Injective (INJ) grazed the $10 milestone on Monday, October 2023, as the bulls extended the winning streak to 10 days. The on-chain analysis examines the main drivers behind this INJ price bounce and how long it could last.

INJ’s price entered a tear over the weekend as markets reacted positively to a vital product feature launched on the Injective’s native decentralized exchange. How much further can the bulls push the INJ price rally?

Injective Network Attracts Hundreds of New Users with New Product Feature

On October 19, Helix, the decentralized exchange (DEX) built on the Injective Layer-1 blockchain, announced the addition of pre-launch futures to its range of product offerings.

This “pre-launch” trading feature enables crypto traders on the Injective’s native DEX to users to speculate on unreleased tokens before their official launch or exchange listings.

The successful launch of this product feature appears to have rubbed off on the Injective, the host blockchain network.

Since the Helix team teased that “pre-launch” trading feature, hundreds of new users have trooped into the Injective network.

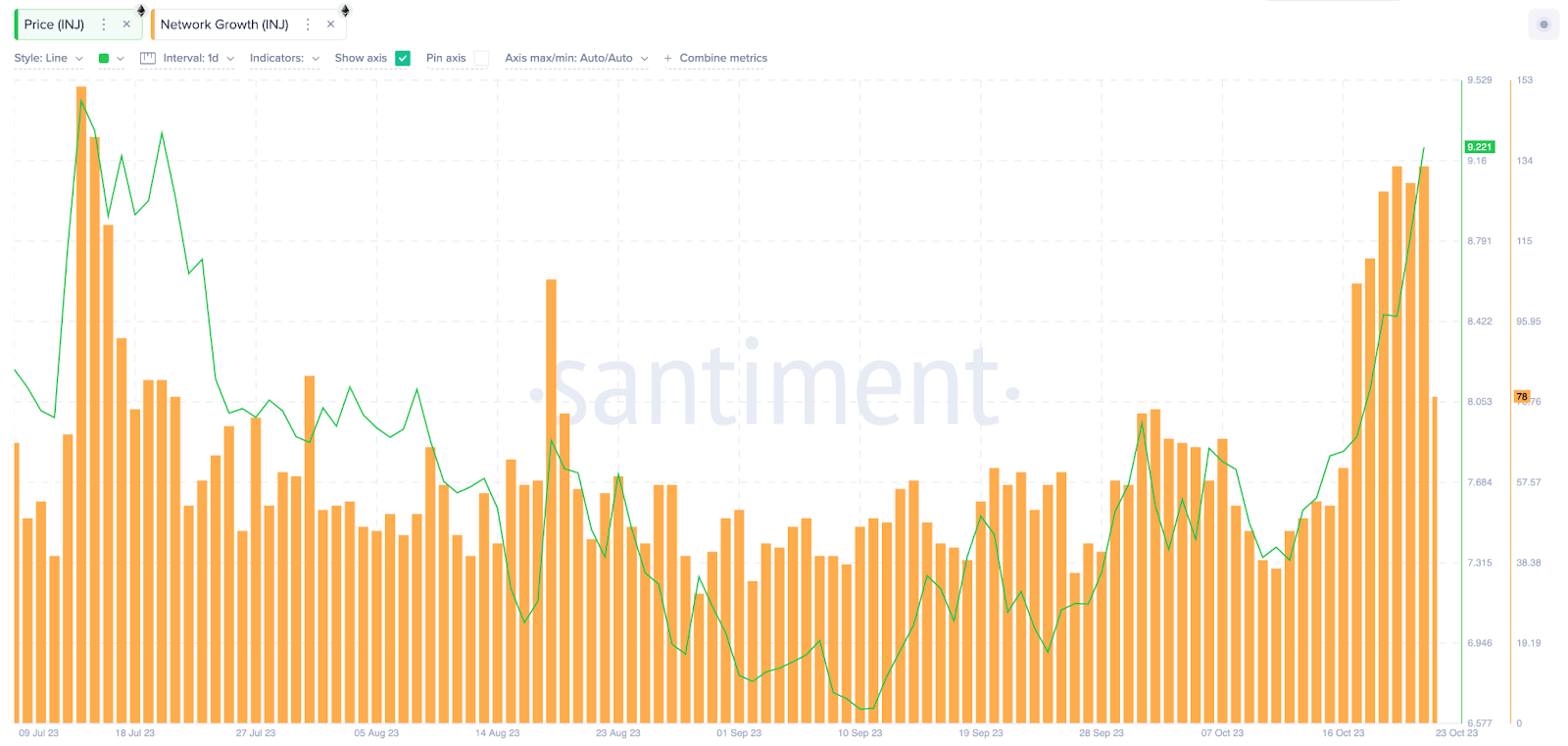

On-chain data shows that Injective Network Growth has been on a persistent rise since October 17. Notably, the 133 new INJ wallets registered on October 20 and October 22 represent the highest network growth for Injective since mid-July.

