Bitcoin’s price went on the offensive once more in the past 24 hours and soared above $30,000 to chart its highest price point since July.

Several altcoins are well in the green as well, with SOL stealing the show after another 5% daily surge.

BTC and Gold Jump in Price

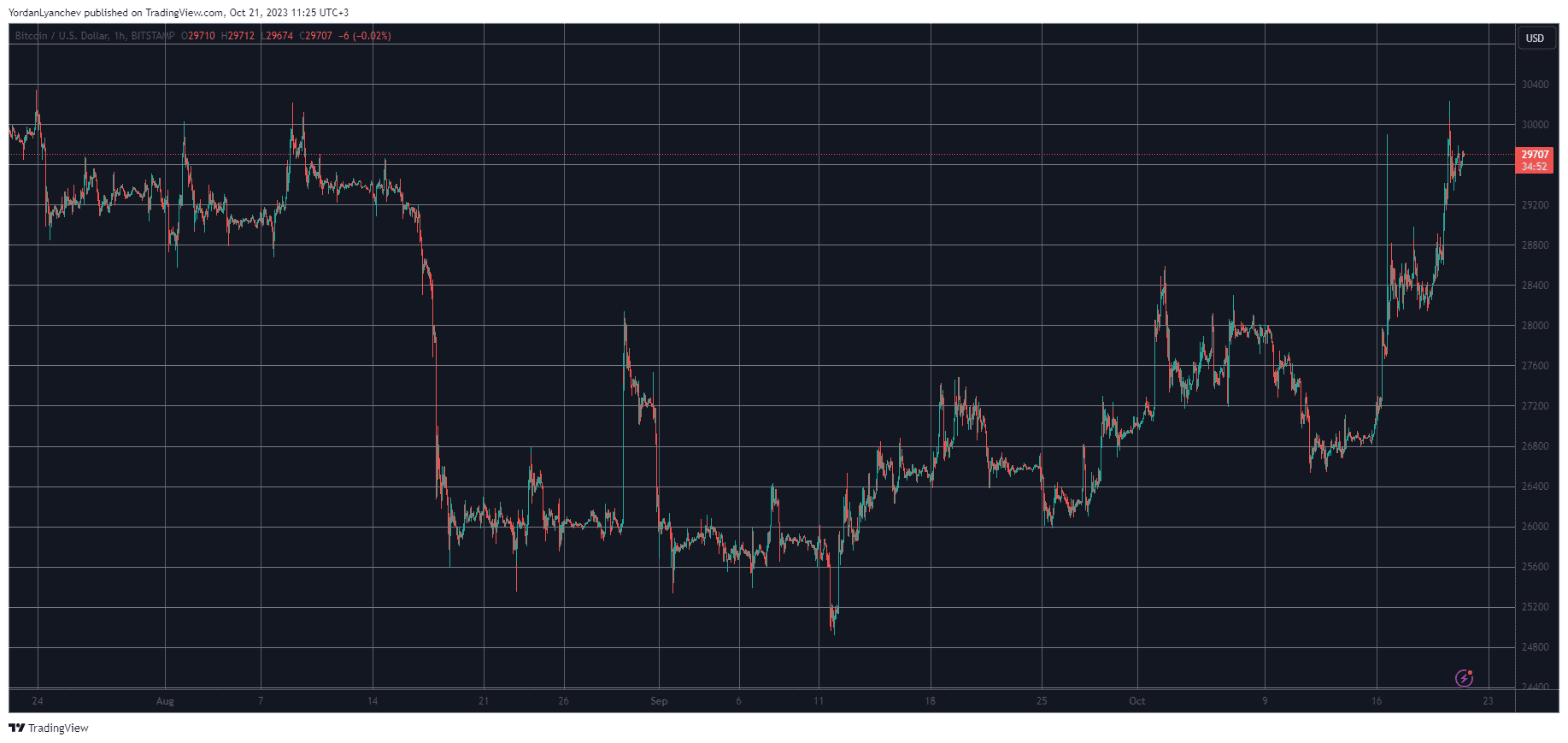

The primary cryptocurrency dumped hard less than ten days ago when it slumped to $26,500 amid the ongoing war between Israel and Hamas. However, the tides started to change at the start of this week, especially after the fake report about an approved spot Bitcoin ETF in the States.

The asset skyrocketed by over $2,000 in minutes before it lost all those gains, as the report was proven to be false. Nevertheless, the bulls kept the pressure on and gradually pushed the cryptocurrency north again in the following days.

This culminated yesterday with a price pump to around $30,300. This became BTC’s highest price point since mid-July. Despite losing some ground and currently sitting below $30,000, BTC is still up by 10% weekly, and its market cap is close to $580 billion.

At the same time, gold, which has been considered the go-to safe haven investment asset for generations despite its sluggish performance, has also soared. The price of the precious metal against the dollar increased by almost $200 in a few weeks and tapped a five-month peak of its own at around $2,000/oz.

Alts in Green

The altcoins are also in the green once again, with ETH maintaining $1,600 and XRP standing tall above $0.5. Cardano, Dogecoin, Tron, Toncoin, Polkadot, Litecoin, and Bitcoin Cash are also slightly in the green.

Polygon, Chainlink, and Solana are the top performers from the larger-cap alts. SOL has soared by another 5% over the past 24 hours and has tapped a multi-month peak of its own at over $28.

More gains come from the likes of MNT, BSV, and KAS from the mid-cap alts.

The total crypto market cap has maintained its recent run and stands still above $1.120 trillion on CMC.

cryptopotato.com

cryptopotato.com