This week, we take a closer look at Ethereum, Ripple, Cardano, Solana, and Injective.

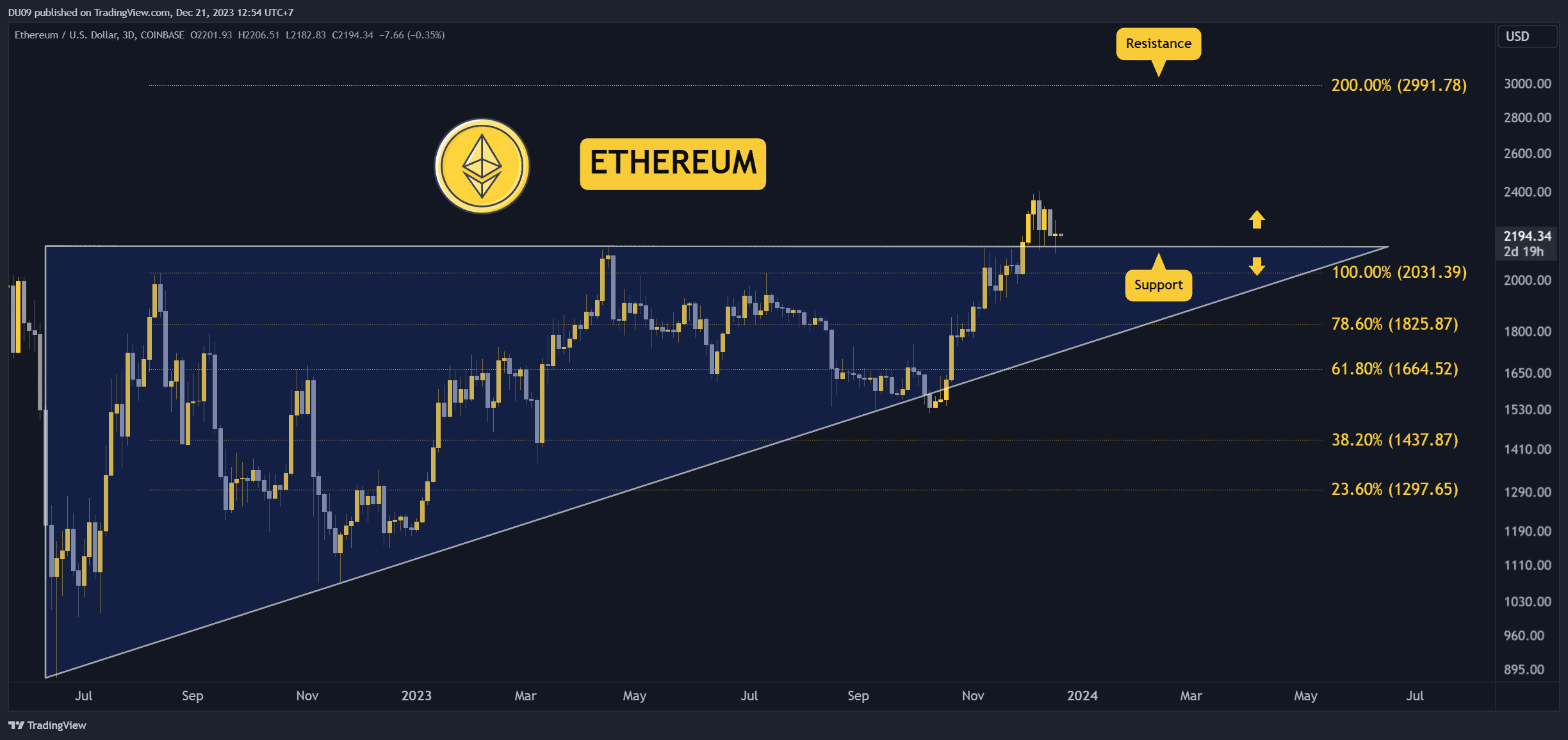

Ethereum (ETH)

ETH is lagging again behind Bitcoin, and the rest of the market is unable to really take off. The price is back on the support at $2,150 and lost 2% of its valuation this week.

Even if Ethereum may be one of the last altcoins to rally, this price action is concerning because it shows a total lack of bullish momentum. Plus, there is strong resistance between $2,400 and $2,500 should any rally happen.

