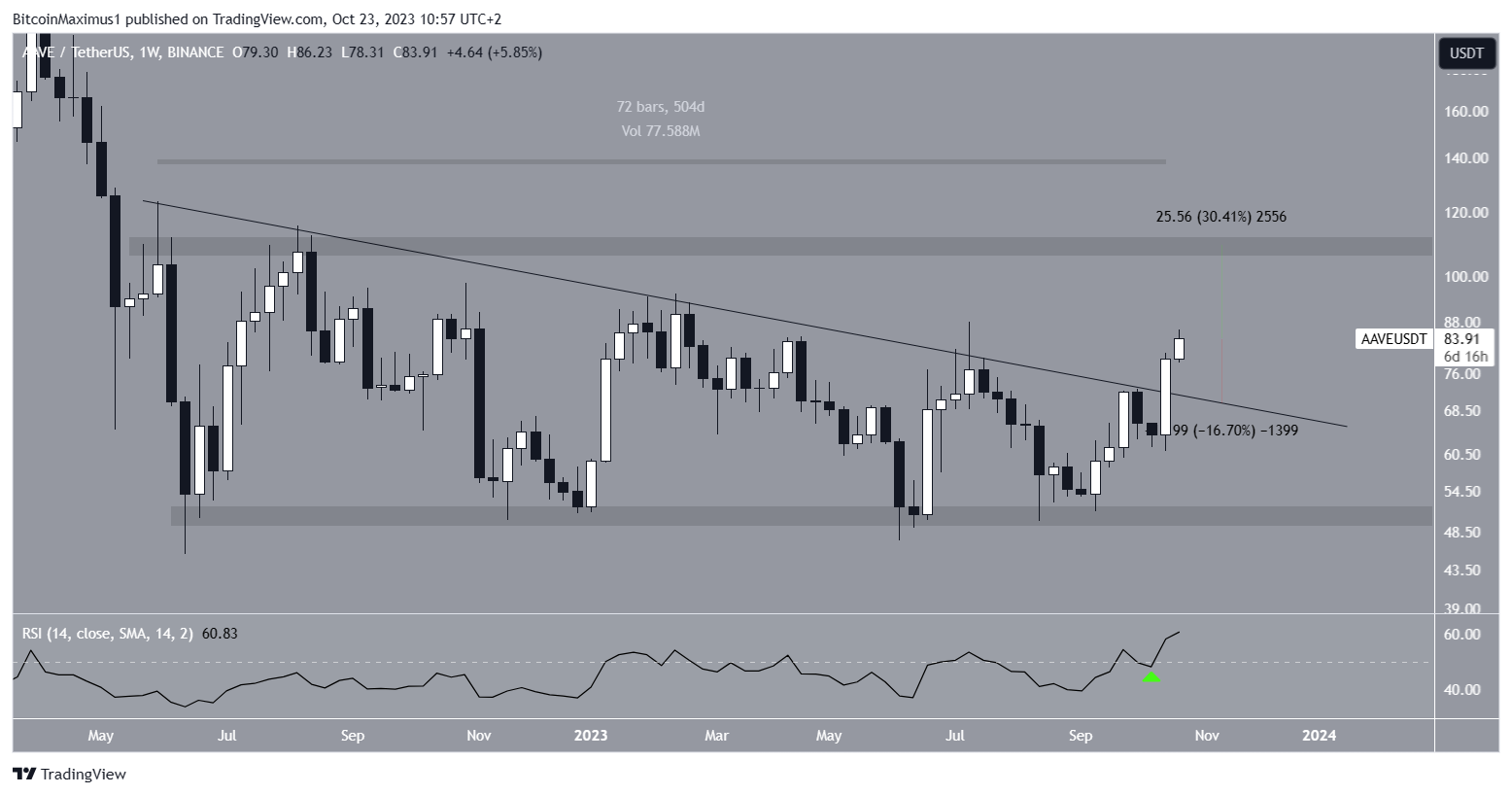

The $AAVE price breakout from a 500-day descending resistance trendline last week led to a high above $86 today.

The price is approaching the $110 resistance area, which has been in place since May 2022. Will it reach it?

$AAVE Breaks Out From 500-Day Resistance Trendline

The weekly timeframe technical analysis shows that $AAVE has decreased under a descending resistance trendline since May 2022. The decrease led to a low of $47.30 in June 2022, validating the $50 horizontal area as support (green icon).

$AAVE has increased since the bounce, creating a higher low in August (white icon).

Read More: 9 Best AI Crypto Trading Bots to Maximize Your Profits

After four unsuccessful $AAVE price breakout attempts (red icons), the altcoin finally broke out from the resistance trendline last week, reaching a high of $86.23 today.

At the time of the breakout, the line had been in place for more than 500 days.

Cryptocurrency analysts on X are predominantly bullish. Crypto Tony and Eliz883 have both outlined the long-term descending resistance trendline, noting that its breakout is a strong sign of an impending bull run.

WolrdOfCharts has outlined a longer-term descending resistance trendline, which has existed since the all-time high.

He believes that a similar bull run is starting.

Read More: 9 Best Crypto Demo Accounts For Trading

$AAVE Price Prediction: How Long Will Increase Continue?

With the RSI as a momentum indicator, traders can determine whether a market is overbought or oversold and decide whether to accumulate or sell an asset.

Bulls have an advantage if the RSI reading is above 50 and the trend is upward, but if the reading is below 50, the opposite is true.

The weekly RSI legitimizes the breakout. This is because the RSI moved above 50 (green icon) and reached a high of 60.

This is the highest value since April 2021, when the price was close to its all-time high. Combined with the close above the long-term descending resistance trendline, this is a sign that the trend has turned bullish.

If the $AAVE price continues to move upwards, it can increase by another 30% and reach the next closest resistance at $110.

Despite the bullish $AAVE price prediction, failure to sustain the increase can lead to a 17% drop to validate the resistance trendline at $68. This could be caused by a bearish weekly close.

beincrypto.com

beincrypto.com