- 1 Ethereum Classic has made the process of transaction smooth. Know more in this post.

- 2 A possible breakout is near, see what is coming for the $ETC bulls.

- 3 The $ETC coin price has shown significant growth in the past few days.

Despite the bullish trend in the crypto market, Ethereum Classic’s ($ETC) performance since the end of October has been modest. Trading activity for several networks has increased due to the demand for spot crypto ETFs. Yet, Ethereum Classic’s market performance has been decent.

Ethereum Classic emerged as a separate blockchain platform due to disagreement over rolling back transactions. Its supporters believe in the principle of “code is law” and that smart contracts should be immutable. The $ETC token is the native token powering Ethereum Classic.

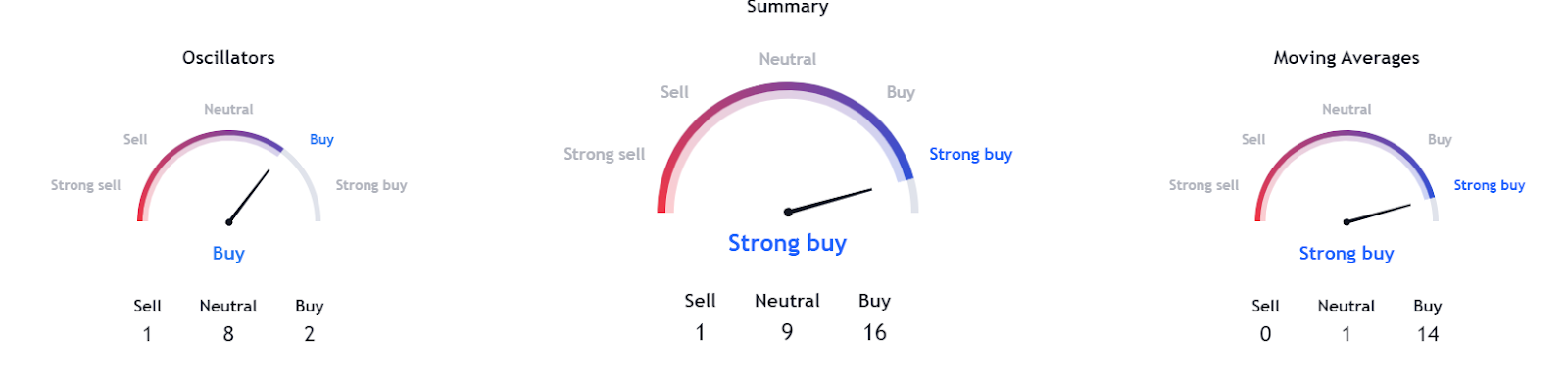

Technical Analysis and Prediction of the $ETC Coin Price

At the press time, the $ETC coin price is trading at $21.84, just below the direct resistance level of $22.20. However, the bulls are expected to prevail in the upcoming trading days, and the primary resistance level will likely break.

The 15-minute uptrend looks strong with EMAs supporting it. 50-min EMA: $21.09, 150-min EMA: $20.64.

The current trend is bullish and is expected to stay that way until the bears break the immediate support level of $20.58. However, yesterday’s surge is significant, leaving the primary support level behind.

What are the Features of Ethereum Classic?

$ETC has significant value as it serves various purposes, including payment for validating transactions within the Ethereum Classic platform. In addition to this, the platform covers the costs of securing block space on the smart contract network. Unlike staking, $ETC operates as a PoW asset, which means investors cannot earn rewards for securing the network.

However, investors can earn rewards on idle $ETC via the Savings feature offered by most centralized crypto exchanges. This feature enables investors to earn a variable interest across a stated time frame, such as a week or three months.

The Process of transaction validation

The process of transaction validation on Ethereum Classic is smooth. Sent transactions are initially gathered in a memory pool (mempool), which serves as temporary storage. Miners choose transactions they want to validate and compete to be the first to solve the complex cryptographic puzzle.

The first miner to solve this puzzle broadcasts the solution to the entire network to inform other miners. Other miners then carry out a revalidation check to ensure that the transaction follows the set-down blockchain rules.

The first miner receives the block reward (about 3.2 $ETC), while other miners get a commission from the transaction fee.

The transaction is added to a block of other transactions and attached to the last block in the network to form a chain.

Conclusion

$ETC has value for validating transactions and securing block space on the Ethereum Classic platform. Despite the bullish trend in the crypto market, $ETC’s performance has been modest since October.

Technical Levels

- Support Levels: $20.58 and $20.05

- Resistance Levels: $22.20 and $22.93

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational purposes only. They do not establish financial, investment, or other advice. Investing in or trading in stocks, cryptos or related indexes comes with a risk of financial loss

With a background in journalism, Ritika Sharma has worked with many reputed media firms focusing on general news such as politics and crime. She joined The Coin Republic as a reporter for crypto, and found a great passion for cryptocurrency, Web3, NFTs and other digital assets. She spends a lot of time researching and delving deeper into these concepts around the clock, and is a strong advocate for women in STEM.

thecoinrepublic.com

thecoinrepublic.com