Bitcoin’s price declines worsened in the past 24 hours as the asset fell further from the $36,000 mark to a weekly low of $35,000.

Most altcoins are also in the red today, and the total market cap dumped by over $40 billion at one point.

BTC Sees Weekly Lows

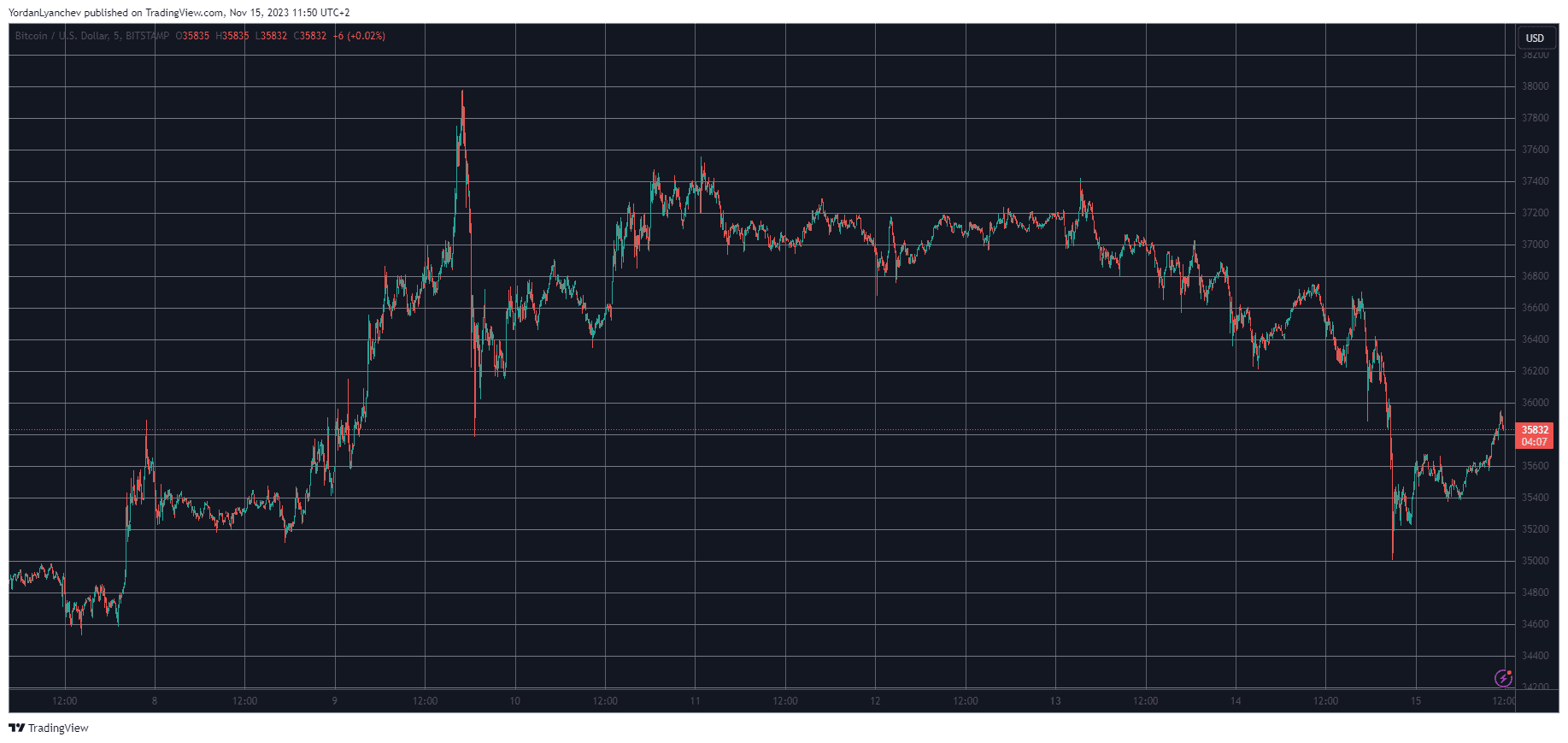

Ever since the enhanced volatility experienced last Thursday, when bitcoin pumped to an 18-month peak at $38,000 and was violently rejected to under $36,000, the cryptocurrency had been trading with significantly fewer fluctuations.

It recovered some ground in the following days and settled at around $37,000 during the weekend and on Monday. The first signs of a potential retracement came yesterday when BTC slipped back down to just over $36,000. The US CPI numbers didn’t move it all that much, at least at first, but the landscape changed for the worse later on.

The bears pushed the asset south hard, and BTC found itself dumping to a weekly low of $35,000 (on Bitstamp). It reacted well, though, and has recovered nearly a grand since then. Nevertheless, bitcoin still sits below $36,000 as of now, and its market cap is close to breaking below $700 billion.

Its dominance over the altcoins has also taken a hit and is under 51% on CMC.

SOL, AVAX Defy Market Movements

Most alternative coins followed bitcoin on its way south. Despite recovering some of the daily losses, assets like ETH, BNB, XRP, ADA, DOGE, TRX, MATIC, DOT, and Toncoin are currently well in the red.

In contrast stand Solana and Avalanche. Both assets are up by 9% and 12.5%, respectively. SOL is close to $60, while AVAX is at $19.

More gains come from the likes of LDO, KAS, RUNE, and ATOM. In the case of the first three, the daily price pumps are by double digits.

Nevertheless, the total crypto market cap saw a $40 billion decline overnight but has recovered approximately half of it from the daily lows.

cryptopotato.com

cryptopotato.com