Tron (TRX) is among the cryptocurrencies making waves in the market in recent months, achieving key milestones for its on-chain metrics. After gaining almost 100% in the past year, the valuation of TRX remains a key area of focus for the crypto market, especially considering the network’s increased activity, which is likely to influence adoption.

With a spotlight on the value of TRX, Finbold consulted the generative artificial intelligence (AI) platform ChatGPT, designed by OpenAI, to offer insights into how the token might trade in the future. Indeed, the query focused on both speculative bullish and bearish scenarios for Tron on January 1, 2024.

To begin with, ChatGPT cautioned about the challenges of predicting cryptocurrency prices, noting that the sector is notoriously volatile. Prices are subject to various influences, including market sentiment, regulatory developments, technological advancements, and macroeconomic trends.

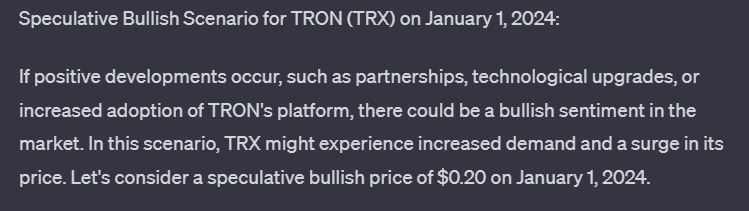

Speculative bullish scenario

According to the AI tool, if TRX faces favorable conditions, the value could rise to a bullish high of up to $0.20 on January 1, 2024. The tool pointed out that positive developments, such as strategic partnerships, significant technological upgrades, or an increase in the adoption of TRON’s platform, could lead to a bullish sentiment sweeping the market.

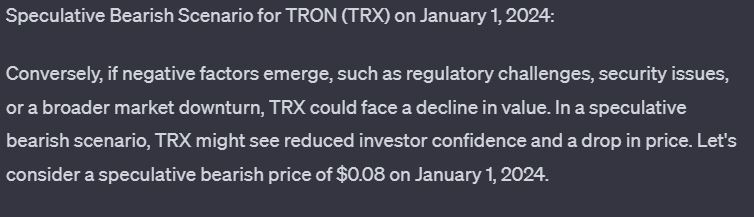

Speculative bearish scenario

On the other hand, if negative factors such as regulatory challenges, security issues, or a broader market downturn cast a shadow over TRON’s prospects, ChatGPT noted that under such conditions, TRX may witness a decline in value. This could be accompanied by reduced investor confidence, with the valuation potentially declining to $0.08 on January 1, 2024.

Tron on-chain metrics surge

It is worth noting that TRON has predominantly traded in the green zone in recent weeks, aligning with broader crypto market sentiments. However, the token has garnered substantial support from on-chain metrics, potentially indicating a bullish outlook.

For example, the upward price momentum propelled Tron to reach an impressive milestone of 200 million users in early December, a feat acknowledged by founder Justin Sun as a significant achievement and a testament to the expanding ecosystem. Before attaining the 200 million user mark, Finbold had reported that Tron had emerged as the go-to blockchain for stablecoin transfers.

Moreover, showcasing an impressive trajectory since the outset of 2023, Tron’s Total Value Locked (TVL) has surged by over 100% in 2023. According to DefiLlama data, as of December 24, the TVL stood at $8.28 billion.

In addition to these achievements, the platform has been proactive on the partnership front, with the recent notable integration with Blockchain.com Pay. This strategic move aims to provide TRON’s extensive user community with an enhanced and streamlined experience.

