After a broadly positive month of September, the crypto market has really regained steam in October, with some of the major cryptocurrencies, including Bitcoin, leading the charge heading into November.

This market momentum comes off the back of positive news surrounding the regulatory approval of BTC ETFs in the United States, which could bring some much needed smart money to the crypto market.

Analysts are hopeful that this could mark a turnaround for crypto in the coming months, which is especially good news for long-term investors of otherwise underperforming crypto assets this year.

Some, such as Nick James of FirmFunded.com, have also argued that BTC is on its way over the $40,000 mark, which would be in stark contrast to the $25,000-$30,000 range seen throughout 2023.

Top 5 Gainers

October has proven to be a month of gainers this year. The news of BTC ETFs coming to the United States rattled the market and triggered a substantial bull run.

Some of the notable gainers alongside Bitcoin include the likes of Solana and Chainlink, who posted truly impressive gains during the month.

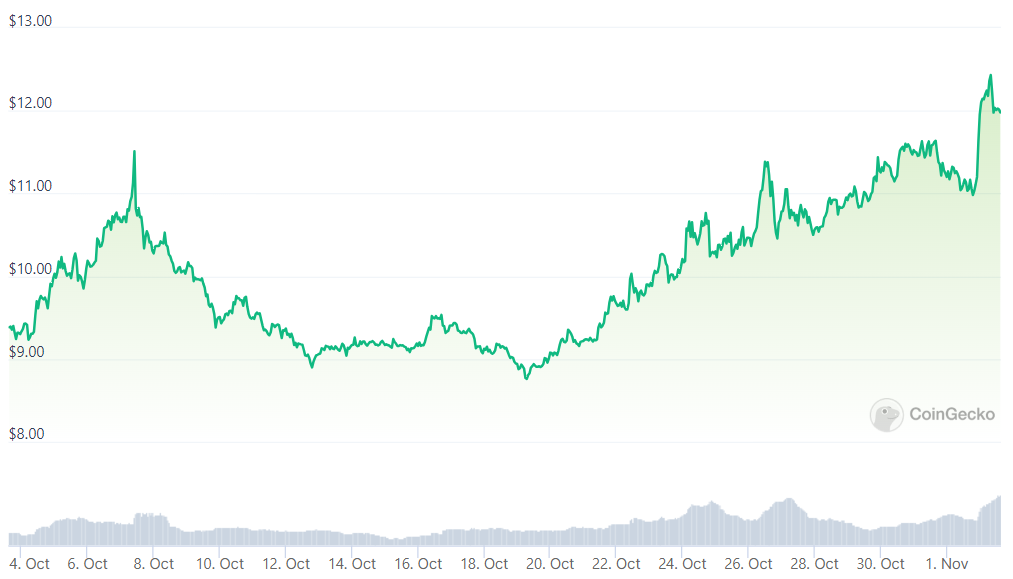

Solana (SOL) +80.71%

2023 has been a rough ride for the long-term investors of Solana and the month of October came just in time to redeem the currency and give investors a glimmer of hope going forward.

Solana has gained over 80% in the month of October, which has also turned its annual performance into the green, with a gain of 39% over the year.

Sustaining this rapid growth may prove challenging for Solana. However, investors will be hopeful of SOL retaining some of its gains heading into November and beyond.

Whether Solana keeps its upward momentum remains to be seen, but October’s rise has truly turned the tides for long-term SOL investors.