Looking ahead, if bears return, ETH has good support at $2,000 should $2,150 fall.

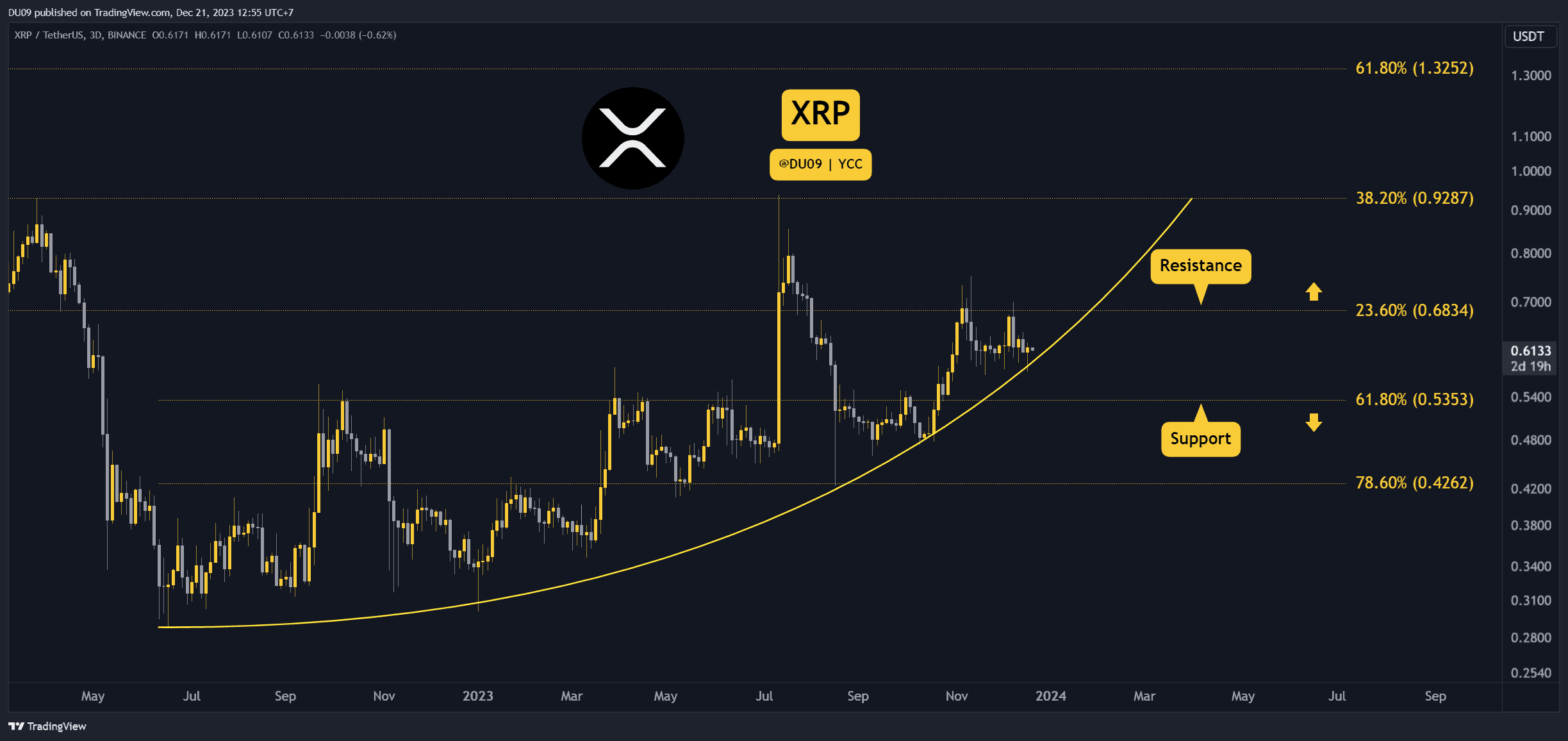

Ripple (XRP)

XRP continues its flat trend without any significant moves at this time, and its price fell by 1.5% this week. The resistance at 68 cents and support at 54 cents remain unchanged.

However, the bigger news is that XRP lost its 5th place by total market cap to Solana, which increased by double digits this week.

Looking ahead, XRP needs to resume its uptrend or lose out to competitors that are getting much more attention lately.

