Former Goldman Sachs executive Raoul Pal says that digital assets are set to outrun tech stocks as an important catalyst begins to appear.

The Real Vision CEO tells his one million followers on the social media platform X that dollar liquidity is ultimately what drives risk assets like stocks and crypto.

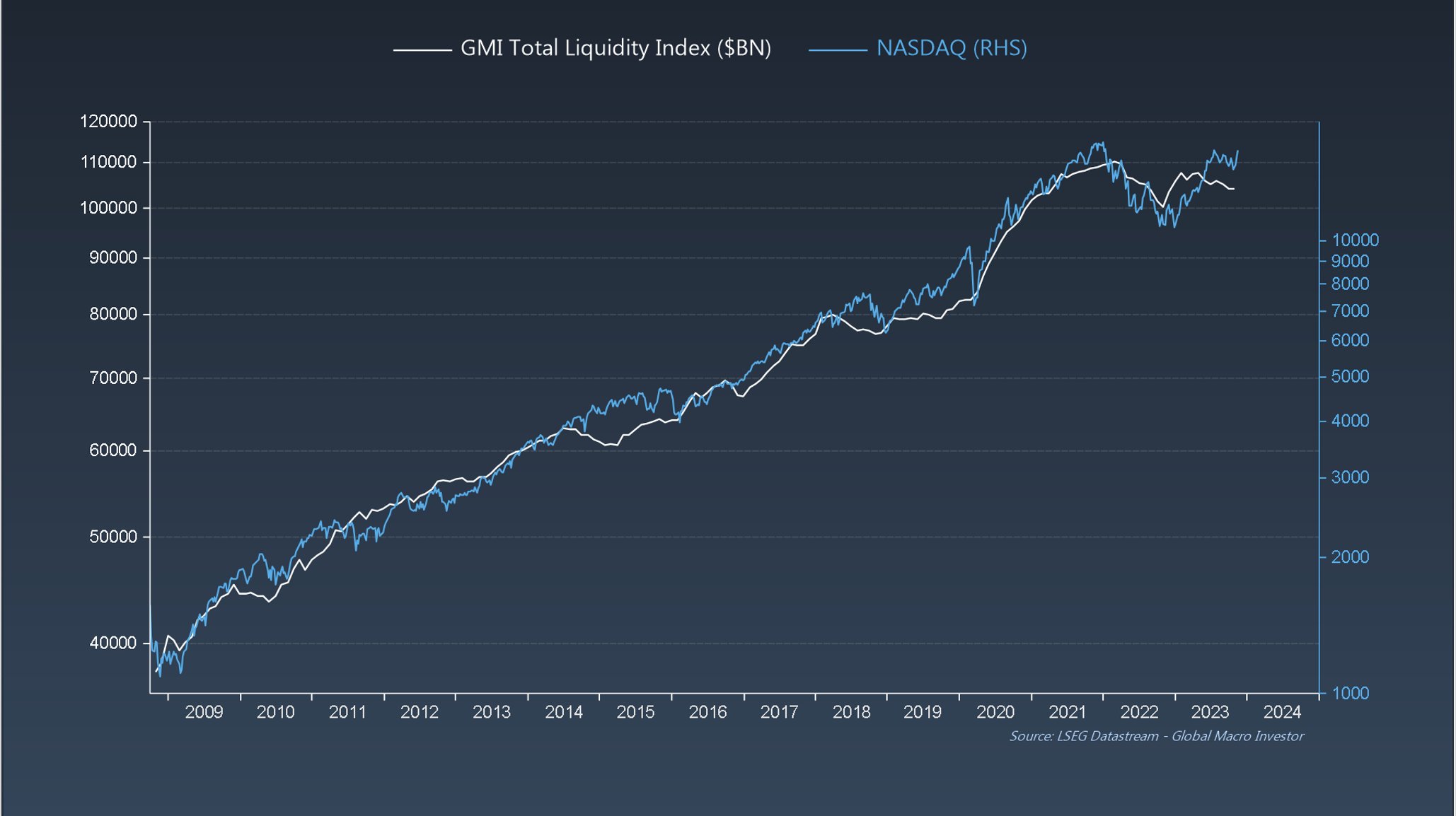

He shares a chart showing that the Nasdaq index has been moving in near lockstep with liquidity for more than a decade, and is still in a strong, intact uptrend.

