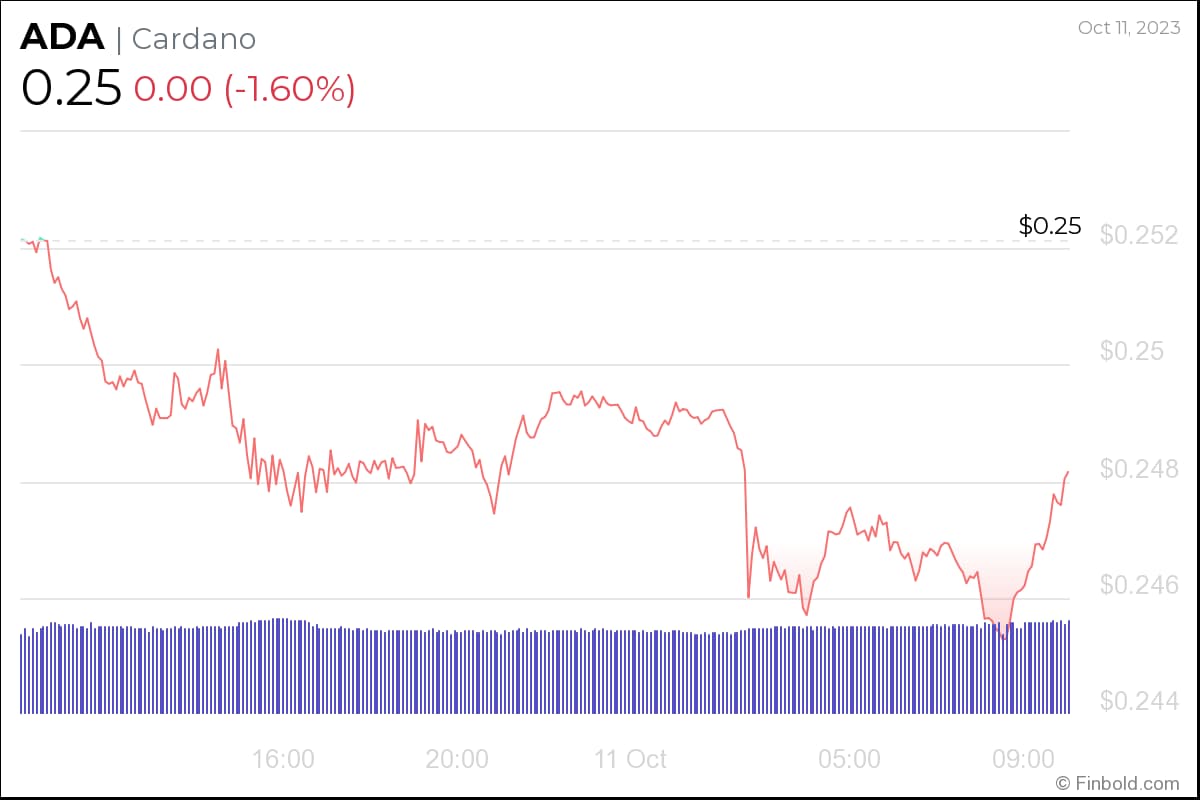

At present, Cardano (ADA) navigates through turbulent waters. As per the latest data, ADA trades around the $0.25 mark, presenting a less-than-rosy short-term prospect.

The absence of distinct support levels fuels concerns of ADA potentially descending to a precarious $0.24 threshold. Recent market movements sketch a rather grim scenario for Cardano. In its heyday, the token found formidable support at the $0.5 mark. However, recent dynamics saw it breaking past this critical benchmark, hinting at a deeper downturn.

Yet, it’s not all storm clouds on the horizon. According to market data insights, Cardano boasts an impressive 611.47 GitHub commits within the past month, outpacing all its crypto counterparts. This surge propels it ahead of both Polkadot (DOT) and its canary test network, Kusama (KSM), which jointly occupy the second spot with 500.67 commits over the same duration.

Such heightened development activity frequently signals robust developer confidence in a blockchain’s future and possibly hints at imminent enhancements within the ecosystem.

