The current cryptocurrency market is witnessing a substantial surge, capturing the attention of investors. While cryptocurrencies like Bitcoin and Ethereum remain prominent with their notable performances, there is a growing interest in more budget-friendly alternatives.

For investors who possess a higher risk tolerance, allocating a portion of their investment capital, ranging from 10% to 20%, into these altcoins can provide a tantalizing chance to diversify their portfolio and position themselves for substantial gains in the forthcoming bull market, here are three cryptocurrencies priced under $10 to consider.

Uniswap ($UNI)

Uniswap ($UNI) is a decentralized cryptocurrency exchange that revolutionized the market with its innovative AMM (automated market maker) model. This model eliminates the need for traditional order books, providing a streamlined method for direct token swaps on the blockchain without intermediary involvement.

Operating as a decentralized protocol, Uniswap allows anyone to create liquidity pools for various tokens, making it a go-to platform for trading new crypto assets before their listing on centralized exchanges.

The AMM model introduced by Uniswap has been widely adopted by decentralized exchanges across different blockchain platforms, with Uniswap maintaining its position as the most active decentralized exchange in terms of trading volume.

Governance of the Uniswap protocol is in the hands of $UNI token holders, who can submit and vote on proposals. $UNI tokens were distributed through an airdrop to past Uniswap protocol users in 2020 and are now available for purchase on various trading platforms.

Furthermore, Uniswap has expanded its offerings by introducing a non-custodial mobile wallet supporting the Ethereum mainnet, along with compatibility with the Arbitrum and Optimism layer 2 scalability platforms.

$UNI is currently priced at just about 5$, but it reached $42.4 at its all-time hight and might see a significant price increase in the upcoming bull market.

Cosmos ($ATOM)

Cosmos ($ATOM) functions as a network designed to facilitate interoperability among different blockchain platforms.

And it’s part of the Cosmos Hub, a Proof-of-Stake blockchain that not only oversees the Cosmos ecosystem but also enables connections with external blockchains like Bitcoin and Ethereum.

The communication between various blockchains within Cosmos is facilitated through the Inter-Blockchain Communication (IBC) protocol.

Both the Cosmos Hub and other blockchains within the Cosmos network are constructed using the Cosmos SDK framework.

These blockchains benefit from a robust Proof-of-Stake consensus mechanism, ensuring secure transactions with a fast processing time of approximately 7 seconds and minimal transaction costs, around $0.01 per transaction.

The native cryptocurrency of Cosmos is known as $ATOM. Users can stake their $ATOM tokens to enhance the network’s security, earning staking rewards along with a share of the transaction fees collected by the network.

Cosmos is set to undergo its v9-Lambda upgrade on March 15, introducing replicated security (RS) to the network.

This upgrade allows blockchains within the Cosmos network to lease security from the Cosmos Hub, streamlining the process for validators. Replicated security aligns with the broader concept of interchain security (ICS) gradually implemented by the Cosmos project.

This upgrade provides Cosmos-based projects the advantage of focusing on their unique strengths without the added concern of managing validators and security.

Also, $ATOM stakers may witness increased yield, as up to 25% of fees collected by “consumer chains” will be directed to Cosmos Hub stakers.

The current value of $ATOM stands at £9.18, and there is anticipation that the forthcoming update could contribute to a price increase.

Although the project is still in its early stages, investors seeking portfolio diversification and potential guaranteed upward price movement might find consideration of $ATOM investment worthwhile.

Celestia ($TIA)

Celestia ($TIA) is a modular blockchain that utilises data availability (DA) sampling to enable the integration of multiple rollups and Ethereum-based DApps into its ecosystem.

In modular blockchains, full nodes play a crucial role in maintaining the integrity and security of the network, and without getting too technical, full nodes need to download and execute all transactions to generate proofs.

However, if some block producers withhold certain transactions, it results in a “data withholding attack.”

While full nodes can detect this by checking for missing transactions, light nodes lack this capability.

Celestia addresses this challenge through Data Availability Sampling, enabling light nodes to verify data without downloading the entire block.

This involves random sampling of a small portion of block data, and once confidence reaches a certain threshold, the block becomes available.

