Prominent market analyst EGRAG sees Algorand ($ALGO) skyrocketing 5,543% to an ambitious price of $7 amid the formation of a new Elliott Wave structure on the weekly timeframe.

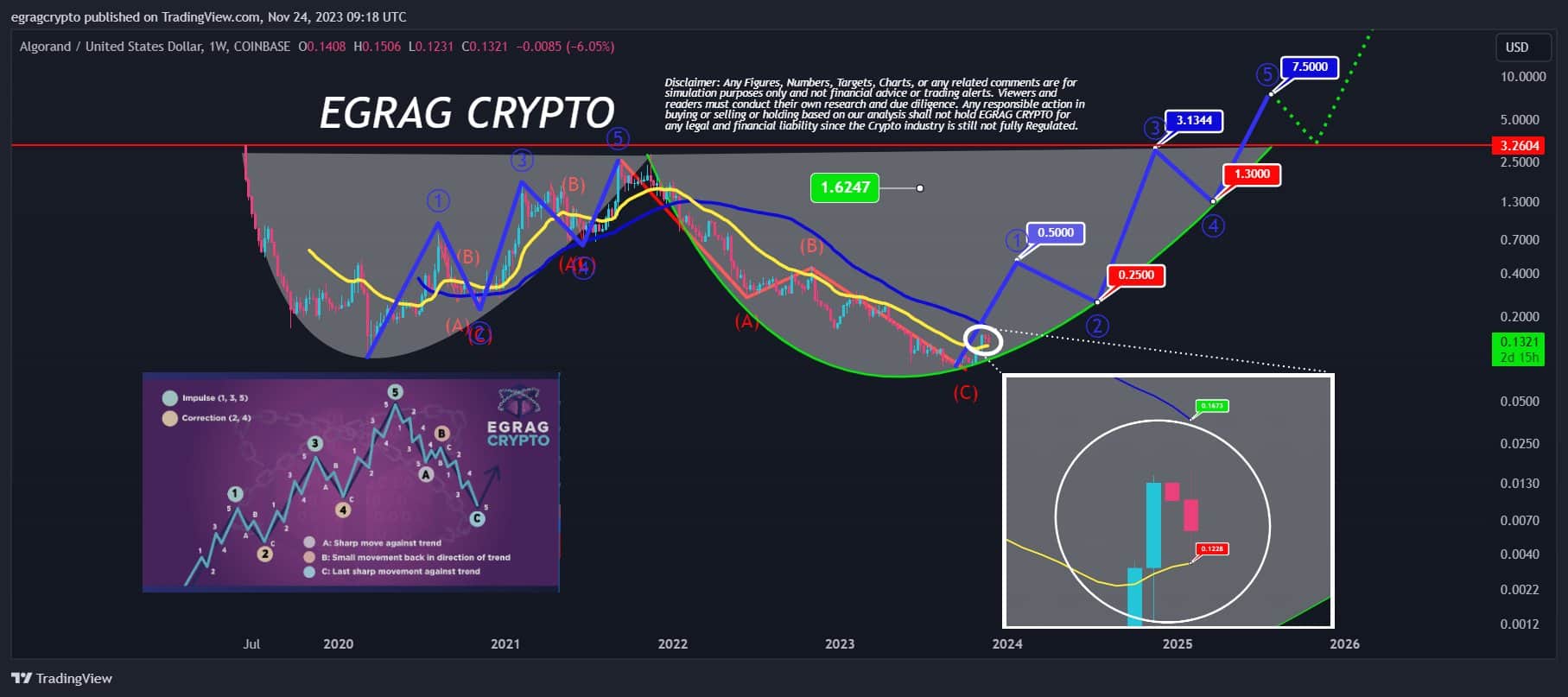

EGRAG disclosed this ambitious price target in his latest Algorand analysis today. He called attention to the formation of a bullish W pattern on the weekly chart, with $ALGO seemingly looking to record the second part of the W in price trajectory.

The formation of this W pattern aligns with an Elliott Wave pattern recorded by the asset. Interestingly, the first part of the W structure saw Algorand register massive gains. This bullish momentum materialized in early 2020, nearly a year after the launch of the protocol.

A Multi-Year Rollercoaster Ride

Algorand had dropped to a low of $0.1020 in March 2020. However, the asset observed a five-wave structure afterward, hitting a high of $2.8200 in November 2021 upon completing Wave 5. This represented a 2,664% increase in 20 months. The surge coincided with the 2021 bull run.

Nonetheless, the bears took control of the scene shortly after the $2.8200 high. As a result, Algorand recorded a corrective ABC pattern that extended into this year. Following the ABC correction, $ALGO dropped to a low of $0.0889 in September of this year.

Notably, EGRAG suggested as $ALGO has begun forming the second part of the W pattern, if it continues to shape it, this will indicate that the ABC correction has concluded. The analyst stressed that $ALGO will now look to start a new five-wave structure, similar to the one from 2020 to 2021.

Algorand Poised to Hit $7.5

Data from EGRAG’s chart reveals that the structure will feature three bullish waves and two corrective waves. The first wave would see $ALGO rally to $0.50, while the second wave would trigger a correction back to $0.25. However, Algorand could surge to $3.13 upon completing Wave 3.

Following Wave 3, EGRAG’s chart suggests that the fourth wave would cause another retracement, resulting in a drop to $1.30. Nonetheless, this correction would be short-lived, with Algorand eventually rallying to the $7.5 price target when it completes Wave 5. This would result in a new ATH.

What solidifies EGRAG’s conviction of such a rally is $ALGO’s position in relation to the 21-week exponential moving average (EMA). The analyst confirmed that Algorand has closed two consecutive weeks above the 21 EMA for the first time since November 2021.

$ALGO currently trades for $0.1329, up 2.39% over the past 24 hours, as it rides on the bullishness in the broader market. The asset witnesses a 12% drop in volume to $37,424,339. At its current position, Algorand would need to rally 5,543% to claim the ambitious $7.5 price target.

thecryptobasic.com

thecryptobasic.com