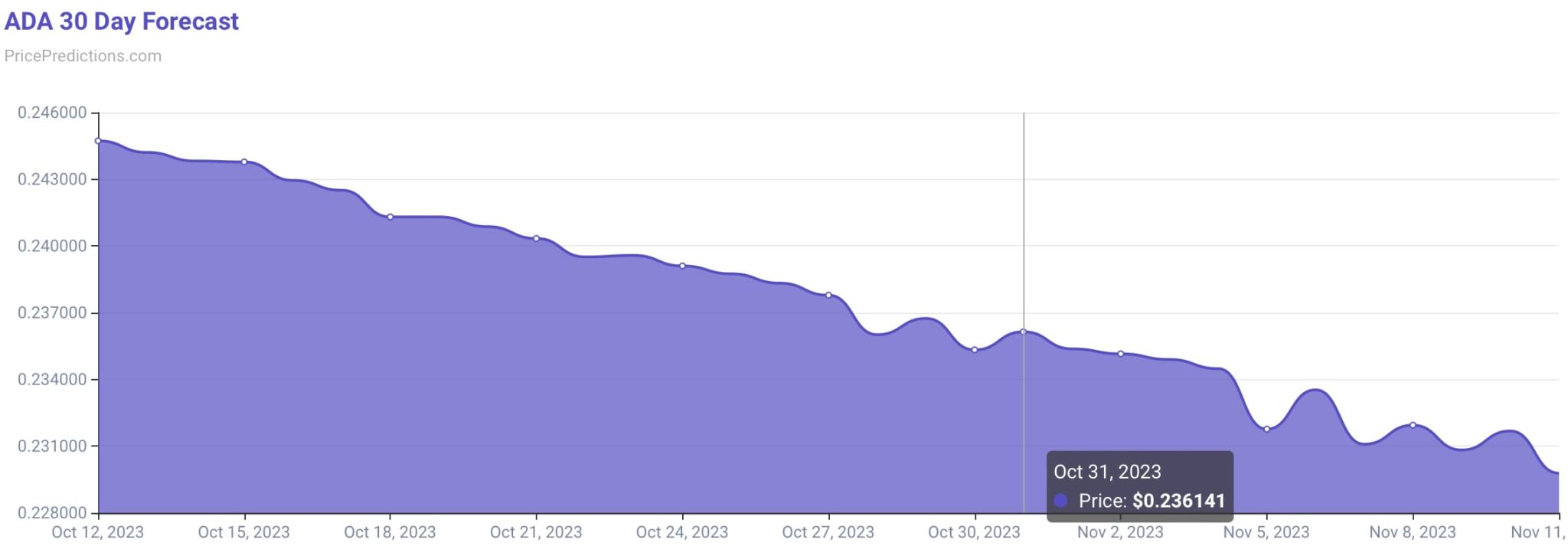

Given this juxtaposition of declining price and increased development, it becomes crucial to understand ADA’s potential trajectory. This dynamic interplay is precisely why Finbold turned to the predictive prowess of AI algorithms at PricePredictions. Such an approach offers a more comprehensive insight, marrying price patterns with developmental momentum, to gauge ADA’s expected position at the end of October.

According to the AI’s analysis, Cardano is anticipated to experience a subtle dip, with a projected trading price of $0.23.

Cardano chart analysis

Cardano is presently trading at an evaluation of $0.24768, neatly anchored between a support at $0.235 and a resistance at $0.26076. As the eighth-ranked cryptocurrency by market capitalization, ADA has witnessed a sharp decline over the last year, registering a contraction of 38%.

Technically, ADA is positioned below its 200-day simple moving average, which typically indicates a bearish sentiment. In the recent 30-day span, bullish momentum was evident on only 13 occasions, accounting for 43% of the days. From its pinnacle, Cardano has retraced a significant 92%, showcasing the distance it has to traverse to revisit its all-time highs.

Despite this setback, it’s notable that Cardano has outperformed 65% of the top 100 digital assets over the same timeframe. Notably, Both Bitcoin and Ethereum have outpaced ADA’s performance during this period.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com