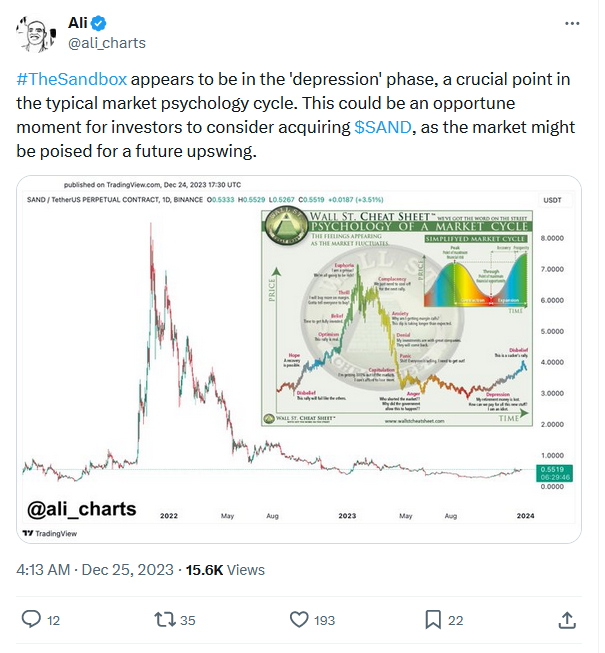

The price of $SAND, the token that powers the metaverse-based game, The SandBox, might be near its bottom and ready for an upward correction, analyst Ali Martinez noted in a recent post on X (formerly Twitter).

According to Martinez, the token’s price is in the “depression” phase of the typical market psychology cycle. An asset is said to be in this phase when it witnesses an extended period of low prices and low investor sentiment.

Furthermore, Martinez added that this presents a buying opportunity for investors, as the altcoin might be poised for a rally.

Is the Rally Underway Already?

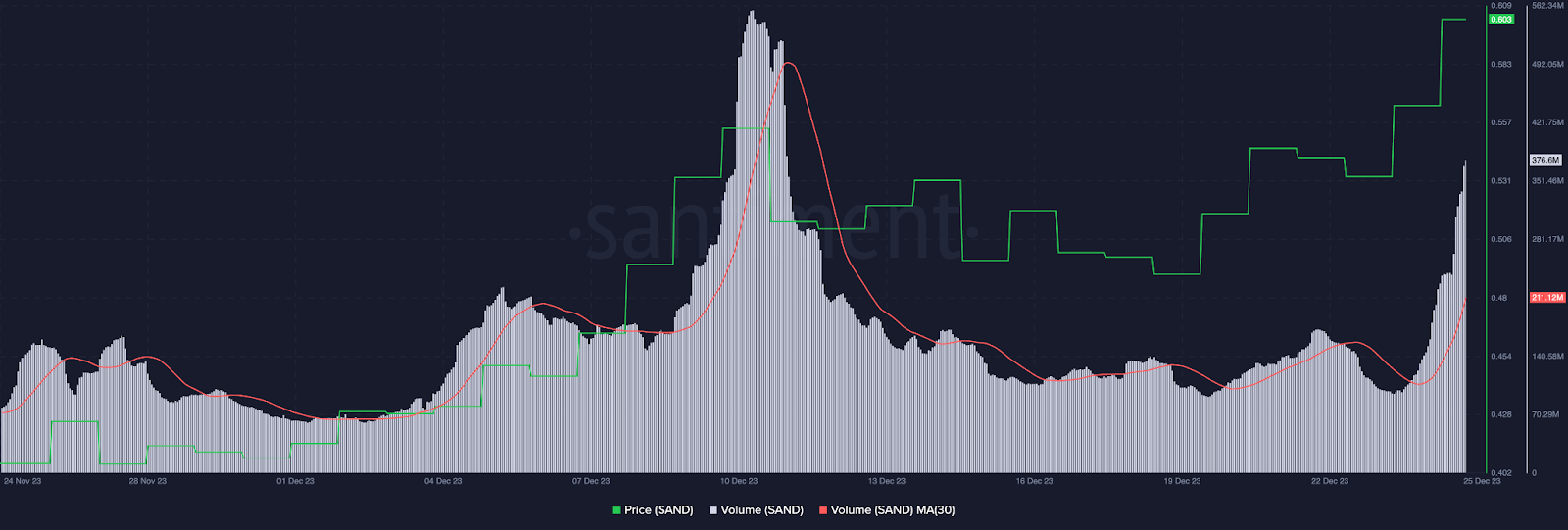

An assessment of $SAND’s price performance in the last month suggested that the predicted price uptrend might be underway already.

Exchanging hands at $0.6054 at press time, the token’s price has grown by 40% in the last month. Moreover, data showed that $SAND’s value has increased by 29% in the last week.

The price growth comes with a significant uptick in trading volume. According to data from Santiment, $SAND’s daily trading volume observed within a 30-day moving average has seen a 49% increase.

Additionally, on December 10, the altcoin recorded a trading volume of $525 million, marking its second-highest trading volume since January. At press time, $SAND’s trading volume totaled $356 million, representing its highest single-day volume in the last two weeks.

On the price chart, key momentum indicators showed a steady increase in $SAND accumulation. The token’s Relative Strength Index (RSI) was 71.88, while its Money Flow Index was 67.20, signaling a surge in buying pressure.

Moreover, the token’s Chaikin Money Flow (CMF) was positioned significantly above the zero line. With a CMF value of 0.34 and rising at the time of writing, it showed that buying momentum exceeded token sell-offs amongst traders.

It also signaled that the market continues to witness a high liquidity inflow, which has sustained the recent price uptick.

Despite the rise in $SAND’s value in the last month, profit-taking activity remains minimal. A look at the token’s exchange activity showed a 10% decline in the total amount of $SAND tokens held within crypto exchanges in the last month, according to data from Santiment.

Within the same period, there has been a 2% uptick in $SAND’s supply outside of exchanges. This showed that investors have increasingly taken their $SAND tokens off exchanges, minimizing the likelihood of a significant surge in sell-offs.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com