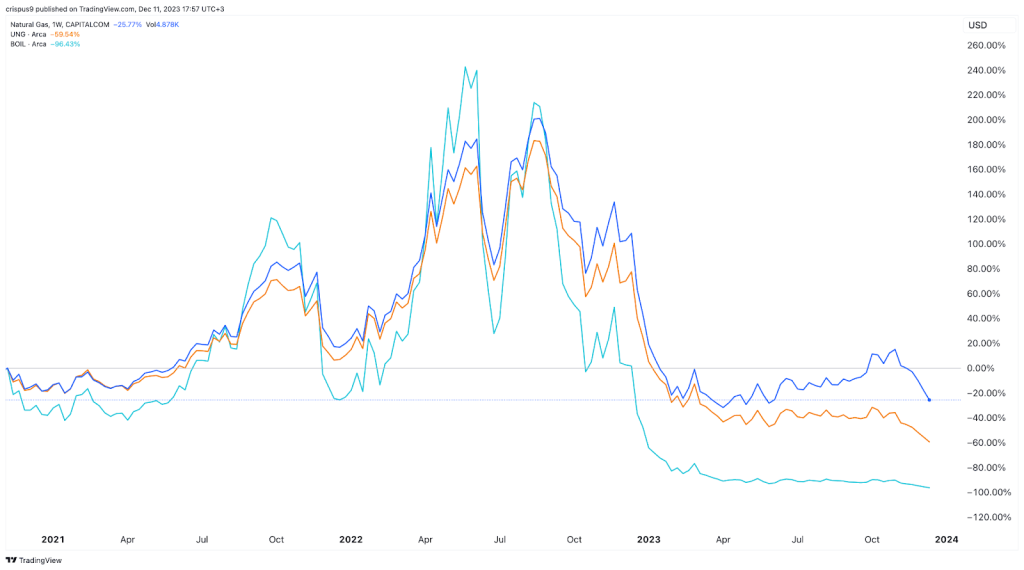

Natural gas price has sold off heavily in the past few weeks as concerns about oversupply continued. It plunged to a low of $2.25 on Monday, its lowest point since June 2023. It has dropped in the past six straight weeks and fallen by more than 77% from its highest point in 2023.

The natural gas price sell-off has hit Exchange Traded Funds (ETFs) that tracks it. The ProShares Ultra Bloomberg Natural Gas Fund (BOIL) has dropped from last year’s high of $2,808 to $24.

Natural gas vs BOIL vs UNG ETFs

Similarly, the United States Natural Gas Fund (UNG) ETF crashed to $4.54, the lowest level on record. It has crashed by over 87% from its lowest point this year, making it one of the worst-performing energy ETFs in Wall Street.

Natural gas price has crashed because of the supply and demand mismatch. Countries like the United States, Qatar, and Russia have increased their natural gas supply in the past few months.

Russia has also managed to successfully pivot its natural gas industry from Europe to Asian countries like China and India. The most recent data showed that China and Russian trade volume jumped to over $218 billion in the first nine months of the year. That was a remarkable increase since the two countries planned to reach $200 billion by 2024.

The same situation happened between Russia and India, where the trade volume rocketed to over $50 billion in the first nine months of the year. Russia’s biggest exports are crude oil and natural gas.

Meanwhile, Europe is sufficiently supplied with enough gas for the upcoming winter season. Most European countries have filled their gas storage. In October last year, the filling level rose to 90% as countries readjusted their supply sources from Russia. Throughout this year, storage has been higher than in 2022. There are also signs that Europe will have a milder winter as we saw in 2022.

Therefore, there is a likelihood that natural gas prices will continue sinking in the coming months as oversupply leads to more deficits. If this happens, there is a likelihood that the natural gas price will drop to the psychological level of $2.0.

Also, if this trend happens, ETFs linked to natural gas like BOIL and UNG will also continue their remarkable sell-off.

Watch here: https://www.youtube.com/embed/JAOUIu9O0lM?start=40&feature=oembed

The post Natural gas price tanks amid oversupply woes: BOIL, UNG ETFs slips appeared first on Invezz

invezz.com

invezz.com