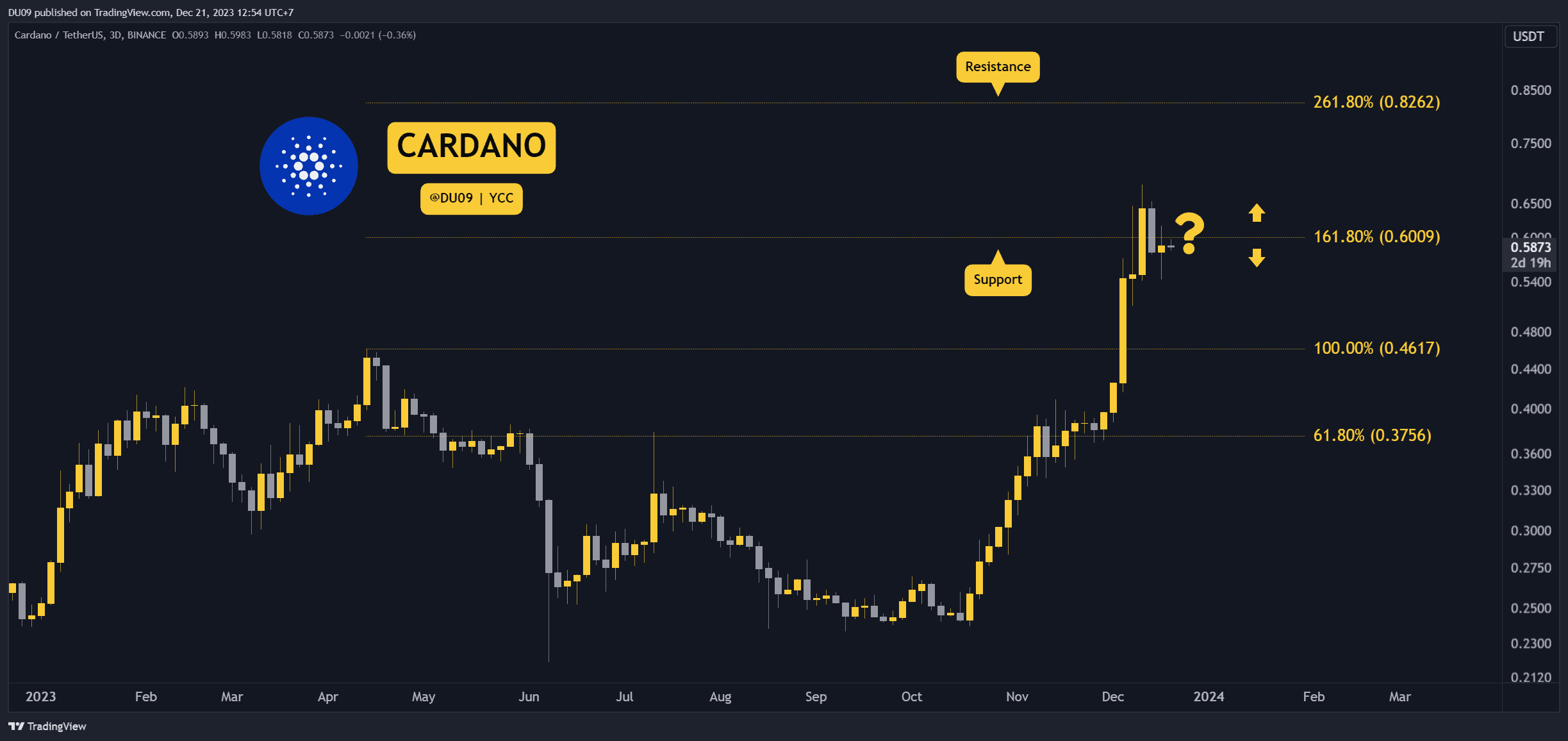

Cardano (ADA)

ADA failed to move higher this week and ended up closing the week with a 10% loss. This came after the price lost its support at 60 cents, which is now acting as resistance.

With the rally on hold, Cardano is at a critical moment. If it fails to move back above 60 cents, then sellers may take over to push it into a deeper correction.

Looking ahead, this cryptocurrency has strong support at 46 cents should bears return in force. As long as the key resistance holds, then sellers have the upper hand.