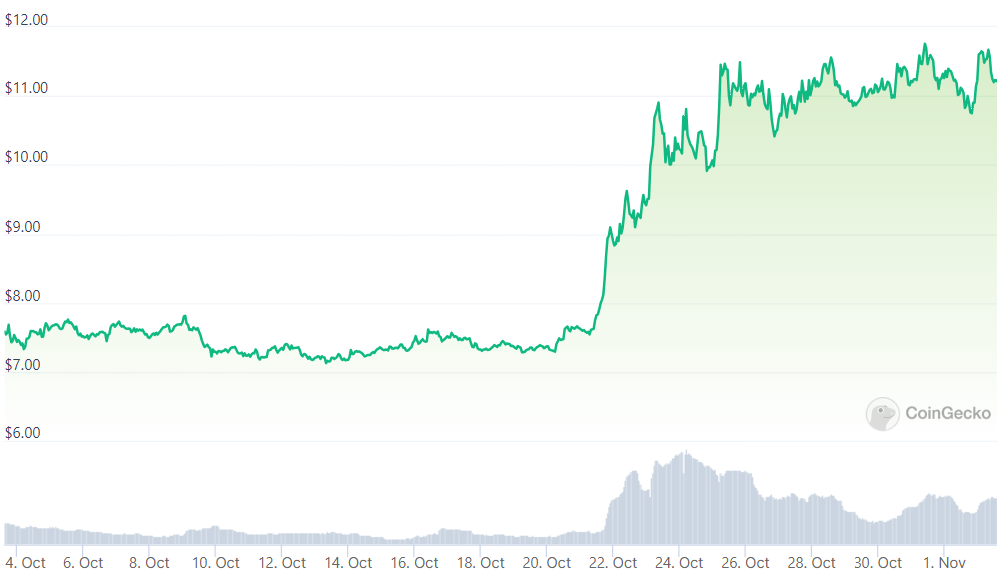

Chainlink (LINK) +40.13%

Another notable gainer in October was Chainlink, which managed to bounce back by as much as 40% during the month, which adds up to a tally of 45% over the past year.

Leading up to October, Chainlink was among the most disappointing major crypto projects of the year, but this month has certainly brought some wind back into LINK’s sails.

The bulk of the price action came on October 22nd and the trend continued towards the end of the month, taking Chainlnk’s price from $8 to $11 over the course of one week.

Going forward, Chainlink investors will be hopeful of more positive news to keep the momentum alive, but much of LINK’s performance will depend on the rollout speed of the Bitcoin ETFs in the U.S.

Bitcoin (BTC) +24.66%

The most important of them all and the catalyst of October’s bull run, Bitcoin has enjoyed a fruitful year in 2023 so far, gaining over 70% over the past 12 months.

October saw the currency jump by roughly 25% on the news of BTC ETFs coming to the United States.

This can accelerate the entry of institutional investment in the crypto market and with BTC being the primary target of such investments, long-term investors will be watching the market closely to see how this development shapes up and affects the price of the asset.

Many analysts are hopeful of BTC reaching the $40,000 price point before the end of 2023, which remains to be seen, but October has brought much more optimism to the market overall.

Avalanche (AVAX) +23.35%

Avalanche has been one of the worst-performing major currencies on the market and while it also gained a healthy 23% in October, this has not been enough to turn its favors when it comes to annual performance. AVAX is down 33% over the course of the past 12 months.

Investors will be hopeful that the positive news that triggered the October boom will continue and finally bring AVAX into the green over the year.

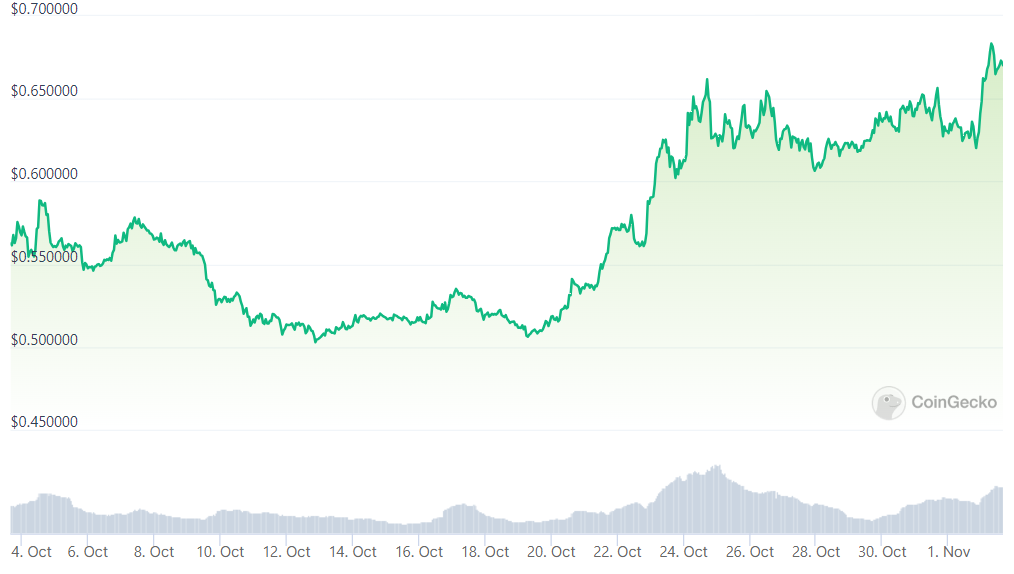

Polygon (MATIC) +19.15%

Another cryptocurrency that saw gains in October but could not substantially improve its annual performance in Polygon.

MATIC gained over 19% in October, but its annual return is a 21% loss for long-term investors.

However, MATIC is characterized by high volatility, which gives investors hope that more positive news could send the coin even higher, eventually reaching positive annual returns.

