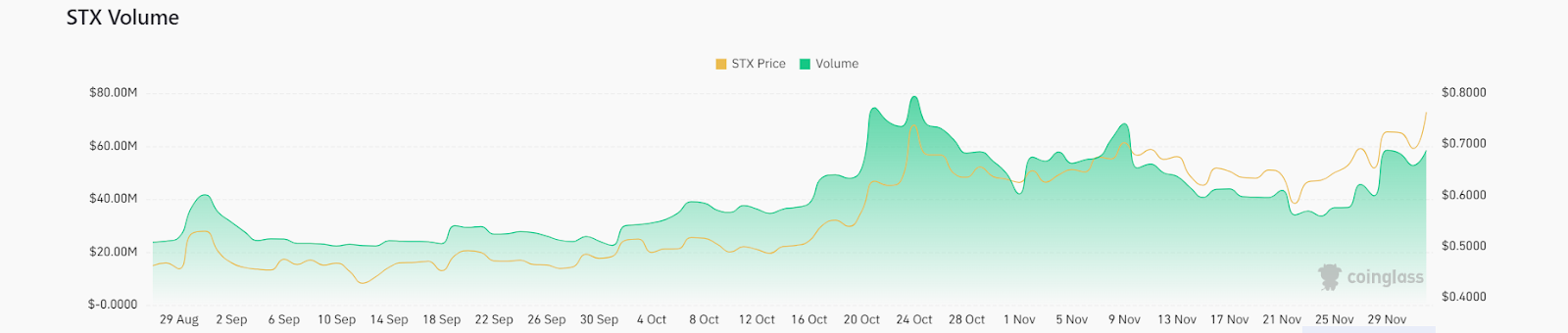

- 1 STX volume is $359.92 Million, it rose by 127.64% in the previous session.

- 2 STX showed an optimized performance in the last three months and six months by 66.45% and 23.75% respectively.

The Stacks is a layer-1 blockchain that runs on the top of Bitcoin’s strong blockchain. It allows creative developers to create smart contracts, dApps, and digital assets.

The Stacks blockchain uses a Proof-of-Transfer (PoX) consensus protocol, which rewards miners with Bitcoin and STX for validating transactions.

The PoX protocol ensures the security, reliability, and decentralization of the Stacks network.The Stacks Ecosystem consists of the Stacks network, the STX token, and the Stacks wallets and applications.

The Stacks wallets enable users to manage their STX securely and easily.

The Stacks applications allow developers to build and launch dApps powered by the Stacks blockchain.The STX token is the fuel and the incentive of the Stacks network. It is used to pay miners for validating transactions and to execute dApp transactions.

STX can also be used to stake and earn rewards, buy digital assets, and pay for services.

Moreover, STX holders can vote on important network decisions.Stacks was created by Blockstack PBC, a public benefit corporation based in the US. Blockstack PBC was founded in 2013 by Muneeb Ali and Ryan Shea.

Blockstack PBC is in charge of developing and maintaining the Stacks network, including the core protocol, wallet, and other tools.