“And liquidity is what drives assets…

Our job is to back the fastest horses (the secular trending assets).

Tech (The Exponential Age):”

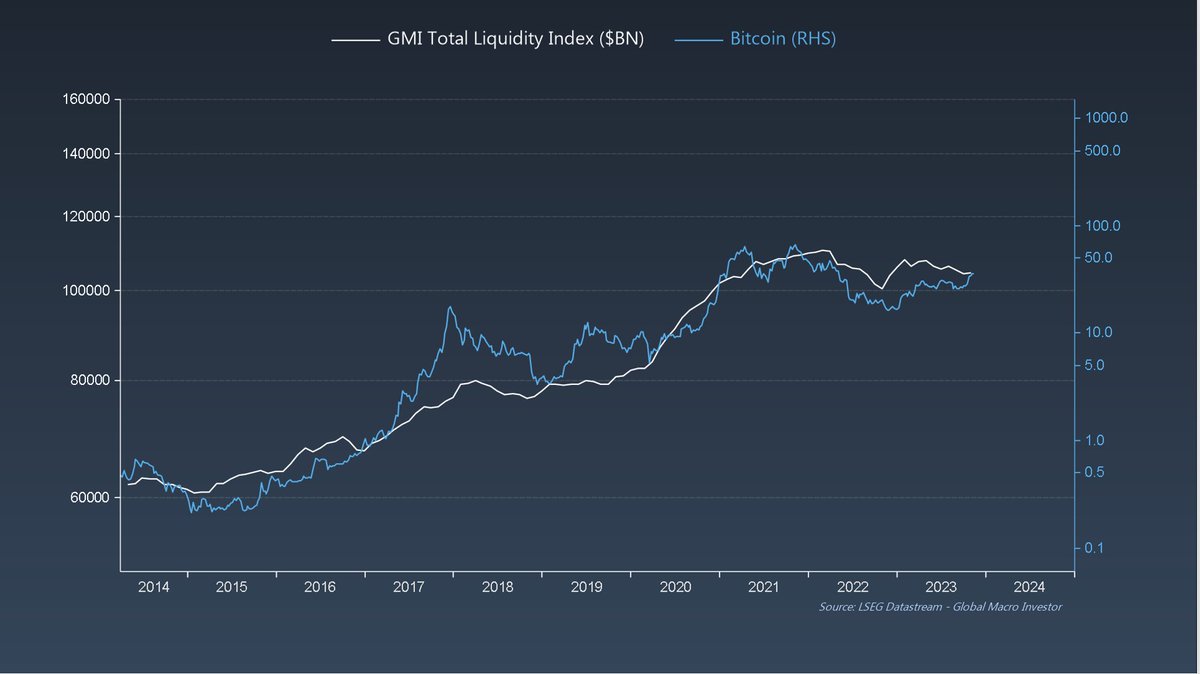

Crypto is no different than the Nasdaq, according to another chart shared by Pal.

“And Crypto (The Super Massive Black Hole):”

