Bitcoin’s (BTC) rally past $44,000 this week has benefited several altcoins, including Dogecoin (DOGE), Stacks (STX), and meme coin Pepe (PEPE). The Bitcoin rally is setting the stage for what experts believe could be a better bull market than 2021.

Much of the optimism surrounding Bitcoin’s recent surge has spilled over into the altcoin space, with Dogecoin, Terra Luna Classic (LUNC), Pepe, and Stacks recording notable gains in the past week. Bitcoin’s rally has been fueled by optimism that the conviction of Sam Bankman-Fried, the charges against Do Kwon, and the plea deal involving former Binance CEO Changpeng Zhao have caused the industry to turn the page on a bad chapter.

Altcoins STX, Solana, and XRP Surge Amid Optimism

Investors are also bullish on the prospects of the US Securities and Exchange (SEC) approving multiple exchange-traded funds that track the price of Bitcoin. Next year’s Bitcoin halving, which reduces the rewards earned per mined block, has also been a traditional bull signal.

Read more: How To Prepare for a Bitcoin ETF: A Step-by-Step Approach

According to Kaiko Research, the trading volume for altcoins surged 67% last week, their highest increase since before the Terra Luna collapse. The volume was driven by traders getting into riskier assets amid a sustained rally.

XRP notched a 3.6% increase in the last seven days, while Solana (SOL) is up 7.5%. Solana and XRP are the fifth and sixth-largest cryptocurrencies by market capitalization. Cardano, the ninth-largest cryptocurrency, is up 10.9%, while the overall market cap of the crypto market has risen 4.8% in the past 24 hours to almost $1.7 trillion.

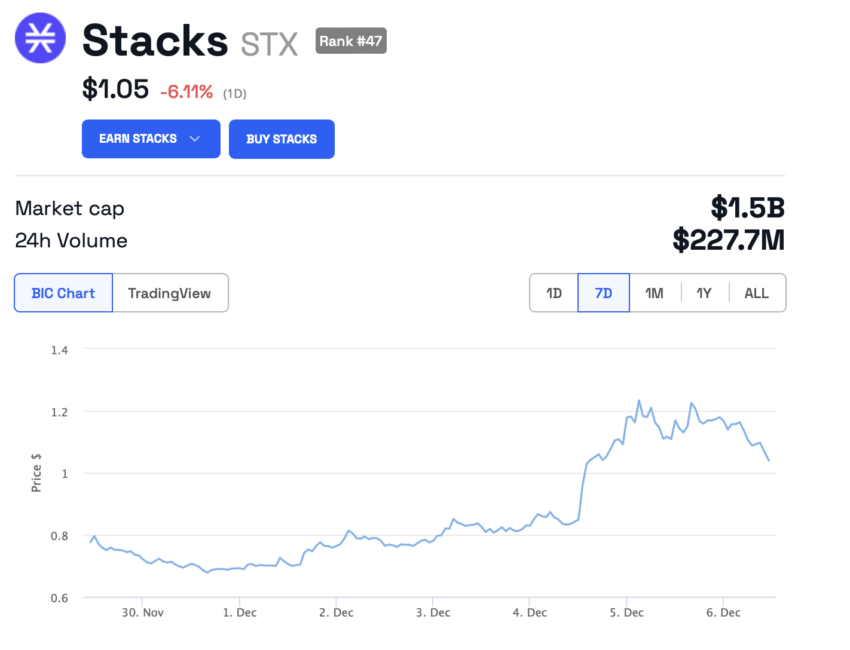

STX, the token used on Stacks, a Bitcoin smart contract network, has notched notable increases in social dominance in the last few weeks, according to LunarCrush. Interactions, posts, and contributors increased, along with the asset’s price, which is up 37% in the past seven days and is changing hands at around $1.05.

Read more: Effective Social Media Strategies for Cryptocurrency Startups

STX Growth Depends on Bitcoin

STX is the native crypto asset of the Stacks ecosystem. It is used to register user IDs and smart contracts that use Bitcoin as a final verification network.

Princeton University graduates Muneeb Ali and Ryan Shea launched the Stacks network in 2013. The protocol uses a proof-of-transfer consensus mechanism to interact with the Bitcoin network. The smart contract language, Clarity, places a high premium on security.

STX miners can earn new tokens by committing Bitcoin. The profitability of the mining system depends on the price of Bitcoin relative to STX.

The continued growth of STX beyond this recent surge will depend on the number of smart contracts deployed. Waning interest will reduce demand for STX since developers need the token to deploy smart contracts.

beincrypto.com

beincrypto.com