Chainlink whales have significantly increased their LINK holdings. This comes after a noticeable reduction in the token’s balance on crypto exchanges, indicating heightened bullish sentiment.

On-chain data provider Santiment revealed that the largest 200 LINK wallets have recently boosted their holdings by more than $50 million. These addresses have cumulatively amassed 746.57 million LINK tokens, valued at approximately $11.84 billion.

Chainlink Whales Go on Buying Spree

This accumulation spree coincided with a notable decrease in LINK’s balance on exchanges. Usually, a falling exchange balance is seen as a bullish signal, suggesting a shift towards long-term holding and less selling pressure.

On-chain data confirms that LINK’s supply on exchanges has plummeted to around 102 million LINK tokens, the lowest point in over a year.

Additionally, Chainlink’s staking v0.2 upgrade has driven new interest in the ecosystem. Data shows that users have staked nearly 20 million LINK tokens out of the 40.87 million limit.

Read more: Chainlink (LINK) Price Prediction 2023/2025/2030

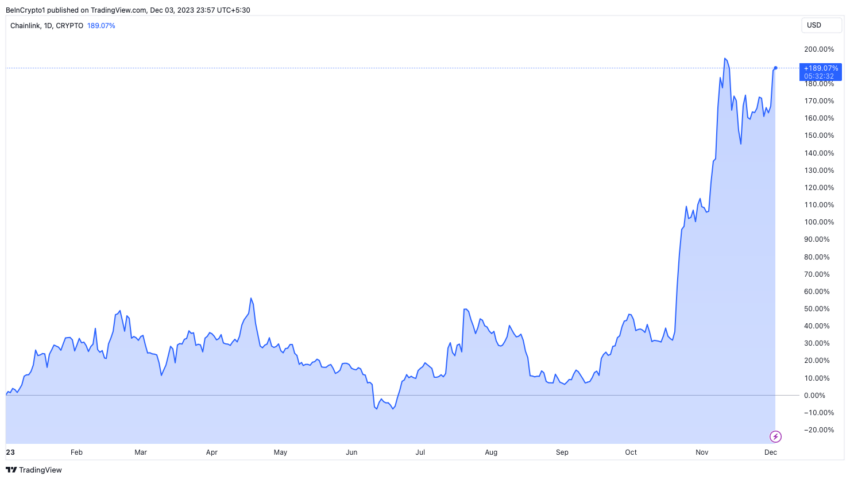

These metrics, combined with the current positive sentiments pervading the market, have resulted in an upswing in LINK’s price. Chainlink has demonstrated a remarkable 189% price growth year-to-date compared to Bitcoin’s 139% increase.

During the period, the network’s Cross-Chain Interoperability Protocol (CCIP) enjoyed heavy adoption from major traditional institutions, including global financial messaging network Swift and South Korean gaming giant Wemade.

“Chainlink is a platform that has now gone far beyond being the leading source of decentralized data, becoming a leading method for off-chain trust-minimized computation and now on its way to becoming the leading cross-chain connectivity standard across both Web3 and TradFi/Banks,” Chainlink co-founder Sergey Nazarov said.

Error Spotted in Chainlink’s Price Feed

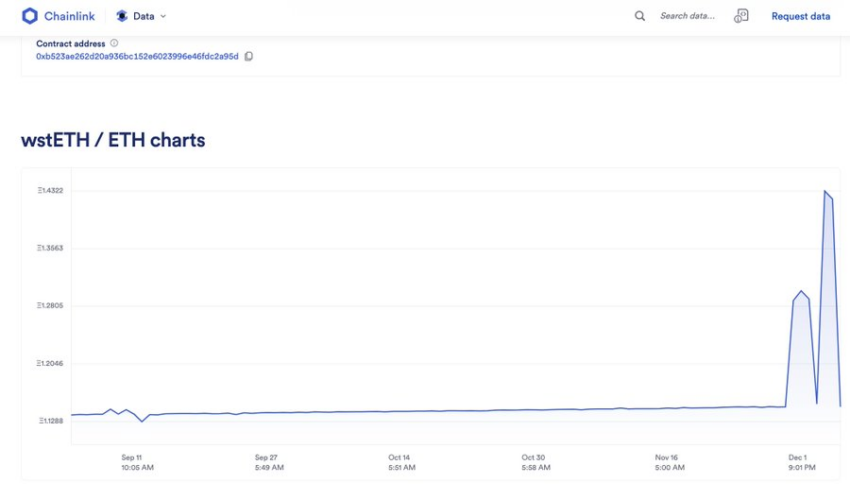

Despite the positive on-chain activity, Silo Labs reported an error in Chainlink’s wsETH/ETH price feed on Arbitrum, leading to the liquidation of five positions. The error stemmed from two significant trades executed on Balancer v2 around 03:00 UTC on December 2.

“These trades were quite sizable and might have been taken into account by Chainlink data provider’s VWAP calculation on Arbitrum. The price reported might have been representative of the volume-weighted market at the given time,” Silo Labs said.

Silo Labs assured that the isolated error poses no systemic risk. Still, the platform pledged to reimburse affected users for the incurred penalties.

“Luckily, Silo’s liquidator caught the liquidation before other liquidators and received the liquidation penalty. We’ll refund the penalty to impacted users. It is the least we can do for them. Please reach out if you were impacted,” Silo Labs added.

Silo Labs is an isolated lending market on Ethereum and layer-2 scaling solution Arbitrum.

beincrypto.com

beincrypto.com