When FTX crashed in November 2022, it triggered a multi-billion dollar exodus spree, bringing Bitcoin down 22% in a single day. By the end of the month, the European Central Bank (ECB) fired an unusual shot across the crypto bow. As Bitcoin’s price stabilized, the central bank suggested this is Bitcoin’s “last gasp before the crypto-asset embarks on a road to irrelevance.”

Interestingly, the ECB’s public comment came from a competitive standpoint. The co-author of “Bitcoin’s Last Stand” was Ulrich Bindseil. As ECB economist, Bindseil authored a paper titled “Central Bank Digital Currency – Financial System Implications and Control” in May 2019. The paper clearly outlined where the monetary system is heading.

| Benefit of CBDC | Possible further factors or requirements |

|---|---|

| A. Efficient retail payments | |

| A.1 Making available efficient, secure and modern central bank money to everyone | In particular in economies without high-quality electronic commercial bank money, and/or without a secure and efficient payment system |

| A.2 Strengthening the resilience, availability and contestability of retail payments | In particular in economies in which banknote demand vanishes and private electronic payments solutions lack competition |

| B. Overcome use of banknotes for illicit activities | |

| B. Better control of illicit payment and saving activities, money laundering, and terrorist financing | Requires (i) discontinuation of banknotes (or at least of larger denominations); (ii) CBDC to not take the form of anonymous token money |

| C. Strengthen monetary policy | |

| C.1 Allows overcoming the ZLB as negative interest rates can be applied to CBDC | Requires discontinuation of banknotes (or at least of larger denominations) |

| C.2 Interest rates on CBDC provide for additional monetary policy instruments, independently of ZLB | |

| C.3 Easier ability to provide helicopter money | Requires that each citizen has a CBDC account |

| D. Sovereign money related | |

| D.1 Improve financial stability and reduce moral hazard of banks by downscaling the role of the banking system in money creation | CBDC takes over to large or full extent sight deposit issuance by banks |

| D.2 Larger seignorage income to state (and citizens) as state takes back money creation from banks. | CBDC takes over to large or full extent sight deposit issuance by banks |

Table 1: Overview of benefits that some have associated with CBDCs, and related factors or requirements

In other words, Bitcoin and CBDCs are heading for a clash – surveillance token vs sovereign money. The world’s financial institutions, from IMF and BIS to ECB, have already established that anonymity is a problem to be solved, so a CBDC token cannot retain the properties of cash in digital form.

“However, anonymity can also be used for illicit purposes and can undermine AML/CFT measures. Anonymity, therefore, poses a policy trade-of—the more anonymity, the larger the risk for illicit use.”

Behind the Scenes of Central Bank Digital Currency, IMF eLibrary

Given the programmable nature of CBDC tokens, that “illicit use” can then be extended ad infinitum. Money, as we know it would no longer be a social engineering tool. Case in point, NatWest Bank integrated Carbon Planner and Carbon Footprint Tracker under the climate change narrative.

With further integration of CBDCs, such features could turn overnight from opt-in features to a Chinese-style social credit system. Once a citizen’s ID is integrated into a CBDC account, few steps remain to build a new social landscape.

For instance, taking advantage of its erected COVID-19 surveillance infrastructure, China can turn off citizen’s access to public travel as they try to get their frozen money out of commercial banks. Bank customer Liu, per Reuters:

“I can’t do anything, I can’t go anywhere. You’re treated as though you’re a criminal. It infringes on my human rights.”

Even without CBDCs, such a scenario played out in Canada during the trucker convoy protests against lockdowns and vaccine mandates. It is no understatement to say this decade will be a turning point. One in which the nature of money will be fully explored.

Will money become a leverage for social planners, or will citizens take advantage of non-governmental money that is truly sovereign?

In this rapidly evolving monetary landscape, what role does Bitcoin play?

Bitcoin’s Decentralized and Open Framework

Bitcoin emerged as an elegant marvel of software engineering. The task before it was daunting. How to secure a publicly verifiable accounting of wealth without any governing body?