While investor confidence may have been lifted in October, it remains to be seen whether MATIC has the fuel to continue its forward momentum heading into November.

Top 5 Losers

Due to the sheer amount of buying happening on the crypto market in October, losers have been few and far between. Some currencies, such as Maker and Sui, did shed some market value this month, coming off the back of a more positive September for these currencies.

Regardless, the overall positive sentiment in October has meant that very little noticeable losses have occurred.

TomiNET (TOMI) -62.1%

A lesser-known coin, TomiNET has had a terrible October, losing over 60% of its market value, which puts the current price at over 50% less than the ATH in June of this year.

TOMI had its ICO in February, which means that there is not a lot of performance data available for this particular coin.

Investors in TOMI will be hopeful of a longer turnaround on the crypto market to boost bullish sentiment and help the coin regain lost ground in the process.

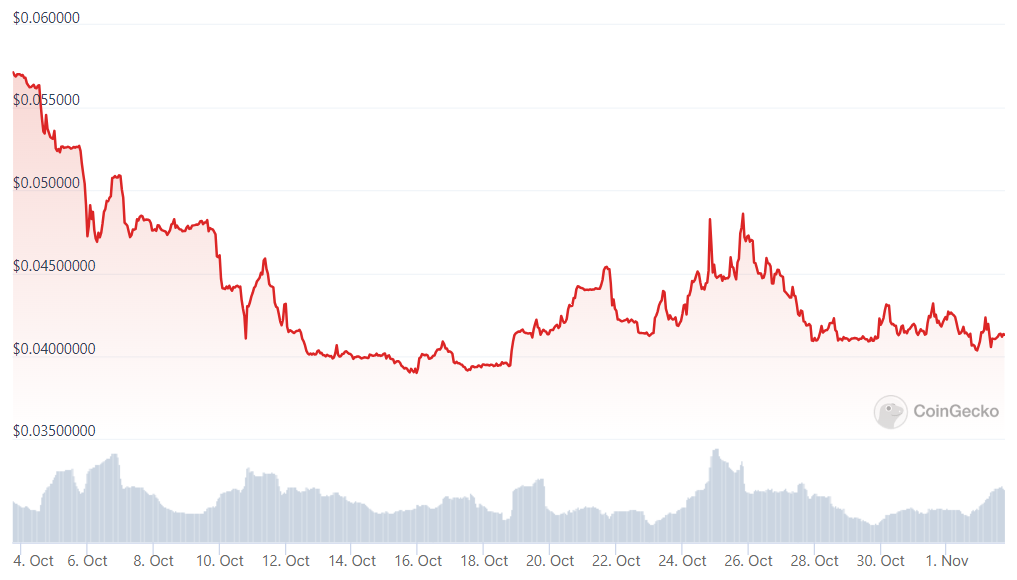

Radix (XRD) -27.4%

Another coin which was an outlier from the October boom was Radix. The coin lost over 27% of its market value during the month, which adds up to an annual loss of 22.6%.

Radix, similarly to TomiNET, will be dependent on broader market sentiment in the coming months. While a bullish run in November might not be enough to propel Radix to all time highs, it could erase some of the losses experienced by Radix investors since the start of 2023.

Whether Radix manages to cover its losses remains to be seen, but investors can be cautiously optimistic about its near-term future prospects.

