Bitcoin’s price movements took a turn for the worse in the past 12 hours or so with a massive $3,000 plunge that pushed the asset south to a weekly low.

Many altcoins have been hit even harder, with XRP, DOT, LINK, LTC, UNIS, BCH, and others losing more than 5% daily.

BTC Slumped Beneath $41K

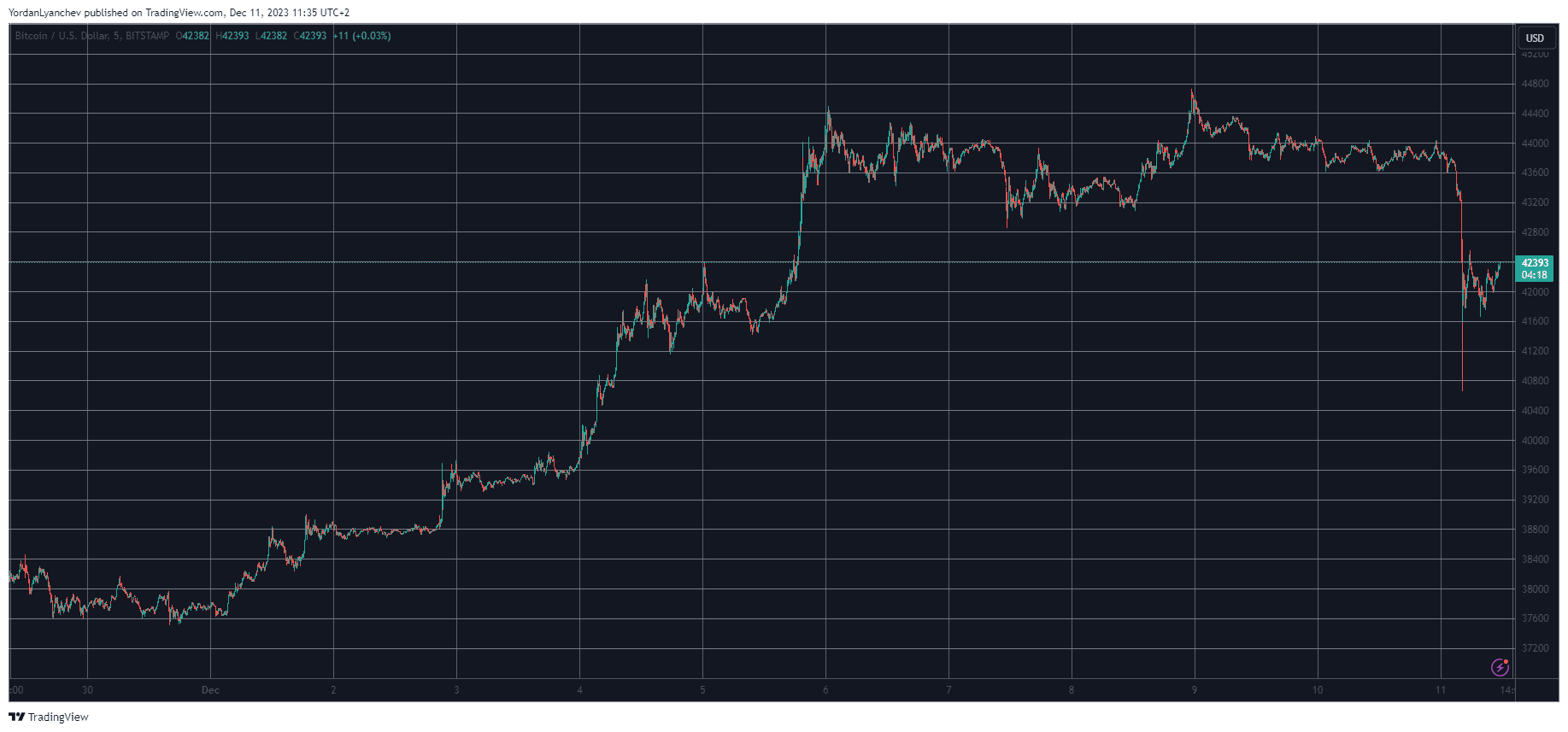

Bitcoin’s start of December was quite impressive. The asset entered the last month of the year at under $38,000 but quickly gained traction and found itself above $40,000 and even $42,000 four days into it.

The bulls kept the momentum going in the following days, which culminated in breaking above $44,000 for the first time since May 2022 on December 6.

After a few days of sideways trading, the cryptocurrency initiated another leg up that resulted in tapping $44,700 on Saturday morning – a new 19-month peak. The rest of the weekend was less volatile, with BTC standing around $44,000.

However, Monday began with a price dump that drove bitcoin south hard to under $41,000. Nevertheless, the primary digital asset has recovered some of the daily losses and now stands above $42,000. This volatility harmed over-leveraged investors, with more than $400 million worth of liquidated positions on a daily scale.

BTC’s market cap has declined to under $830 billion now, but its dominance over the alts stands still at 52.4% on CMC.

Alts Drop Harder

As it typically happens when BTC faces extreme volatility, so do most of the alts. In this case, red has taken over almost all charts.

Ethereum is down by over 4% and sits under $2,250. Binance Coin, Solana, Dogecoin, Tron, Polygon, and Shiba Inu have seen declines by similar percentages.

More daily losses come from the likes of Ripple, Polkadot, Chainlink, Litecoin, Uniswap, Cardano, Bitcoin Cash, Stellar, and others. In their situations, the drops are around 5-7%.

The total crypto market cap saw more than $80 billion gone at one point, declining from $1.640 trillion to $1.560 trillion during its intraday bottom.

cryptopotato.com

cryptopotato.com