Network Growth measures the rate at which a blockchain network attracts new users by totaling the daily number of new wallets created. Typically, a spike in new users is a bullish signal.

It implies increased demand for the native token and the products and services on the blockchain network.

The correlation between Helix’s recent product launch and Injective Network Growth spikes suggests the new product feature is a major driver behind the ongoing INJ price rally.

Read More: 9 Best Crypto Futures Trading Platforms in 2023

Spikes in Media Hype Raise Some Early Red Flags

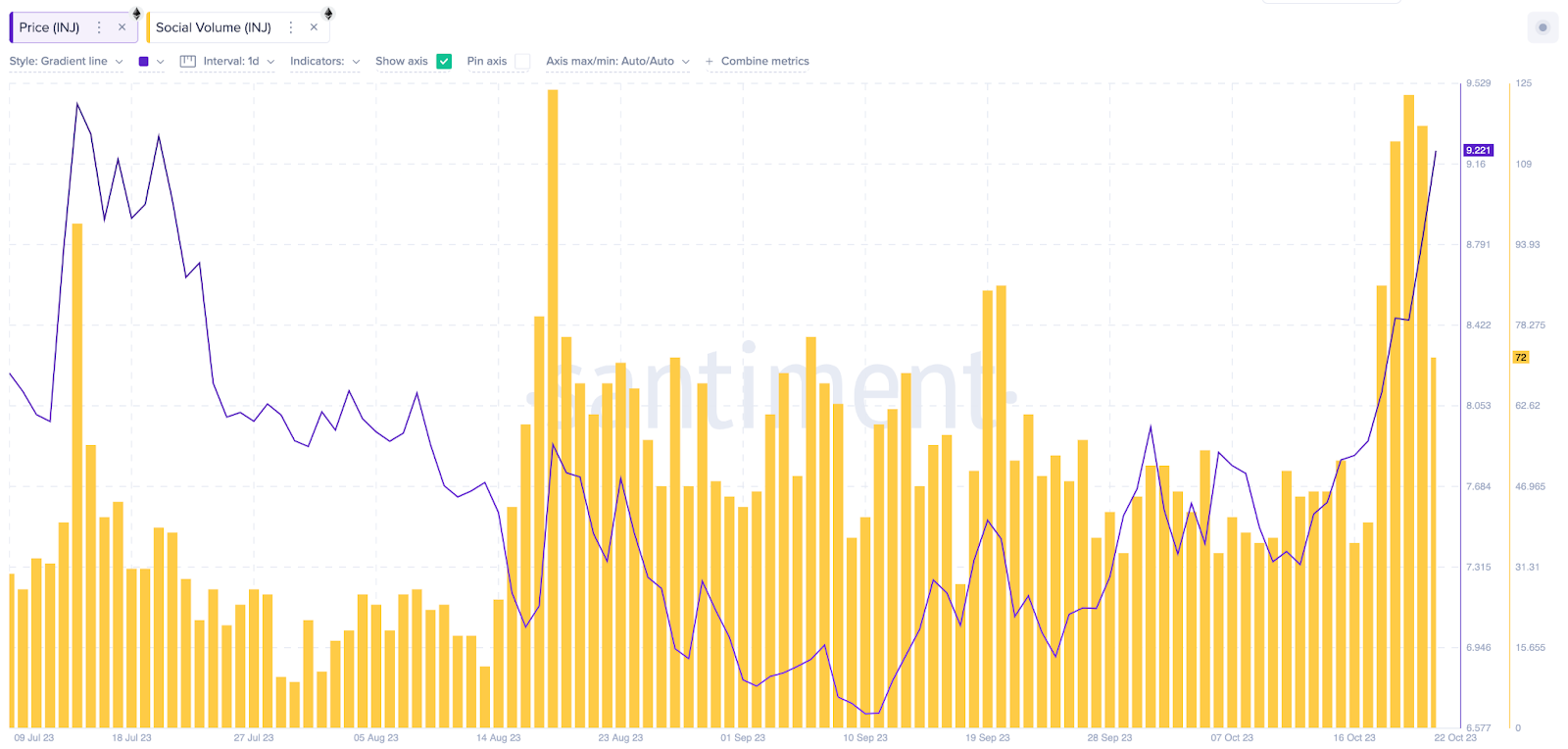

The increased demand triggered by the flurry of new users trooping to the Injective network has driven INJ price to a 20-month peak. However, on-chain data shows the resulting media frenzy is approaching euphoric territory.

