While optimism continues to dominate the cryptocurrency market that the SEC will approve the spot Bitcoin ETF, positive news came from Grayscale.

According to reports, the SEC has begun negotiations regarding the conversion of Grayscale's Bitcoin trust product GBTC into a spot Bitcoin ETF.

This positive news from Grayscale and the SEC was received positively by cryptocurrencies, especially Bitcoin, and crypto prices showed a positive trend in the market.

At this point, the crypto market cap reached $1.38 trillion, an increase of 3.45%.

While BTC rose to $ 36,800 with the news, altcoins also turned green. The largest altcoin Ethereum (ETH) increased by 2.43% in the last 24 hours, reaching up to $1,929.

Apart from ETH, XRP, Cardano (ADA), Dogecoin (DOGE) and Chainlink (LINK) recorded significant increases.

While XRP increased by 3.56% in the last 24 hours to over $0.70, Cardano increased by 4% to $0.368; DOGE increased by 4.17% to $0.0767; LINK increased by 8.6% and reached $14.6.

Apart from these, MINA with an increase of 21%, NEO with an increase of 13%, PEPE with an increase of 13% and SUI with an increase of 11% also made significant gains in the last 24 hours.

While these increases were experienced in Bitcoin and altcoins, investors in short positions were also left in reverse and liquidated.

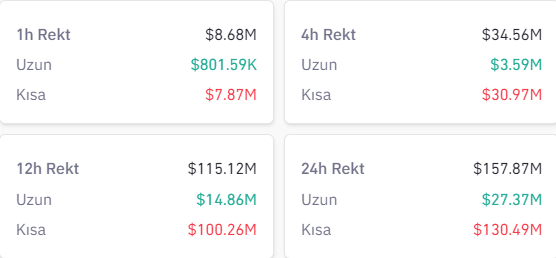

According to data from Coinglass, close to $157.87 million worth of positions were liquidated in crypto futures in the last 24 hours. Of this, $130.49 million consisted of short positions and $27.37 million consisted of long positions.

Among liquidated short positions, Bitcoin ranked first with $71.3 million, which corresponds to a rate exceeding 50%. After BTC, $17.95 million in ETH was liquidated, followed by GAS and LINK.

*This is not investment advice.