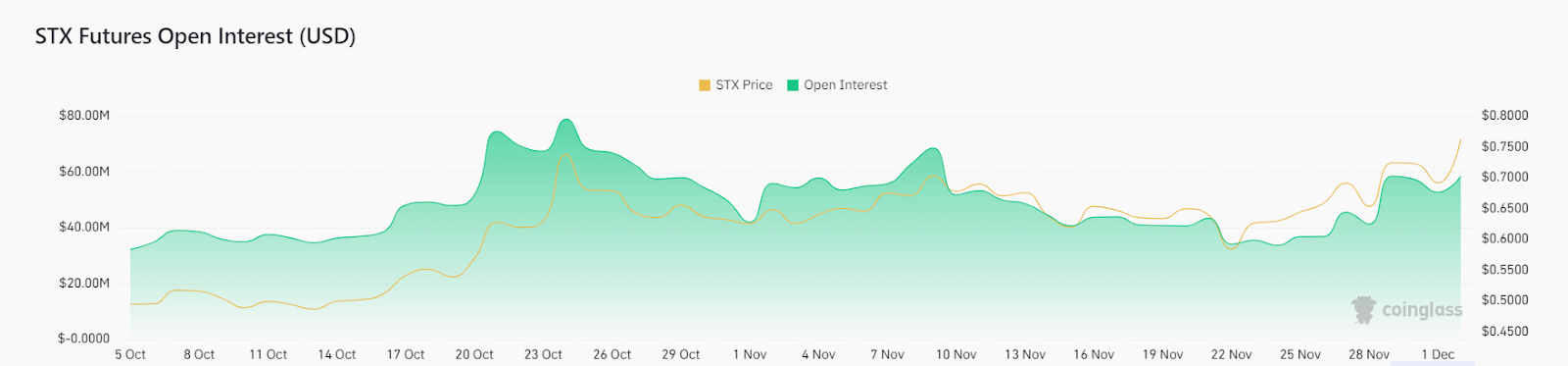

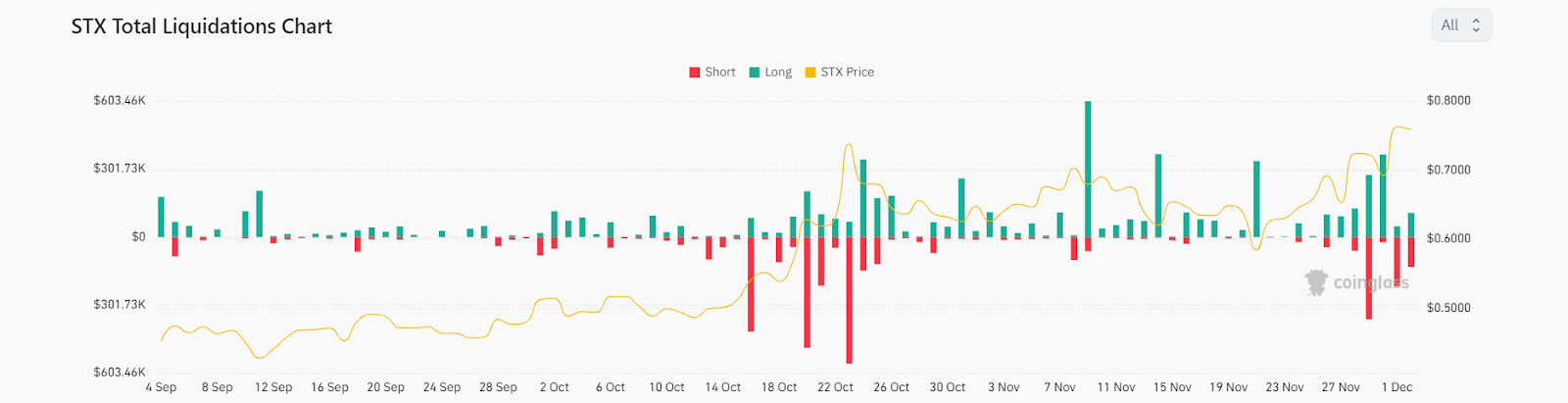

3-Months Data Of Volume, OI, & Liquidation.

Source: by coinglass

Stacks crypto’s (STX) open interest is $70.35 Million, it surged by 15.05% in the previous session.

STX volume is $359.92 Million, it rose by 127.64% in the previous session.

The long versus short ratio for 24 hours is 0.9889. The short liquidation is $296.95K versus $136.32K for the long liquidation.

STX showed an optimized performance in the last three months and six months by 66.45% and 23.75% respectively.

The Stacks crypto is trading at $0.7592 with a 0.60% decrease in the last 24 hours.

Stacks Chart Overview On 1-D

STX crypto is ready for a splendid surge ahead, as it harnesses buyers’ energy to pierce through the hurdles and climb to new altitudes from the current base.

If the buyers maintain the pressure, the STX price could surge from the current level. The next target for the STX price is $0.8000.

However, if the Stacks crypto price fails to stay above the $0.7000 level, it could decline further.

The STX price is higher than the 20-day and 50-day exponential moving averages, which indicates that the EMAs are a strong support. Therefore, the STX price trend is positive and rising.

Conclusion

STX crypto is ready for a splendid surge ahead, as it harnesses buyers’ energy to pierce through the hurdles and climb to new altitudes from the current base. STX showed an optimized performance in the last three months and six months by 66.45% and 23.75% respectively.

Technical Levels

Support Levels: $0.7000

Resistance Levels: $0.8000

Disclaimer

In this article, the views, and opinions stated by the author, or any people named are for informational purposes only, and they don’t establish the investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.

Steefan George is a crypto and blockchain enthusiast, with a remarkable grasp on market and technology. Having a graduate degree in computer science and an MBA in BFSI, he is an excellent technology writer at The Coin Republic. He is passionate about getting a billion of the human population onto Web3. His principle is to write like “explaining to a 6-year old”, so that a layman can learn the potential of, and get benefitted from this revolutionary technology.

thecoinrepublic.com

thecoinrepublic.com