2023 was a rollercoaster for Bitcoin, altcoins, and the overall cryptocurrency market, marked by regulatory upheavals, institutional advancements, and significant price movements.

Indeed, the industry faced challenges and opportunities, reflecting the nature of this emerging financial sector.

What Happened to Cryptocurrencies in the First Half of 2023

In January, Bitcoin experienced an annual low of $16,680, setting a sobering tone for the crypto market. However, this was just the beginning of a year filled with significant events.

The Securities Exchange Commission (SEC) made headlines in February by shutting down Kraken’s staking program, resulting in the company paying $30 million in fines. This action underscored the increasing scrutiny crypto-related services face from regulators.

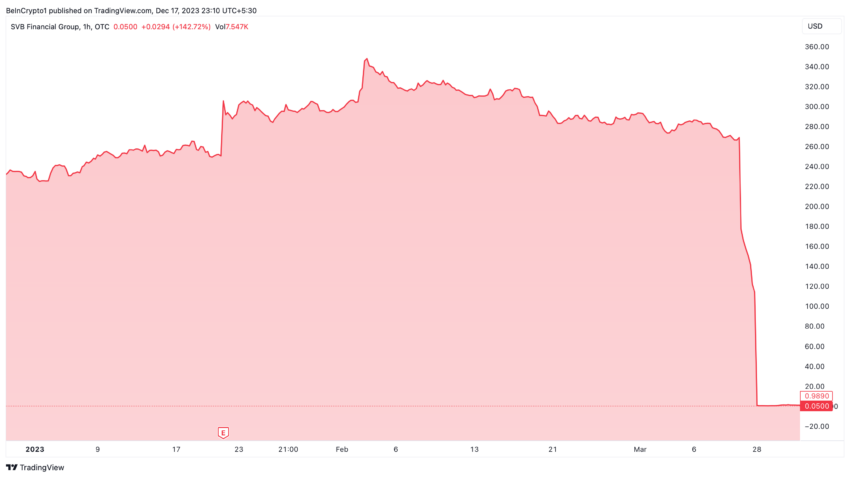

March witnessed the collapse of Silicon Valley Bank, a significant event in the financial sector with indirect impacts on the crypto market. In the same month, the Ethereum-based layer-2 solution, Arbitrum, launched its ARB token, adding to the growing list of innovations in the blockchain space.

April saw ARK Invest refile its Bitcoin ETF (exchange-traded fund), reflecting the persistent interest in tying cryptocurrency to traditional financial instruments. This trend continued into May, with the Department of Justice investigating Binance for potential Russian sanctions violations.

June was a tumultuous month. The SEC filed lawsuits against both Binance and its CEO Changpeng Zhao and Coinbase over alleged US securities violations.

The Rest of the Year Was Also Challenging But Prosperous

In contrast, BlackRock filed for a spot Bitcoin ETF, joined in July by Fidelity, Wisdom Tree, VanEck, and Bitwise – a clear indication of institutional interest in Bitcoin. BlackRock’s CEO, Larry Fink, also made a bold statement, suggesting Bitcoin “could revolutionize finance.”

“Instead of investing in gold as a hedge against inflation, a hedge against the onerous problems of any one country, or the devaluation of your currency whatever country you’re in – let’s be clear, Bitcoin is an international asset, it’s not based on any one currency and so it can represent an asset that people can play as an alternative,” Fink added.

The same month, in July, XRP was ruled not a security, a significant decision for Ripple and the broader market.

Moreover, August saw PayPal launch the PYUSD stablecoin, and Coinbase introduced its Layer-2 network, Base. Notably, Impact Theory’s settlement with the SEC marked the first enforcement action against an NFT (non-fungible token).

In September, Japan’s largest investment bank, Nomura, launched a Bitcoin Fund, signaling a growing acceptance of crypto in traditional finance. October was marked by the launch of the first Ethereum Futures ETF and Paul Tudor Jones’ reaffirmed positive stance on Bitcoin.

“I would love gold and Bitcoin together. I think they probably take on a larger percentage of your portfolio than historically they would because we’re going to go through both a challenging political time here in the United States, and we’re going to go through – we’ve obviously got a geopolitical situation,” Jones said.

November was dramatic, with Sam Bankman-Fried found guilty on all seven criminal fraud counts. BlackRock filed for a spot Ethereum ETF, and Binance settled for $4.3 billion, with CEO Changpeng Zhao stepping down.

The year ended on a high note, with Bitcoin retaking $44,000 for the first time since April 2022. Subsequently capping off a year of highs and lows, regulatory challenges, and significant strides in institutional adoption. This turbulent yet transformative year sets the stage for the future trajectory of Bitcoin and the cryptocurrency market at large.

beincrypto.com

beincrypto.com