$NEO gained bullish momentum after over eight months as Bitcoin (BTC) surpassed the $30,000 mark on Oct. 19.

The asset reached $15.3 on Nov. 5, marking a 36-week high — $NEO reached $15.5 in mid-February. The native crypto of the Chinese blockchain Neo, which once competed with the second-largest blockchain, Ethereum (ETH), has gained bullish momentum after eight months of constant declines.

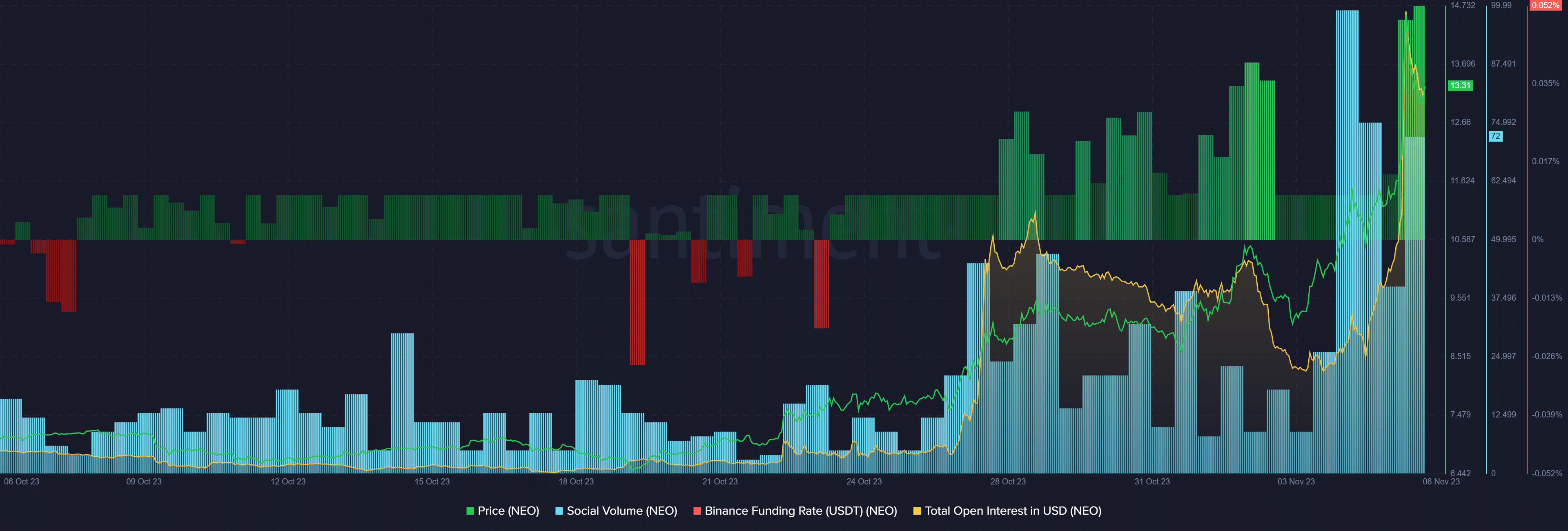

According to data from the market intelligence platform Santiment, $NEO’s social volume skyrocketed over the past week — marking an 800% surge in the past seven days.

$NEO reaches 36-week high while short-positions rise - 1">

$NEO reaches 36-week high while short-positions rise - 1"> Moreover, data from Santiment shows that the Binance futures funding rate for Neo has reached 0.05%. In simple terms, this indicates that short-position holders are dominating long-position holders until major movements happen.

You might also like: U.S. Treasury sanctions a money launderer tied to Russian elites

As the token reaches its local top, $NEO’s total open interest (OI) witnessed a 68% rise in the past 24 hours. According to the market intelligence platform, Neo’s total OI in derivatives contracts has reached $44.3 million.

However, while the Binance funding rate suggests the dominance of short positions, the exact amounts of short and long positions are still not precise.

$NEO is up by 17.6% in the past 24 hours and is trading at $13.66 when writing. It’s important to note that the asset registered a 91% rise over the past 30 days.

Data shows that the total market cap of $NEO is currently sitting at $963 million, making it the 50th largest cryptocurrency. Neo’s 24-hour trading volume surged by 316%, reaching $613 million.

Read more: Top assets to watch this week: EGLD, SOL, ARB