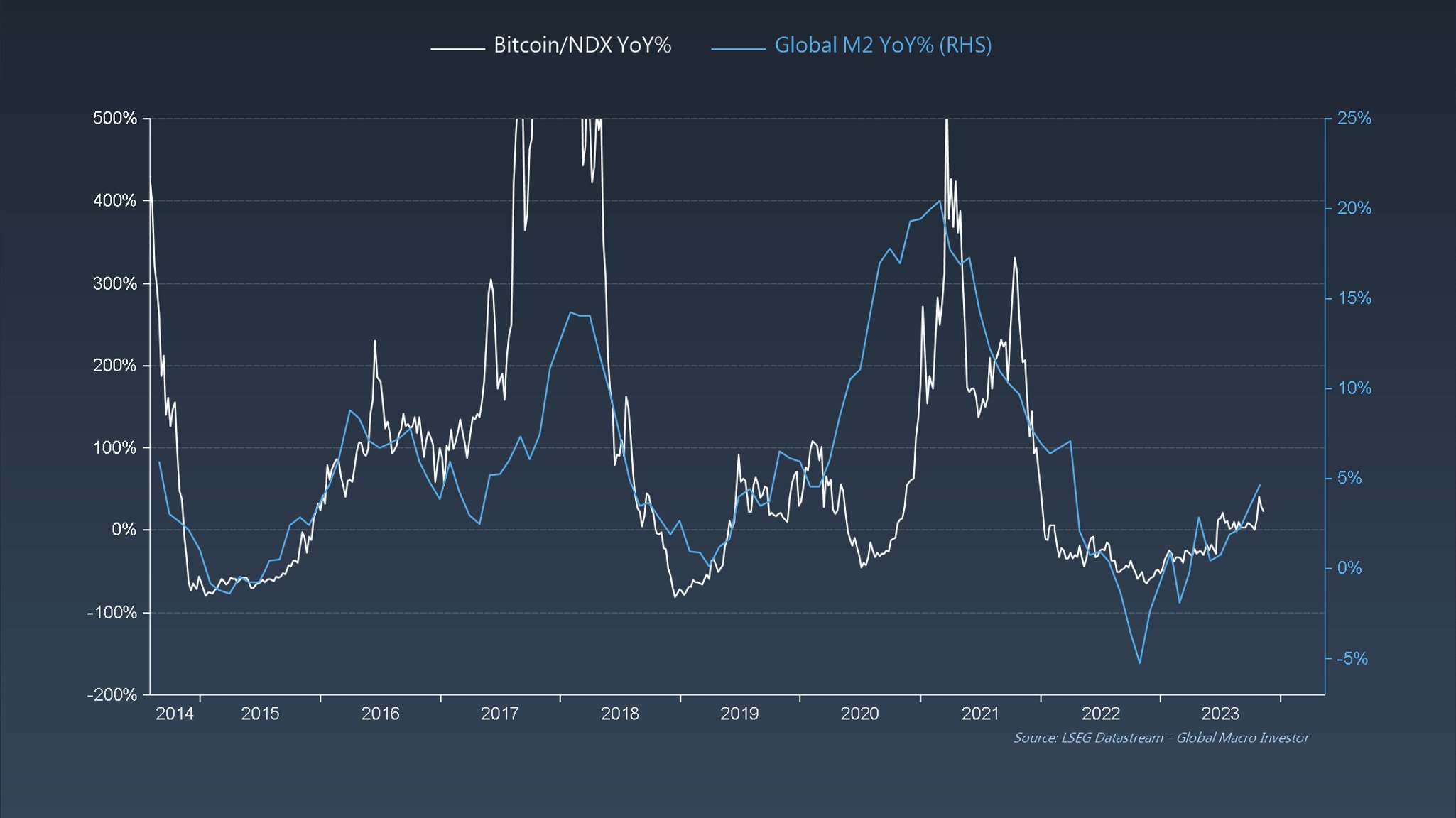

The macro guru highlights that crypto tends to be the faster horse when global liquidity starts to pick up.

“But crypto massively outperforms tech as the liquidity cycle turns positive…”

Pal is also bullish on altcoins moving forward, but notes that picking and choosing smaller altcoin projects can be immensely difficult and risky.

In a newsletter earlier this month, the macro investor said that Ethereum (ETH) rival Solana (SOL) recently entered an uptrend after breaking out of a classic bullish pattern.

“SOL broke out from its inverse head-and-shoulders last month and is now up over 475% year-to-date. This has been one of our core trades at GMI (Global Macro Investor) this year and has worked out really well.”

Generated Image: ClipDrop

dailyhodl.com

dailyhodl.com