Celestia has launched its maintet less than a month ago, and it generated a lot of traction among investors in Layer2 (L2) projects.

Celestia witnessed a slow start in on-chain activity after the launch, but this did dampened investors’ enthusiasm, leading to a rally in its token, reaching $6.30 – 200% higher than its debut price of around $2.10.

$TIA is the native token for Celestia, with a total supply of 1 billion. The token mechanism is designed to inflate at 8% in its first year, which will decrease by 10% each year (7.2% in second year, 6.48% in third year etc.) until it reaches floor of 1.5% annually.

The major use case for the $TIA token is to pay for the blob space. In order to use the Celestia network for DA, roll-up developers must submit payforblobs (PFB) transactions to the network for a fee, which is denominated in $TIA.

Celestia’s success is contingent on the adoption of applications and protocols relying on its DA layer.

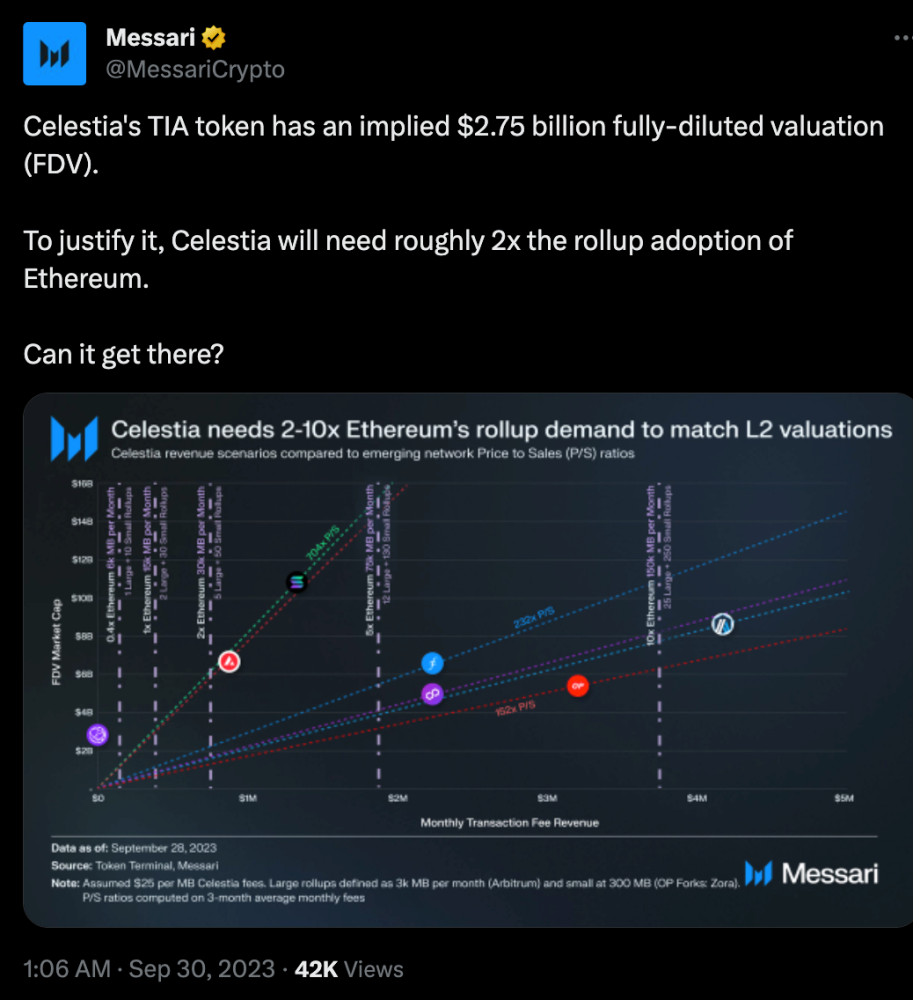

According to Messari, Celestia will need to capture 2x the rollup adoption of Ethereum to justify the valuation, so a steep correction in $TIA market price is anticipated before a considerable rally in the next two years.

However, now might be an excellent opportunity to begin accumulating the coin, as short-term fluctuations may be inconsequential if the project attains success.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com