The current bullish market sentiment is significantly influencing the broader cryptocurrency market. Obscure assets, such as ZRX, the governance token for the 0x decentralized exchange protocol, have surged by an impressive 238% in the last two months.

According to BeInCrypto data, the token’s value surged approximately 20% today and an impressive 88% over the past week to a yearly high of $0.50 as of press time.

What is Driving ZRX Price?

Prominent crypto analytical firm Santiment attributed ZRX’s impressive price rally to whale transactions. According to the firm, whale transactions for the crypto tokens are at an 18-month high, and older coins are returning to circulation.

Crypto trading platform Hyblock further corroborated this report, pointing out that ZRX was one of three tickers in which whales were rapidly building long positions relative to retail.

Read more: 7 Must-Have Cryptocurrencies for Your Portfolio Before the Next Bull Run

0x Protocol is a decentralized exchange infrastructure protocol allowing users to trade ERC20 tokens and other digital assets across various blockchain networks, including Ethereum.

It eliminates the need for centralized intermediaries and is driven by the ZRX token. ZRX holders engage in governance activities and also have access to the project’s communal treasury. CoinMarketCap claims the protocol has facilitated over $200 billion in trading volume since its inception.

In April, its developers, 0x Labs, said the project’s governance would transition to the community to enable it to flourish.

Institutional Interest Driving Market

The crypto market is driven by institutional and whale demand, who are scooping up major digital assets.

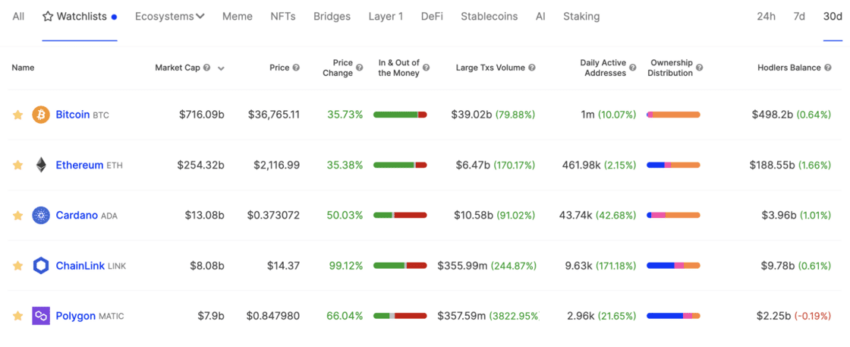

Blockchain data aggregator IntoTheBlock posited that:

“Institutional and whale demand has picked up strongly, with Bitcoin seeing an 80% increase in the volume of transactions of over $100,000, Ethereum 170%, and Polygon over 3,800% compared to 30 days ago.”

Over the past several weeks, the crypto market has faced increased interest. This is due to the buzz surrounding the possibility of a spot Bitcoin exchange-traded fund (ETF). As a result, the value of top digital assets, including Bitcoin, Ethereum, and Solana, has rallied to new yearly highs.

Read more: How To Prepare for a Bitcoin ETF: A Step-by-Step Approach

Observers have suggested that the current upward trend indicates that the market awaits approval of several ETF applications.

beincrypto.com

beincrypto.com