As depicted below, the INJ Social Volume score reached a 65-day peak of 123 on October 20.

The Social Volume score evaluates the number of times a project is mentioned across various relevant crypto media channels over a given period. Typically, crypto projects tend to attract intense media hype once they begin to race up the price charts.

Strategic traders often consider extreme media frenzy an early warning signal that the price has reached a local top and that it might be a good time to exit.

This phenomenon has already been observed around July 14 and August 18, respectively. On both occasions, the INJ Social Volume score spiked to euphoric peaks, and prices declined days after.

Going by this historical trend, Injective price could retrace if holders begin to book profits over the coming days.

INJ Price Prediction: Mild Retracement Before Another Rally

From an on-chain perspective, INJ holders have historically tended to book profits once media hype heightens. Now, having reached a 2-year price peak, it looks even more likely.

However, due to the organic network growth behind the rally, Injective can find support at a relatively high price level.

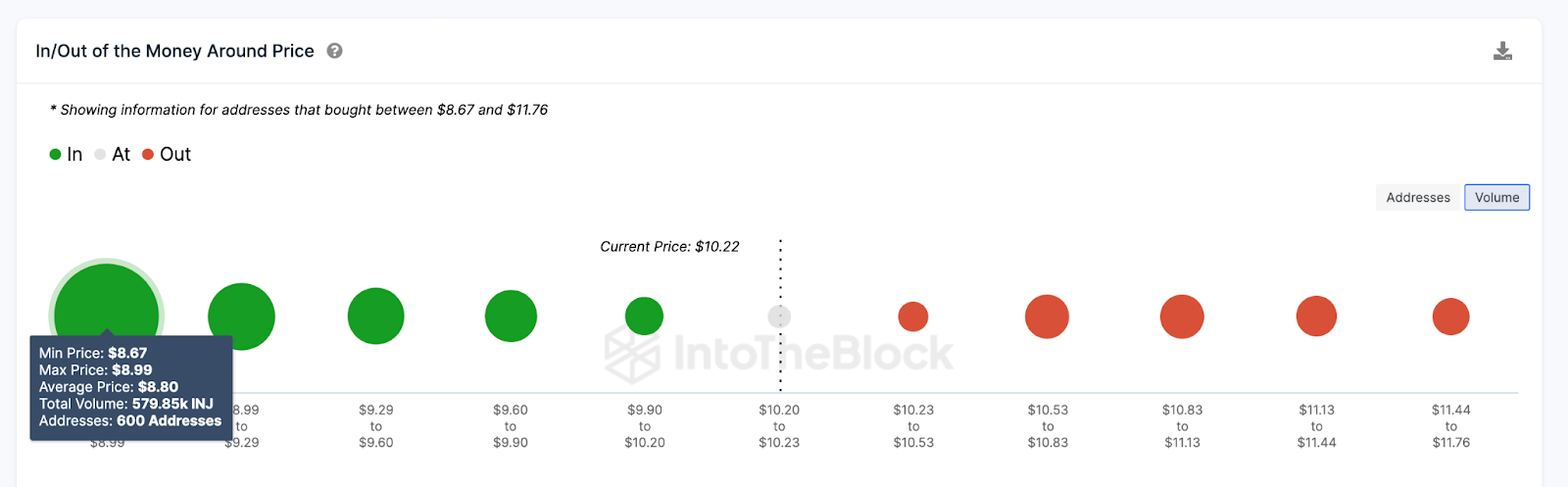

The Global In/Out of the Money data, which groups all current INJ holders by their entry prices, also confirms this forecast. It shows that the giant buy-wall at $8.50 can prevent a major bearish reversal.

As depicted below, 600 addresses had bought 579,850 INJ tokes at the minimum price of $8.67 Considering the positive sentiment surrounding the crypto markets, INJ could rebound from that range.

But if INJ investors opt to book profits as they did when social hype peaked on July 14 and August 18, INJ’s price could slide further.

But on the flip side, the bulls could attempt to drive the Injective price rally toward $20. However, in this case, the bears will likely mount a sell-wall could mount a sell-wall at $12. At that zone, 175,000 addresses had bought 19,800 INJ at the maximum price of $11.76

But if the bulls can flip that resistance level, an INJ price upswing toward $20 could be on the cards.

beincrypto.com

beincrypto.com