The Sandbox ($SAND) price reclaimed the $0.45 territory this week, bringing its November gains to 45%. On-chain analysis beams the spotlight on how the recent partnership with fashion giant Gucci has impacted market demand for $SAND tokens.

The Sandbox has flipped Axle Infinity to claim top spot as the most valuable project in the metaverse sector. Can the Gucci partnership spur more $SAND price gains?

Crypto Whales Enter The Sandbox ($SAND) Buying Frenzy

Crypto whales have been spotted buying $SAND aggressively since The Sandbox announced its latest partnership with Gucci on Nov. 8. The collaboration is set to allow The Sandbox gamers to explore decades of Gucci’s luxury fashion history and iconic designs through an immersive interactive journey”

“Gucci Cosmos Land is a new way for fashion and history lovers alike to access the iconic London-based exhibition from anywhere in the world,” said Sebastien Borget, COO and co-founder of The Sandbox

On-chain data has revealed that the $SAND price rally that followed the announcement was largely driven by a group of strategic crypto whales.

Between Nov. 11 and Nov.16, crypto whales (wallets holding 100,000 to 1 billion $SAND) acquired a whopping 30 million $SAND tokens. This buying frenzy took the whales’ cumulative balances from 749 million to 779.30 million within a week of the Gucci partnership with The Sandbox.

The newly-acquired 30 million tokens are worth approximately $13.2 million, when valued at the current market price of $0.44. This intense whale buying pressure has evidently put upward pressure on $SAND price.

The timing of the ongoing buying trend affirms that the partnership has spurred investor confidence in The Sandbox price prospects. As other strategic retail investors begin to mirror the whales’ trades, it could further propel $SAND price closer to the $0.50 mark.

Read more: Top 10 Metaverse Platforms To Watch Out for in 2023

Bullish Retail Traders Have Seized Control of Spot Markets.

The Sandbox price performance this week has been attributed to the crypto market rally and a strategic Gucci partnership. But looking beyond the media headlines, latest on-chain data readings depict how the bullish buyers have gradually seized control of the $SAND market over the past month.