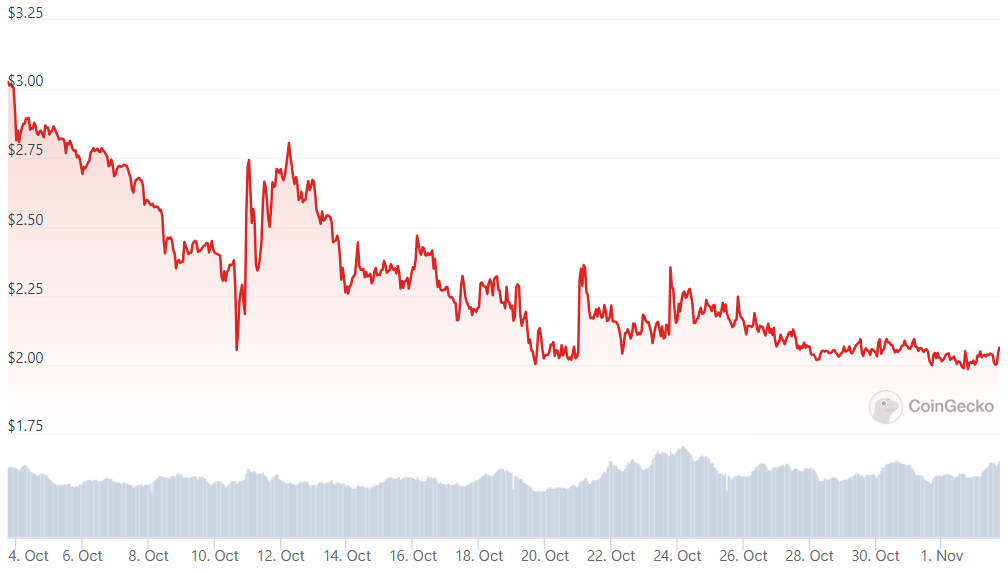

Maker (MKR) -10.71%

Maker had a relatively difficult month in October, losing roughly 10% over the past 30 days. However, the month did see MKR surge on the news of BTC ETFs, but failed to keep the momentum as a correction was imminent, as evident on the price chart.

It is uncertain whether Maker will be able to turn its fortunes around in the coming months, as a concentrated bullish effort will be required for the coin to retain its position.

Maker has dropped from $1,600 to $1,300 in October and started to slowly regain ground towards the end of the month.

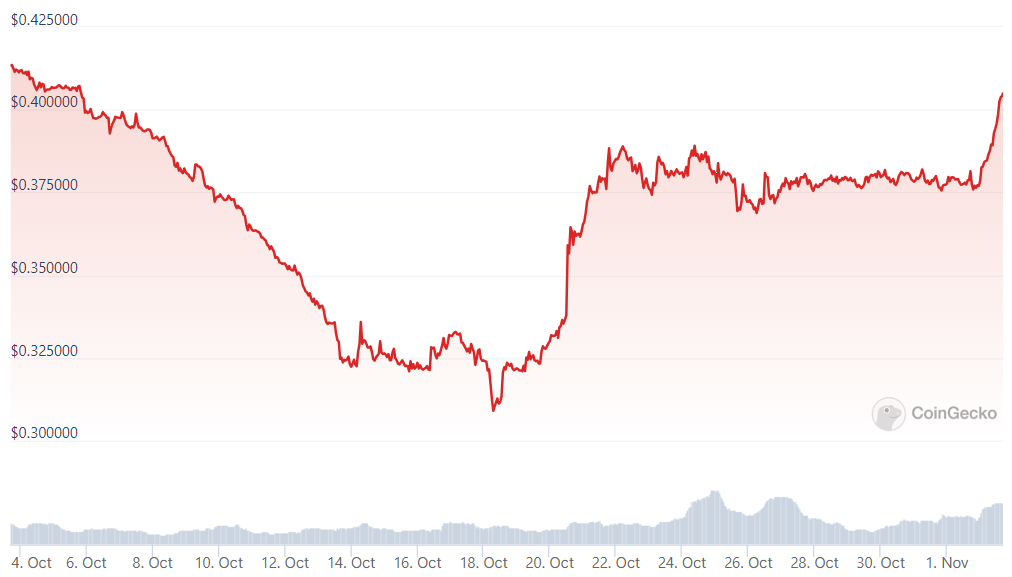

Mantle (MNT) -1.8%

Thanks to the dominant bullish run in the month of October, major losers have been few on the crypto market and Mantle is one of them. The coin lost roughly 2% of its market value over the month, which might not be noteworthy in itself, but the coin was close to breaking below the $0.30 support line, before bouncing back close to $0.40.

This significant drawdown and comeback could mean that Mantle is gearing up for a positive month in November.

Bitcoin Cash (BCH) -1.2%

Bitcoin Cash has been a mixed bag during the month of October, falling to as low as $210 and bouncing back up to $265 towards the last week of the month.

BCH did manage to turn green overall, but this can still be seen as an underperformance when compared to most other major currencies on the market.

BCH investors would expect the coin to see some bullish action in October but so far this has not happened. Whether November will be the month when Bitcoin Cash marks a turnaround remains uncertain.

Final Thoughts

The month of October has been spectacular for the global crypto market. The rise of BTC triggered a massive bull run on the market, with most of the major and minor crypto currencies posting double digit growth.

Certain currencies, such as Solana and Chainlink, enjoyed their best month in 2023, while others, such as Bitcoin Cash and Maker, lagged behind.

Going forward, keeping this momentum may prove challenging, but certainly not impossible.

Long-term investors should be hopeful of a broader market turnaround if November also continues in the same direction.

Overall, crypto investors will be pleased with the month of October and should be looking forward to more action as 2023 slowly draws to a close.

cryptonews.net

cryptonews.net