Bitcoin registered a massive nosedive yesterday, falling by almost $2,000 in hours after the Binance-DOJ news broke out.

The altcoins saw similar volatile moves, and, somewhat expectedly, Binance’s native cryptocurrency was the most notable loser.

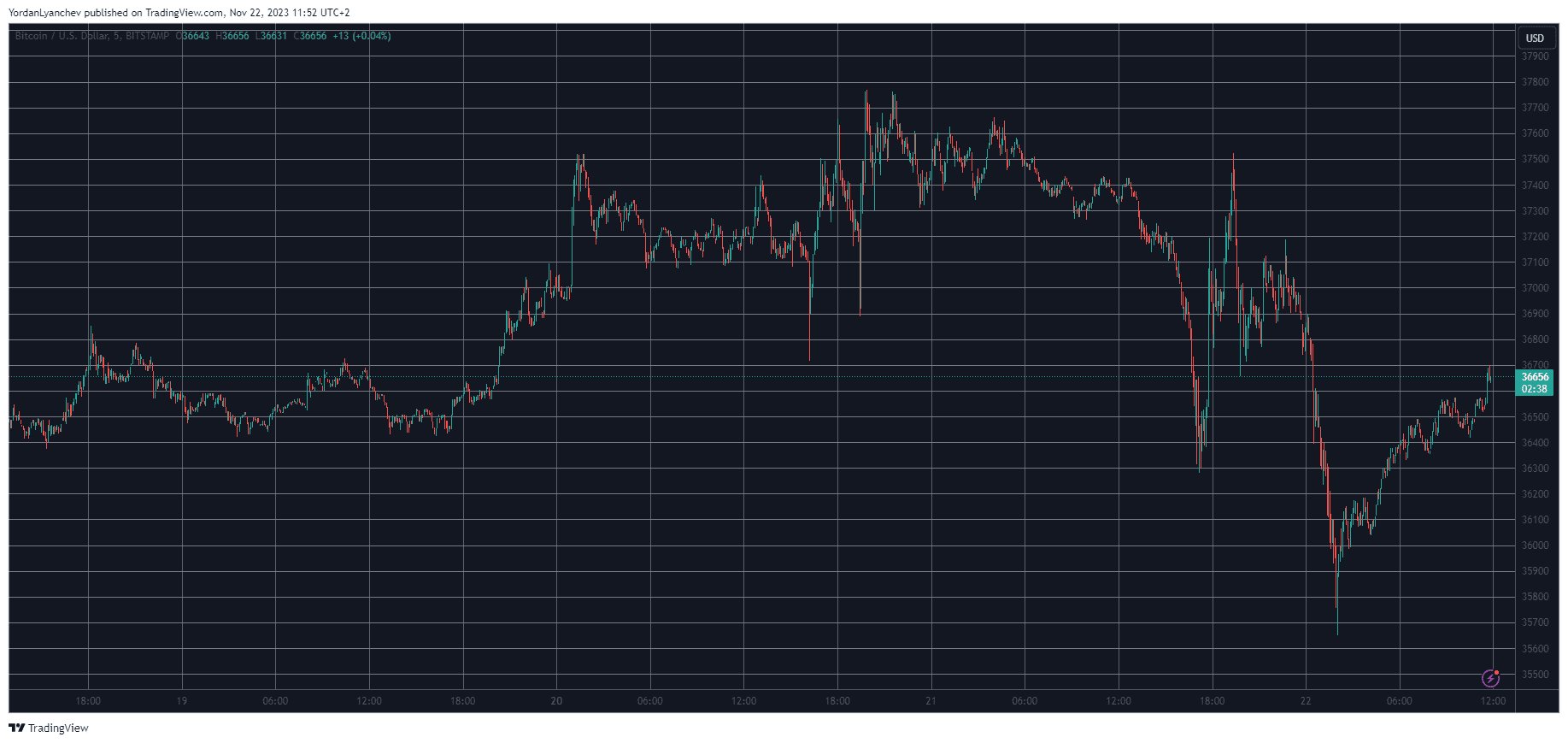

BTC’s Rollercoaster

The primary cryptocurrency tried its hand at taking down the $38,000 level once again on Monday, following a few days of sideways trading at around $36,500, but to no avail. As with the previous attempts, the bears were quick to intercept the move and didn’t allow BTC to even challenge $38,000 this time.

Then came reports that Binance had agreed to settle with the US Department of Justice, which had a positive impact on the crypto market at first. However, when it all became official on Tuesday and the DOJ announced a settlement with Binance in which the latter had to pay a $4.3 billion fine, and its CEO – Changpeng Zhao – had to step down, prices went sour.

In a matter of minutes, BTC slumped by roughly $2,000 to $35,600. However, it bounced off and spiked above $36,600, where it currently sits, leaving over $200 million worth of liquidations.

Bitcoin’s market cap has suffered and is down to $715 billion, and its dominance over the alts has declined to 51.5% on CMC.

BNB Dumps the Most

As was probably expected, Binance’s native token was the hit the worst amid this fiasco. BNB went from a 5-month peak at over $270 to a three-week low of $222 in a matter of hours. Now, though, the asset has recovered some ground and stands north of $235.

The rest of the larger-cap alts are also in the red on a daily scale. Ripple, Solana, Cardano, Dogecoin, Tron, Avalanche, and Polkadot have all declined by 3-4%. Polygon’s MATIC has dumped by more than 5.5% and sits at $0.75.

Nevertheless, there’re a few gainers from the top 36 alts. These include Uniswap, Lido DAO, OKB, RUNE, and a few others.

The total crypto market cap, though, lost $60 billion at one point in a day and, even though the market is slightly better now, the metric is still below $1.4 trillion on CMC.

cryptopotato.com

cryptopotato.com