Bitcoin’s network architecture archives this through permissionless decentralization. Anyone with internet access can become an auditor, a network node that verifies data blocks containing all the transactions. These full nodes contain the entire ledger history, comparing one block against the other.

At the same time, auditors (Bitcoin miners) are incentivized with BTC rewards for their proof of work. Most importantly, Bitcoin is grounded in physicality. Miners’ computers have to harness their computing power to solve complex cryptographic puzzles when adding new transaction blocks.

And that computing power requires energy. At 462 million terrahash per second (TH/s), Bitcoin is the world’s largest computing network.

For such a network to be compromised, like falsifying block transactions or double-spending, the attackers must recalculate unique identifiers (hash) for BTC transactions of all previously added transaction blocks.

By all intents and purposes, attacking Bitcoin’s blockchain would be virtually impossible for even large state agents precisely because of Bitcoin’s grounding in proof-of-work physicality.

Yet, this energy cost has made Bitcoin a frequent target. If it were a country, Bitcoin would rank 34th by energy consumption. Is this wasteful? Does it matter if the Bitcoin network already consumes renewable sources or stabilizes existing power grids? Is the cost of securing a public ledger fairly priced?

The market certainly seems to perceive it as such.

If that weren’t the case, we would already have a new kind of Bitcoin when Greenpeace launched the “Clean up Bitcoin” campaign. This is an odd approach, given that Bitcoin code is open source.

For the cost of the media campaign, Greenpeace could have funded Bitcoin’s hard fork as a proof-of-stake Bitcoin. Therefore, cleaning it up as a low-energy network. The fact this failed to occur means that Bitcoin has an intractable first-mover advantage

Bitcoin’s First-Mover Advantage and Market Expansion

Bitcoin’s controversial physicality as an energy-intensive network is the baseline for its market expansion. After all, if anyone could copy or tweak Bitcoin’s open-source code, where would its value be?

The fact that the Bitcoin network uses energy as a scarce resource infers value onto BTC. And the more energy it uses for computing hashes, the more it is difficult to attack it. Note that this is only possible with the first-mover advantage.

As the first cryptocurrency, Bitcoin has become synonymous with digital money, reaping the benefits from the network effect. This organic branding increased Bitcoin’s liquidity pool to $1.2 trillion in November 2021.

Although the Federal Reserve’s unprecedented money supply increase is largely responsible for this liquidity boost, it showcases the demand for predictable monetary policy. To that end, El Salvador was the first nation to break the psychological barrier by adopting Bitcoin as legal tender.

Indicatively, Argentinian presidential candidate Javier Milei won 30% of votes against the incumbent Economy Minister Sergio Massa, as the enforcer of monetary policies that led Argentina to have 138.30% YoY inflation rate in September.

According to Javier Milei, Argentinian presidential candidate:

“Bitcoin represents money’s return to its original maker: the private sector. Money is a private invention. Bitcoin has an algorithm that one day it will reach a certain amount and there is no more.”

In the meantime, the CBDC deployment in Nigeria, the second largest after China, has been met with adoption failure and social chaos. Moreover, the Central Bank of Nigeria’s 300-page CBDC paper openly noted that eNaira can potentially undermine financial stability.

Namely, that reliance on central banking would make commercial banks obsolete, necessitating CBDC limits to prevent bank runs. Banking disintermediation risk is the same concern issued by the UK’s House of Lords in January 2022.

“While a CBDC may provide some advantages, it could present significant challenges for financial stability and the protection of privacy.”

This is another window in which Bitcoin demand can further expand. However, Bitcoin’s primary driver is its monetary predictability, which is sorely lacking within the central banking system.

Bitcoin’s Monetary Policy Puts Users First

It is no secret that Bitcoin emerged as a peer-to-peer electronic cash after 2008 banking bailouts. After all, this message is ingrained in the Bitcoin genesis block, serving as an indictment of central, fractional-reserve banking.