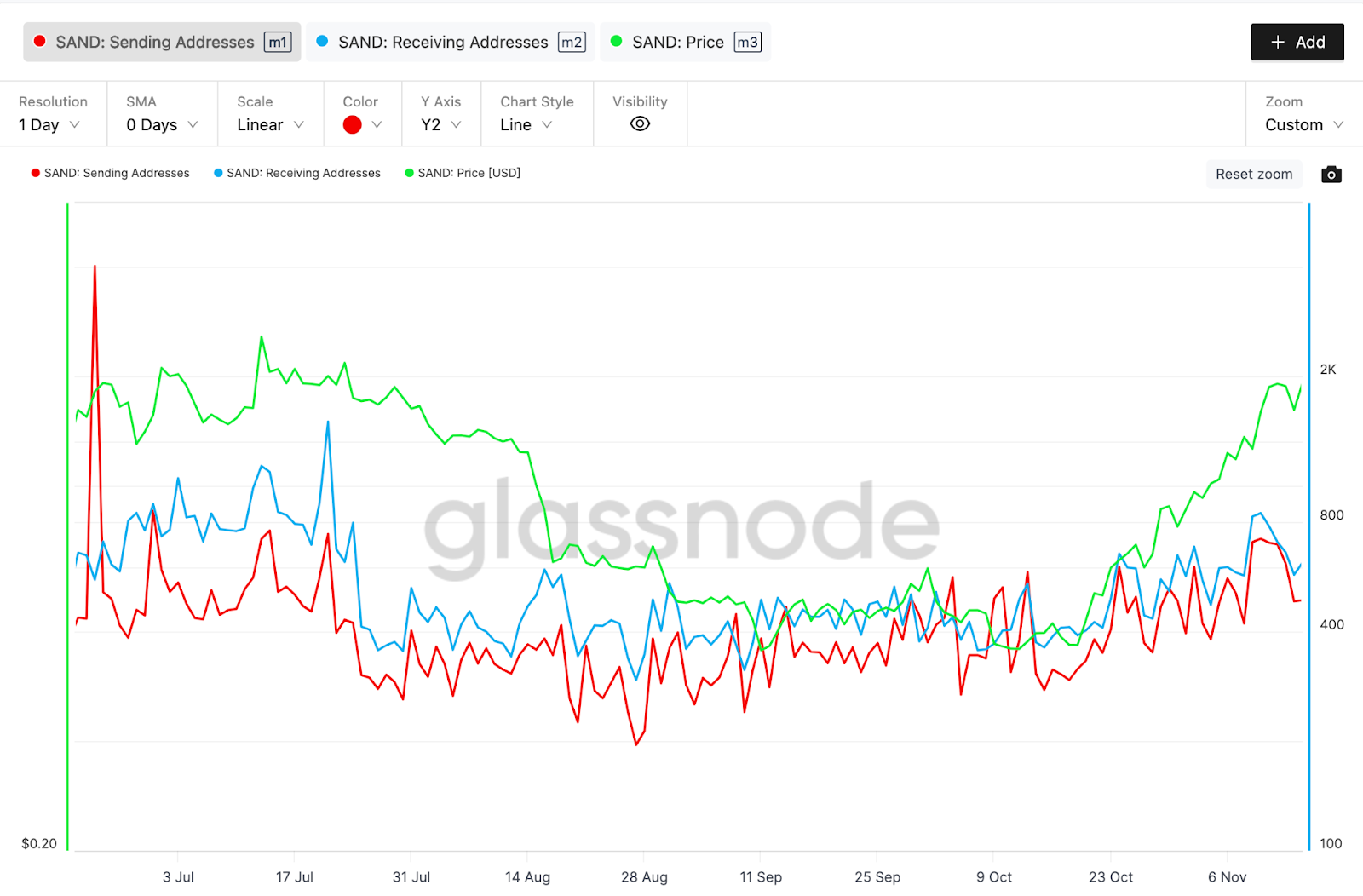

On Nov. 10, The Sandbox recorded 844 receiving addresses, which are significantly higher than the corresponding sending addresses. A closer look at the chart reveals that the number of unique addresses buying $SAND have consistently exceeded the sending (or selling) addresses in each of the last 30 trading days, dating back to Oct. 15.

By counting the daily number of recipient wallets, the receiving addresses metric gives an estimate of the number of unique buyers purchasing the underlying token. Conversely, the sending addresses metric estimates of the number of existing holders who are actively offloading, selling off or transferring out their tokens.

Logically, it is a bullish signal, when the number of traders buying $SAND (i.e. receiving addresses) has consistently exceeded the number of sellers (sending addresses) for a prolonged period.

Evidently, this has played a vital role in the 45% $SAND price rally over the past month.

The Sandbox Flips Axie Infinity to Claim Metaverse Top Spot

The Sandbox bulls have dominated markets for over a month. However the Nov. 8 Gucci partnership announcement appears to have intensified the bullish momentum.

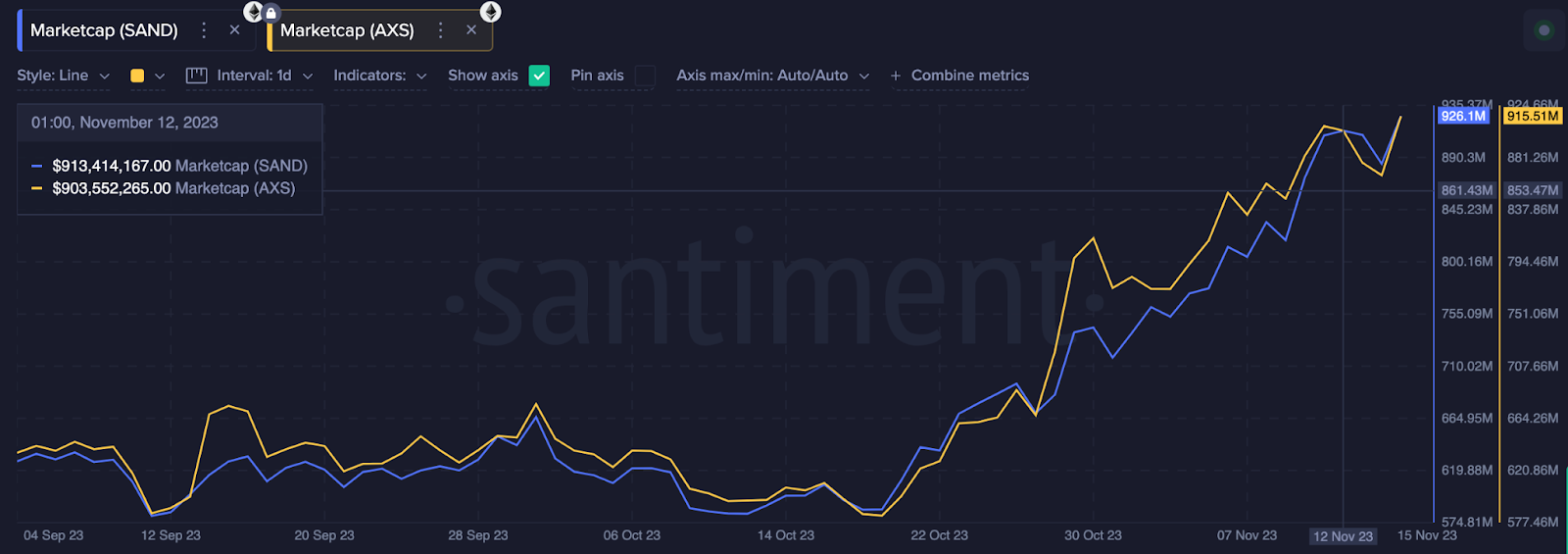

As the number of receiving addresses hit a four-month peak on Nov. 10, $SAND token market capitalization has also skyrocketed. The chart below shows that $SAND’s market valuation surpassed $926 million on Nov. 16.