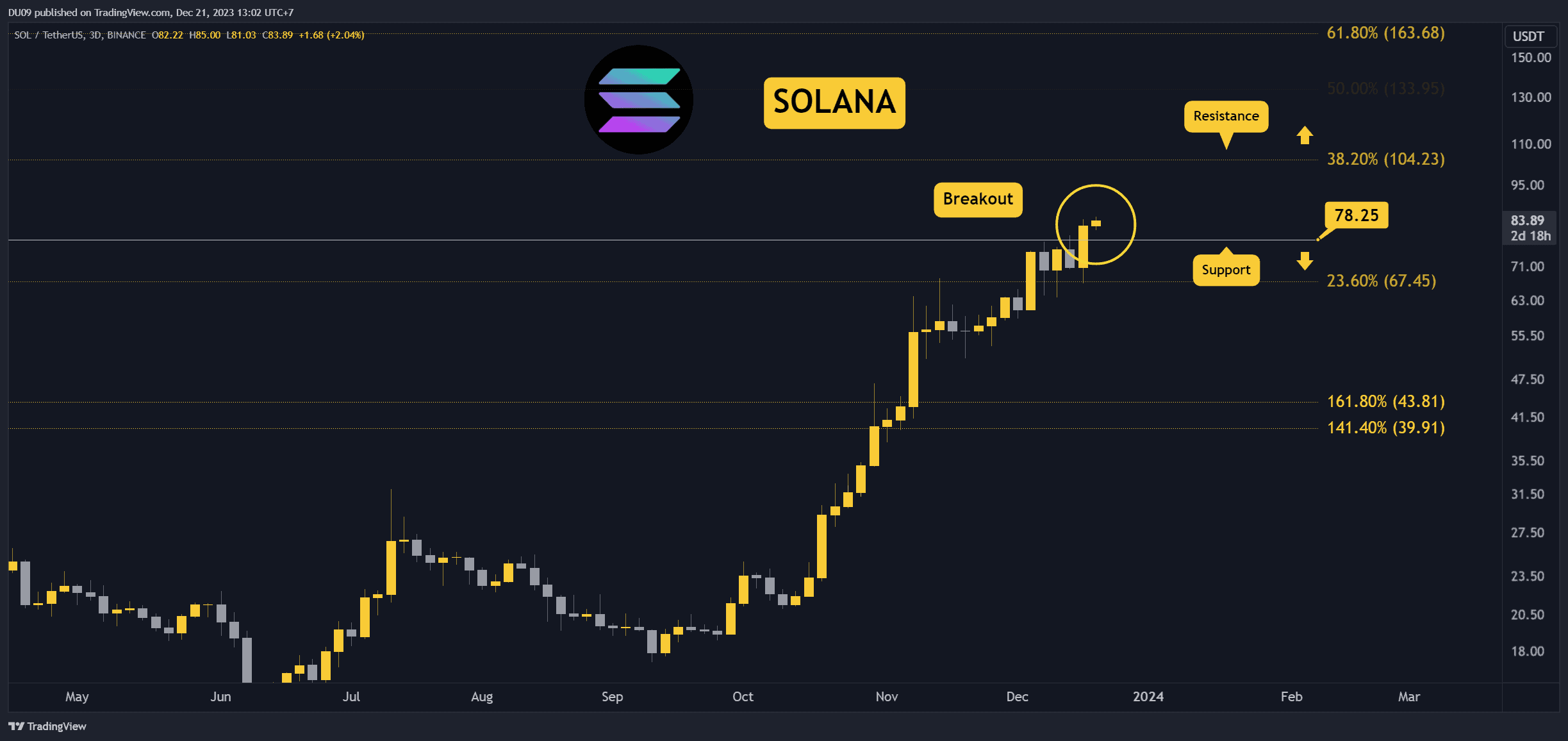

Solana (SOL)

In an impressive move, Solana broke above $78 and booked a 20% price increase this week. In doing so, it also replaced XRP to become the 5th biggest cryptocurrency.

Should this rally continue, then Solana is less than a 25% price increase to reach a three digits valuation. Considering the current market momentum, this could come sooner rather than later.

Looking ahead, the bias on SOL remains bullish, and sellers appear gone or too weak to take back control of the price.

