United States Securities and Exchange Commission’s (SEC) Chair Gary Gensler’s recent remarks on Bitcoin echo a cautionary tale of “fraud, scams, bankruptcies, and money laundering.” His stern stance, reiterated at the 2023 Securities Enforcement Forum, highlights the need for stringent regulations in the crypto market.

However, the narrative varies significantly across borders. Nations like Canada and Paraguay showcase the brighter facets of Bitcoin, particularly in the mining sector.

SEC Chair Gary Gensler Goes Off Against Crypto

Gary Gensler’s unwavering view depicts a Bitcoin industry laden with nefarious activities, often camouflaging beneath the veil of modern financial innovation.

His words resonate amidst the turmoil witnessed in the crypto market. Most notably, the implosion of crypto exchange FTX, crypto hedge fund Three Arrows Capital, and the algorithmic stablecoin Terra UST.

“This is a field rife with fraud, scams, bankruptcies, and money laundering. While many entities in this space claim they operate beyond the reach of regulations issued before Satoshi Nakamoto’s famous white paper, they also are quick to seek the protections of the law, in bankruptcy court and litigating their private disputes… And don’t get me started on crypto. I won’t even name all the individuals we’ve charged in this highly noncompliant field,” Gensler said.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

Under Gensler’s helm, the SEC has been relentless. The federal agency is pursuing lawsuits against crypto titans like Coinbase and Binance, vouching for the sanctity of the Howey Test to discern investment contracts.

“There is nothing about the crypto asset securities markets that suggests that investors and issuers are less deserving of the protections of our securities laws. Congress could have said in 1933 or in 1934 that the securities laws applied only to stocks and bonds. Yet Congress included a long list of items in the definition of a security, including investment contract,” Gensler added.

On the contrary, a glance beyond the US borders, and even within, unfolds a more auspicious narrative. The spotlight shifts to Bitcoin mining often vilified for its energy voracity, yet there are places where the story is different altogether.

Bitcoin Mining Proves to Support Local Economies

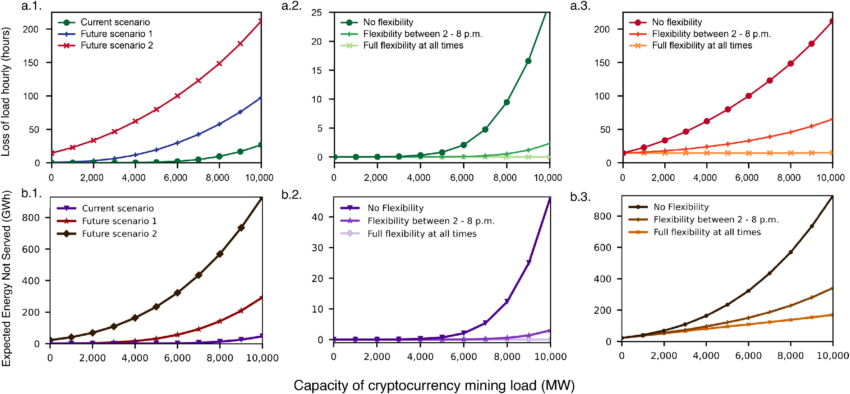

Data from Texas A&M reveals a negative correlation between system-wide average local marginal price (LMP) and system-wide total load. This suggests a symbiotic relationship rather than a parasitic one.

“Our analysis shows that treating cryptocurrency mining as fully flexible demand does not negatively impact grid reliability, even when present in large quantities at specific locations,” the report concluded.

Likewise, Lee Bratcher of the Texas Blockchain Council emphasized the positive grid impact of Bitcoin miners’ curtailment efforts during high-demand periods.

“We recognize that ERCOT needs more visibility into the timing of these curtailments and are working collaboratively with the ERCOT to ensure this happens,” Bratcher said.

The ripple effect of Bitcoin mining transcends grid resilience. In Texas, the venture has generated approximately 2,000 rural jobs, a testament to the economic propellant crypto mining can morph into. And companies like Riot unveil the broader picture where miners prepurchase electricity and sell it back during exigencies like heatwaves to contribute to the grid and the local economy.

“Riot achieved a new monthly record for Power and Demand Response Credits, totaling $31.7 million in August, which surpassed the total amount of all Credits received in 2022. Based on the average Bitcoin price in August, Power and Demand Response credits received equated to approximately 1,136 Bitcoin,” Jason Les, CEO of Riot, stated.

Read more: Best Cloud Mining Sites 2023: A Beginners Guide

The narrative transcends to nations like Canada and Paraguay. There, Bitcoin miners are bolstering local economies and aligning with carbon goals.

For instance, Iris Energy in British Columbia harnesses excess hydropower, creating jobs and fostering community growth through grant programs. Similarly, in Paraguay, Sazmining’s collaboration with the Itaipu dam manifests a win-win scenario. It monetizes excess electricity, boosting the local GDP, and enticing a new breed of ESG investors.

As Bitcoin miners in these nations industriously strive to alter the often misconstrued narrative, their tales are a stark divergence from the grim picture painted by SEC’s Gensler, shedding light on the manifold avenues where Bitcoin intersects with real-world solutions, albeit nascent.

beincrypto.com

beincrypto.com