The Bitcoin and altcoin markets are going through a stark downward correction triggered by a solid rejection near pivotal resistance levels. Amidst a market trend that hovers between mixed and bearish, investors are audaciously entering into emerging crypto projects, aiming to ride on their sudden surges. Interestingly, the market’s low volatility has steered investors towards profitable cryptocurrencies, with Bancor, Cartesi, and Holo emerging as the market’s hot subjects, each showcasing noteworthy price swings.

HODLers Become Impatient Due To Flat Market

The stagnant markets have notably impacted even the most steadfast traders and investors at this juncture. While many have been tenaciously hodling, numerous professional traders have been strategically capitalizing on projects that are being overlooked.

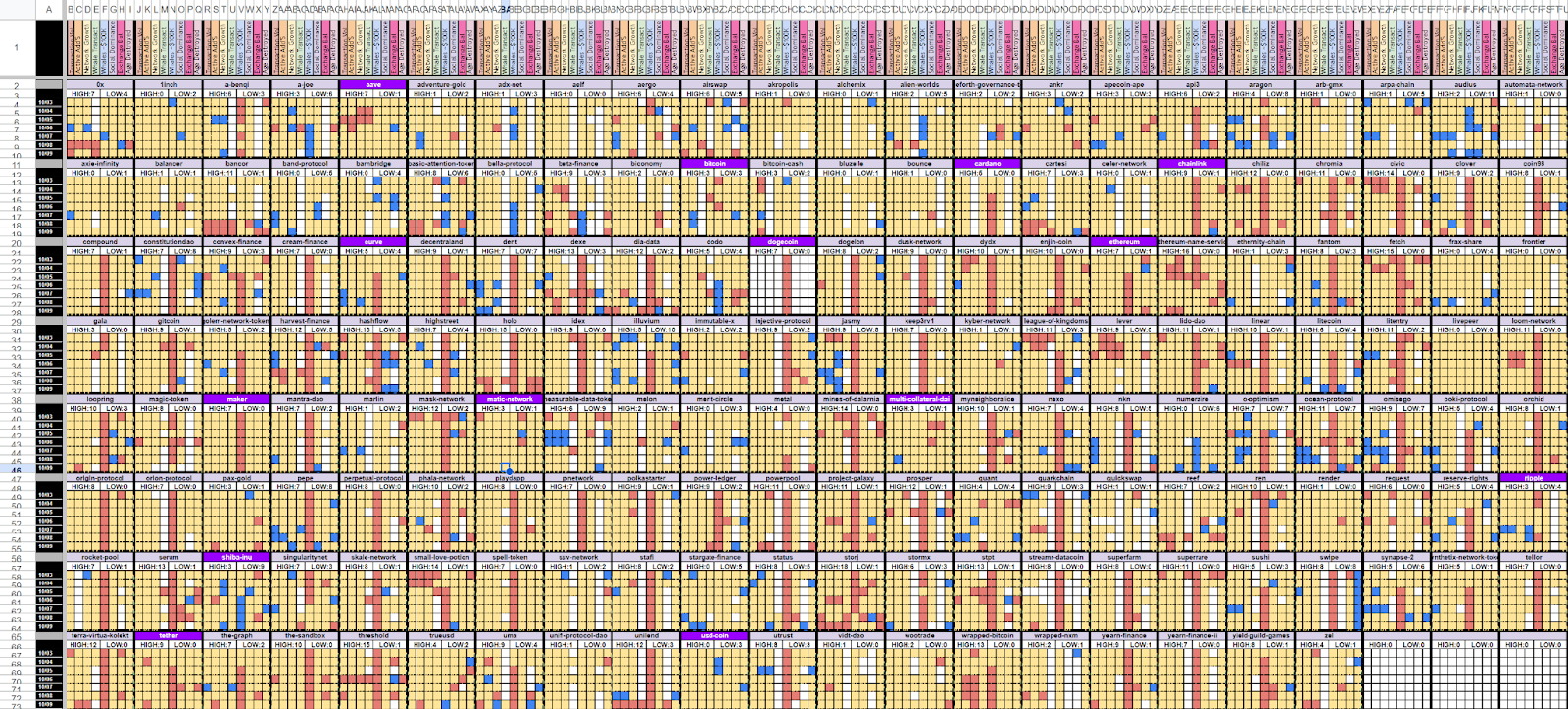

For those seeking to keep abreast of which projects might be mathematically poised to surge next, Santiment’s newly introduced Asset Activity Matrix is a tool worth exploring. Individuals can create a copy and integrate their Sanbase API to access real-time data for approximately 175 projects.

In utilizing this version, the focus is on identifying projects that exhibit a plethora of recent red boxes, setting any top 5 days (based on the past 90) for some of Santiment’s most insightful metrics. Conversely, the bottom five days are highlighted in blue, indicating networks that are notably inactive (and perhaps best sidestepped).

According to Santiment, networks experience heightened activity due to recent significant price movements. However, the most exciting opportunities may lie in projects that have not only witnessed noteworthy price surges lately but have also seen a surge in network growth, whale transactions, and accumulation.

Here are a few projects that are likely to exhibit increased volatility due to a surge in activity that hasn’t been observed on their respective networks for some time:

- Bancor ($BNT): Surge in Transaction Volume, Active Addresses, Network Growth, Whale Transactions, Exchange Inflow, Age Destroyed (Consumed)

- Cartesi ($CTSI): Distinguished by High Transaction Volume, Active Addresses, Whale Transactions, Age Destroyed (Consumed)

- Holo ($HOT): Standout include High Whale Transactions, $100K-$1M Whale Accumulation, Exchange Inflow, Age Destroyed (Consumed)

- Powerpool ($CVP): Noteworthy for High Active Addresses, Network Growth, $100K-$1M Whale Accumulation, Age Destroyed (Consumed)

- Storj ($STORJ): High Transaction Volume, Active Addresses, Network Growth, Whale Accumulation, Age Destroyed (Consumed)

- Unilend ($UFT): High Transaction Volume, Active Addresses, Network Growth, Whale Transactions, $100K-$1M Whale Accumulation, Exchange Inflow

It’s worth noting that four out of these six highlighted projects may be experiencing increased network activity because of recent price pumps. For the remaining two, there are no guarantees of an imminent price surge. Therefore, it’s essential to conduct your research, evaluate these projects, and keep an eye on others showing similar heightened network activity in the coming weeks.

BNT Records Massive Gain Of 65%

The crypto market is experiencing a relatively high volatile weekend. Bitcoin and various other altcoins flashed swings near resistance levels. However, amidst this, Bancor (BNT) emerged as the standout performer, experiencing a remarkable surge in its valuation, securing the title of the weekend’s top gainer in the market.

This impressive price upswing in BNT can be primarily attributed to the recent introduction of the ARB Fast-lane protocol. This protocol empowers users to engage in arbitrage opportunities between BNT and other decentralized exchanges (DEXs), thereby significantly influencing Bancor’s recent price surge.

Moreover, a surge in whale activity came to light as a cryptocurrency wallet linked to Upbit, a prominent South Korean cryptocurrency exchange, acquired a staggering 4.71 million BNT tokens, equivalent to approximately $2.5 million. This substantial acquisition contributed to BNT’s price surging by over 65% in just a week.