Injective (INJ)

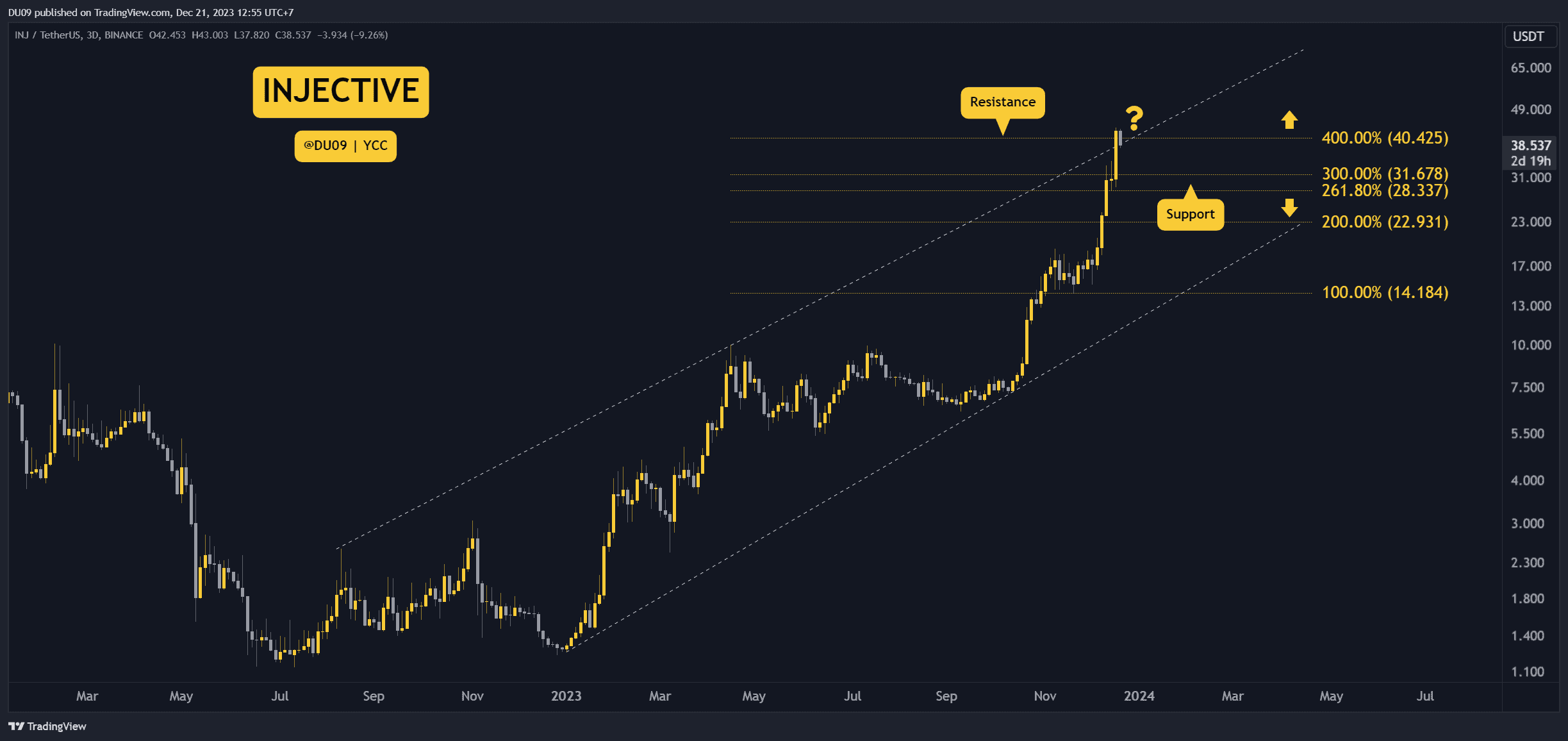

Injective outperformed most of the market, and it closed the week with a 28% price increase. This impressive performance comes after INJ rallied without a stop since mid-December.

In the process, the price reached $43, setting a new record and an all-time high. However, this latest push higher has taken the price at the limits of this uptrend channel, which could now act as a resistance.

Looking ahead, INJ could decide to have a short pullback here before resuming its uptrend. There is good support at $31, should that happen.

cryptopotato.com

cryptopotato.com