A widely followed crypto analyst is breaking down Bitcoin ($BTC) by looking at its historical patterns.

Pseudonymous crypto trader Rekt Capital tells his 359,500 followers on the social media platform X that if $BTC repeats the pattern it displayed in 2019, it’s going to fall further before rebounding.

“$BTC… If history repeats…Green circle first. Then blue circle.”

Also based on his historical analysis, Rekt Capital says $BTC is testing a trendline as resistance that could become support.

“Bitcoin tends to develop a trendline resistance (red) at an 8-degree angle in the pre-halving period.

This trendline tends to be retested as new support months after the halving.

After the key retest, $BTC rallies to new all time highs within 3-5 months”

$BTC is worth $26,760 at time of writing.

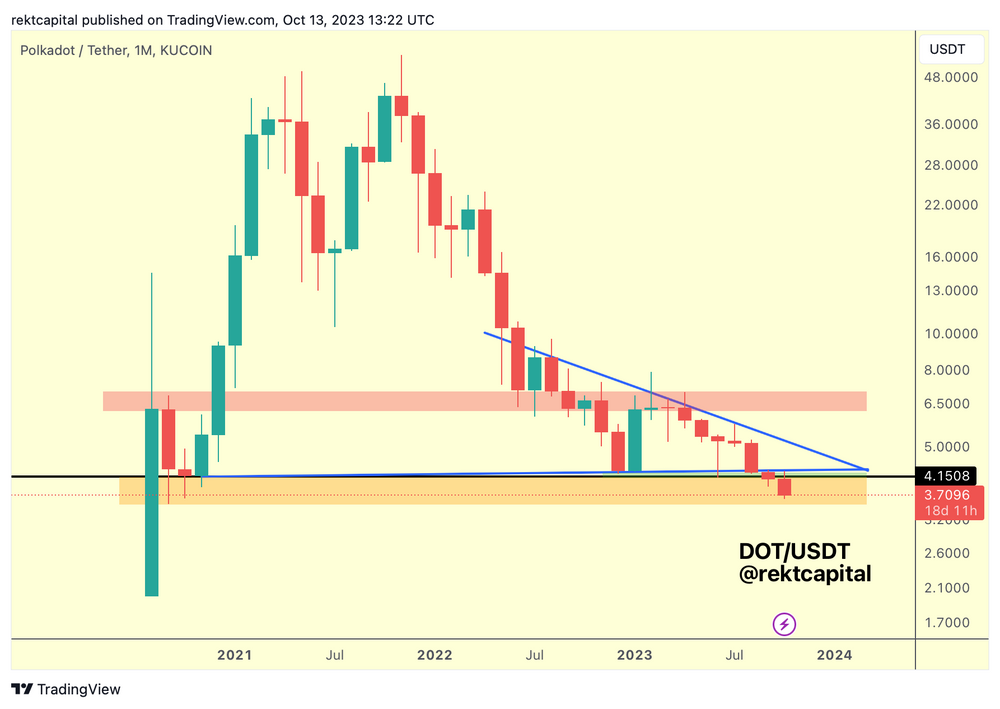

In the latest edition of the trader’s altcoin newsletter, Rekt Capital says that the Ethereum ($ETH) competitor Polkadot ($DOT) likely still has lower to go.

“Last month, Polkadot monthly closed below the black level which was a confluent level with the bottom of the blue triangular market structure.

And this month, price upside wicked into this level to flip it into new resistance before confirming further downside continuation into the orange area…

The bottom of the orange area may be retested as support in the future and in the event of little reaction, $DOT may actually lose this region with time in an effort to establish an accumulation range at new lows.”

$DOT is trading for $3.68 at time of writing.

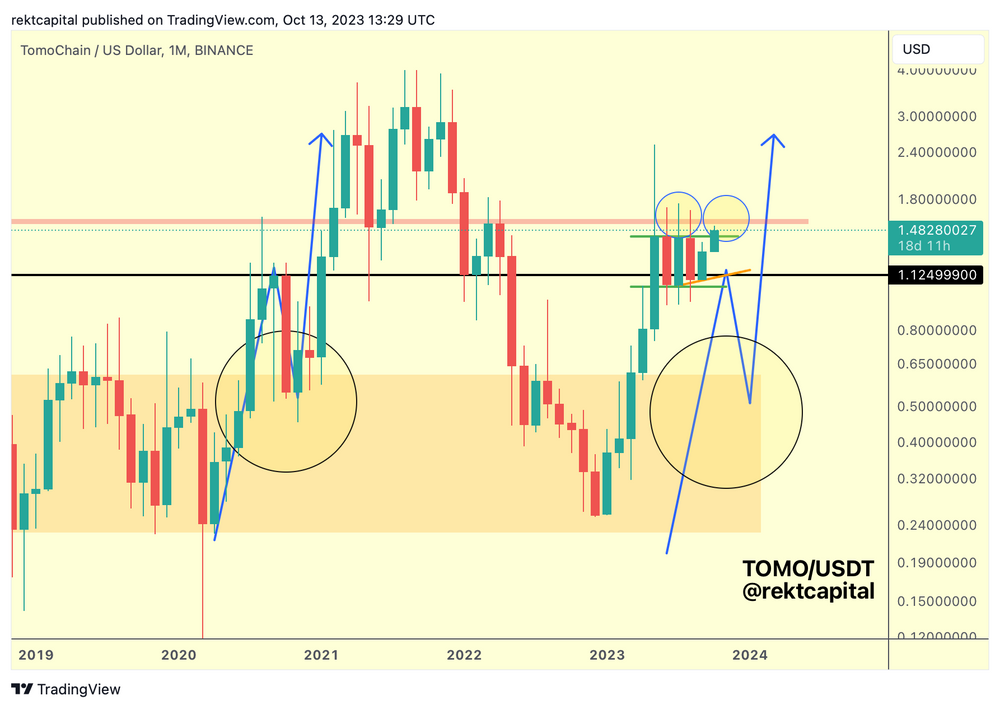

Looking at $ETH-based altcoin TomoChain (TOMO), the pseudonymous trader asks if TOMO could be on its way up.

“Could TOMO form an upside wick here?

It’s possible which is why a monthly close above the green range high is needed or at the very least a successful retest of that same level – either are needed to propel TOMO into the red resistance area to try to break it.

At this time, there is reason to believe that this green range may be acting as a re-accumulation range.”

TOMO is worth $1.47 at time of writing.

Generated Image: Midjourney

dailyhodl.com

dailyhodl.com