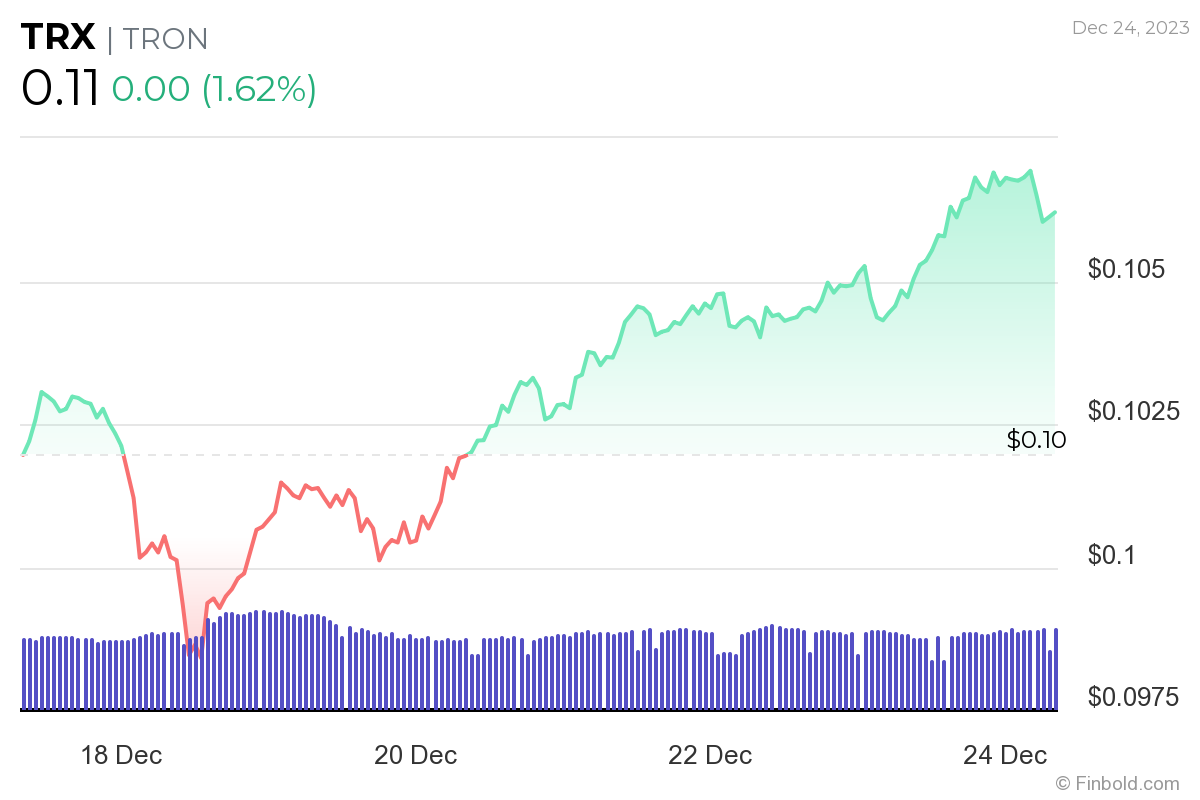

However, amidst these notable on-chain metrics, the valuation of TRX has encountered challenges, seemingly stalling at the $0.11 resistance mark. Conversely, the token continues to trade above the $0.10 support zone, with holders anticipating a significant upward movement.

Tron price analysis

By press time, Tron was valued at $0.11, reflecting daily gains of approximately 1.6%. Looking at the weekly chart, TRX has experienced a notable surge, marking an increase of almost 3%.

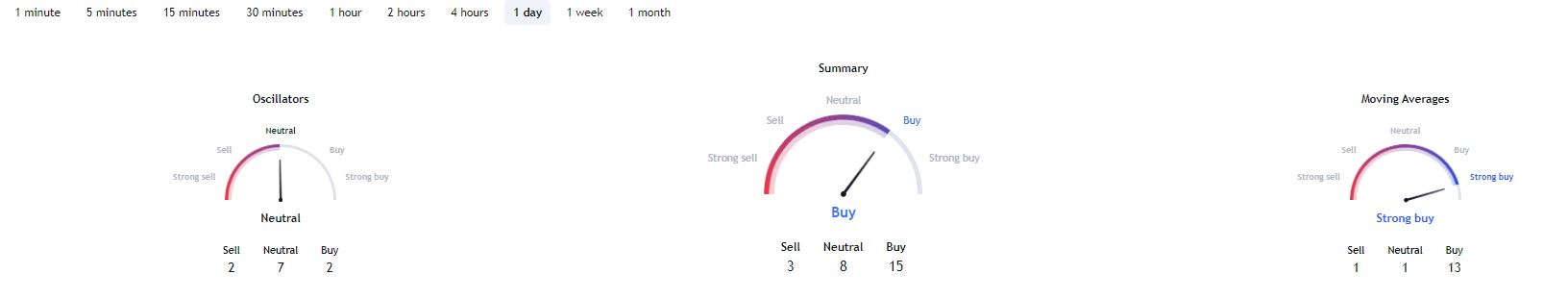

Elsewhere, a technical analysis of Tron, derived from TradingView, paints a bullish picture for the token. A summary of the one-day indicators suggests a ‘buy’ recommendation at 15 while moving averages signal a ‘strong buy’ at 13. Oscillators are currently ‘neutral’ at 7.

It’s worth noting that although Tron has performed positively on key on-chain metrics, the token’s future trajectory will likely be closely tied to the overall market momentum.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com