In a largely favorable week, the global crypto market cap rose 2.12% from $1.41 trillion at the start of the week to the current $1.44 trillion, with Bitcoin (BTC), Creditcoin (CTC) and Oasis Network (ROSE) each making notable movements.

BTC clinches new yearly peak

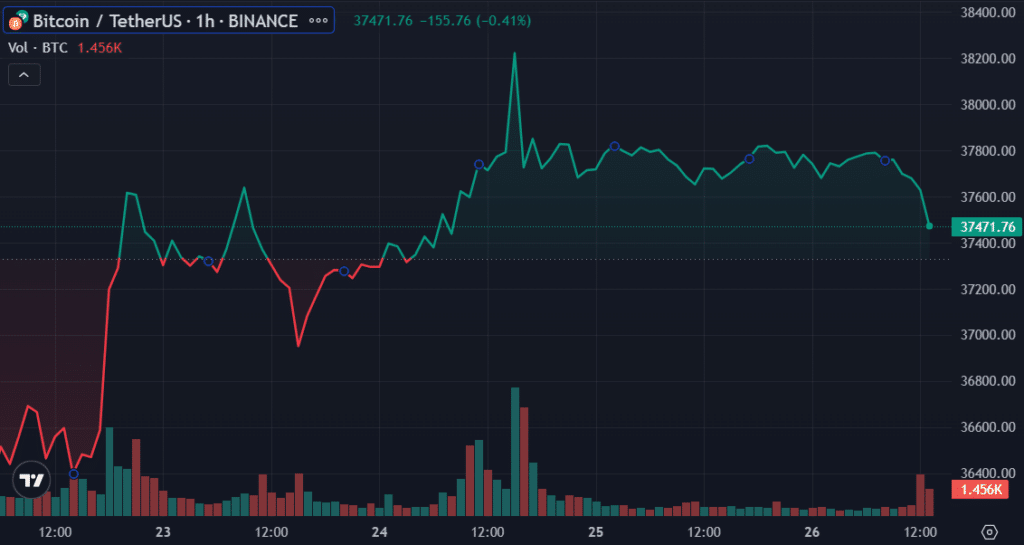

Being the most dominant crypto asset, Bitcoin’s recent movements impacted the broader crypto market. The asset began the week on favorable grounds but succumbed to pressure from the bears on Nov. 21 amid reports of Binance’s legal troubles.

The reports triggered a BTC price collapse on Nov. 21, as the asset slumped from $37,448 to $35,735, breaking below two major support levels. Bitcoin dropped 4.56% that day, and the rest of the crypto market recorded similar declines.

Interestingly, the next day saw an equal and opposite price movement. BTC registered a 4.66% increase on Nov. 22, recovering all the losses triggered by the Binance news, and even adding a meager 0.10% increase. The bullish momentum extended to Nov. 24 when BTC clinched a new yearly peak of $38,414.

However, BTC could not retain the $38,000 mark for long, closing Nov. 24 at $37,717. Efforts to recover the $38,000 mark have proven futile since then. Regardless, Bitcoin has sustained its bullish momentum, as it trades above the 50-day EMA ($34,170) and the 200-day EMA ($29,761). BTC is up over 3.1% this week.

You might also like: Binance listing triggers 75% price surge for Blur token

CTC crosses 200-day EMA

Creditcoin was one of the beneficiaries of this week’s bullish run. Like BTC, the asset started the week on a positive note, but faced a decline on Nov. 21 amid the market-wide collapse. CTC dropped 4.18% that day, closing the day at $0.1799.

However, its recovery was more pronounced than Bitcoin’s. The asset surged 9.09% the next day, riding on Bitcoin’s resurgence. CTC extended its rally, skyrocketing by 24.82% from Nov. 22 to Nov. 24. This sustained uptrend saw it cross above the 200-day EMA for the first time in nine months.

Creditcoin dipped below the 200-day EMA on Feb. 23 and has since been unable to trade above it. Despite a slight 1.48% drop on Nov. 25, CTC remains above both the 200-day EMA ($0.2143) and the 50-day EMA ($0.1706). Creditcoin has gained 23% this week.

ROSE hits nine-month high

Oasis Network was one of the few assets that began this week on a bearish note, witnessing two consecutive declines on the first two days of the week. ROSE dropped 4.75% on Nov. 20 and then recorded a steeper decline of 9.55% on Nov. 21, as the broader market faced a drop.

Remarkably, the asset recovered the Nov. 21 loss, surging 11.51% on the following day. The uptrend continued for the rest of the week, with ROSE soaring 14.57% from Nov. 24 to 26. It rallied to a high of $0.0832 today before facing resistance. This represented its highest price in over nine months.

To hedge against any significant drops, ROSE needs to hold above the $0.0764 support stationed at the 0.38 Fibonacci level. On the other hand, the asset would need to conquer Fib. 618 is currently at $0.0854 for bullish continuation.

Read more: Tether and Bitfinex withdraw opposition to FOIL request