And notably, this means that The Sandbox has now flipped Axie Infinity (AXS) to become the largest metaverse project.

Market capitalization is a financial metric representing the total value of a cryptocurrency circulating supply. It is computed by multiplying the current price of the cryptocurrency by the total units circulating supply. It provides an estimate of the overall value of any blockchain project at a specific point in time.

The Sandbox leapfrogging Axie Infinity as the largest metaverse project this week is a testament to the community’s growing confidence.

Hence, if $SAND buyers continue to outnumber the sellers, $SAND price count enters another leg-up in the days ahead.

Read More: Best Upcoming Airdrops in 2023

$SAND Price Prediction: Breaking $0.50 Could Catalyze More Gains

From an on-chain standpoint, the rising whale demand and increased number of active buying addresses are fundamental factors driving the ongoing $SAND price rally. With these indicators still on the uptrend, it puts The Sandbox price in good stead for further gains.

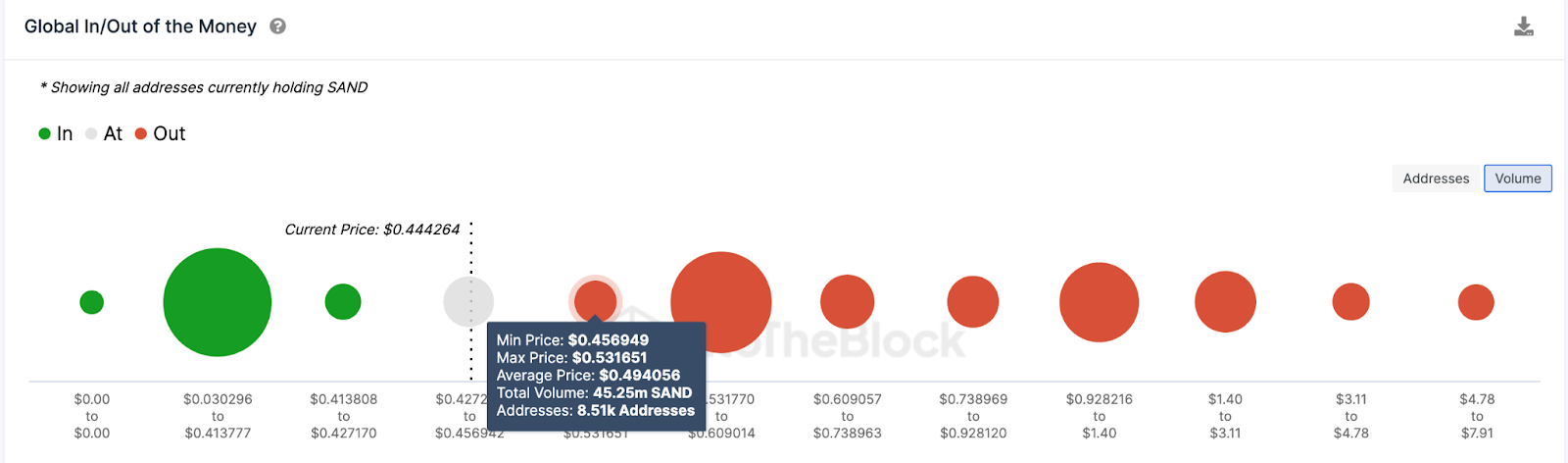

The Global In/Out of the Money (GIOM) data, which groups the current $SAND holders according to their entry prices, also confirms this bullish price prediction.

It, however, shows that the bears must scale initial resistance at $0.50 to be confident of a parabolic breakout. As shown below, 8,510 holders bought 45.25 million $SAND at the average price of $0.49. If those investors exit early, they could trigger a $SAND price correction.

But if the bulls can scale that sell wall, The Sandbox’s native token price will likely reclaim $1 as predicted.

Still, the bears could negate the positive prediction if $SAND price dips below $0.35. But, in that case, the 20,050 holders that bought 1.05 billion $SAND at the maximum price of $0.41 could offer initial support. If those investors HODL firmly, $SAND price will likely avoid a larger downswing.

Read More: Best Crypto Sign-Up Bonuses in 2023

beincrypto.com

beincrypto.com