Central banks have a track record of drastic currency devaluation throughout history, as they arbitrarily tweak money supplies based on governmental needs. According to the Bureau of Labor Statistics, the dollar’s purchasing power declined by 93.7%. This means that $1,594.76 today was worth $100 in 1920, six years after the creation of the Federal Reserve.

The relentless devaluation of currency exerts immense pressure on personal wealth, compelling individuals to pursue aggressive investment strategies, such as short-selling, to counteract this insidious form of wealth erosion.

Without the dollar’s shock-absorbant global reserve currency status, one could only wonder what that debasement would look like.

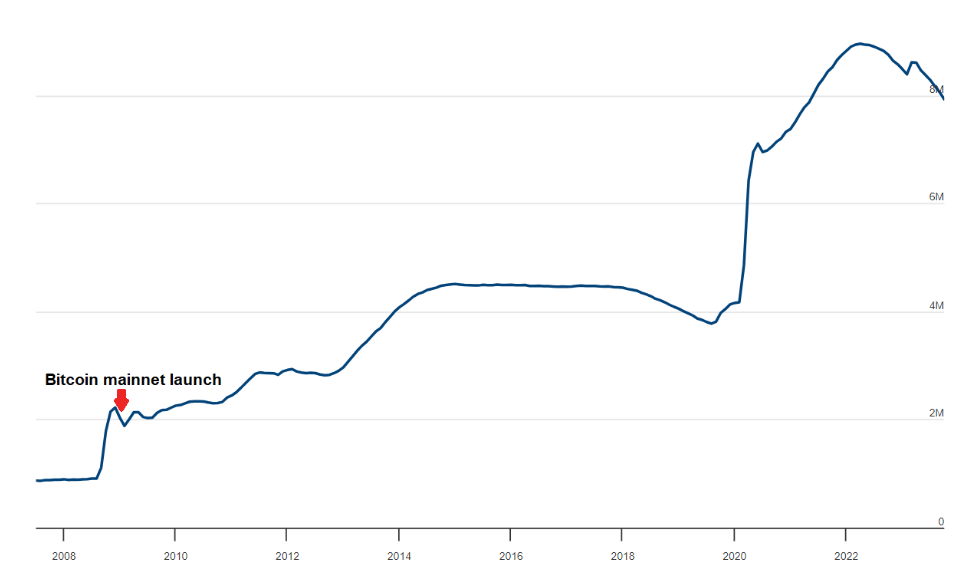

Alongside stocks and commodities, Bitcoin emerged as one currency debasement hedge, limited to 21 million BTC, a certainty enforced by its vast computing network. For comparison, the Federal Reserve balance sheet increased by 290% since Bitcoin launched in January 2009, from $2 trillion to nearly $8 trillion.

At the same time, the USG engorged on debt feeding, courtesy of the Fed, having doubled national debt as GDP percentage to nearly 120%. On October 19th, at the New York Economics Club, Fed Chair Jerome Powell admitted that moral hazards in the central banking system created a perilous path.

“The path we’re on is unsustainable, and we’ll have to get off that path sooner rather than later,”

Yet, it is exceedingly difficult to conceive a path without warped incentives in the current system. How could any politician promise to “fix problems” without more money printing and more debt? A debt that could eventually lead to a sovereign debt crisis.

If anything, a CBDC deployment would lead to the same monetary policies but with greater granular control of people’s funds and spending habits. Unlike any other asset, Bitcoin lacks a governing structure that infuses it with moral hazards. For the first time in monetary history, Bitcoin represents publicly verifiable wealth accounting.

Conclusion

In the last three years, the world witnessed the accelerated erosion of purchasing power. As governments create money ex nihilo from central banks, the cost has to be paid. Inflation is only the interim cost on the road to the sovereign debt crisis.

As debt servicing becomes more unsustainable, central banks will likely resort to inflating away the debt. They could devalue debt realistically by rapidly increasing the money supply and outpacing debt growth.

This is the historical window in which Bitcoin could come into play as an alternative, disintermediated from moral hazards but bound by cryptography, energy, and math.

cryptoslate.com

cryptoslate.com