In a year dominated by market volatility, the liquid staking sector has shown significant growth despite challenges. Over the past few months, the sector has experienced substantial declines in token prices, with an average price movement of -26.21%.

Lido Finance Current Data

However, even in this environment, Lido (LDO) Finance has maintained its dominant position in the sector. Lido holds an impressive market share of 84.4% based on staked assets. The strong token is further highlighted by Lido’s market value-to-staked assets ratio of 0.11. This figure is significantly lower than the sector’s average (0.85) or median (0.67) values, reflecting Lido’s dominant position.

Lido’s popularity is evident in its large number of token holders. In Ethereum alone, Lido’s stETH token is held in 271,350 addresses, indicating a significant leadership position compared to Rocket Pool’s rETH, which only has a fraction of this number. Lido also has a substantial user base in non-Ethereum liquid staking tokens such as MSOL and SAVAX. Additionally, Lido’s total value locked (TVL) reached $15.37 billion with a notable increase of 10.24% within a week.

Critical Level in Lido

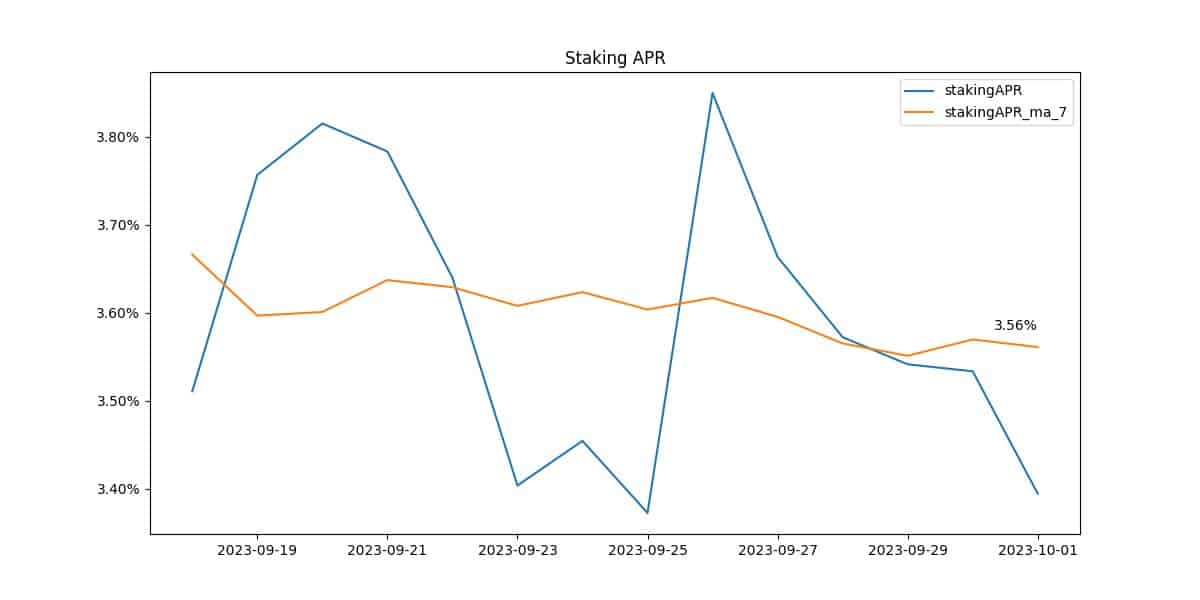

Despite this impressive growth, the annual percentage rate (APR) of staked ETH experienced a slight decline last week, settling at a 7-day moving average of 3.56%. Amidst this growth, Lido is also focusing on its development. Proposals for Solana‘s development have been actively discussed and received attention.

One of the proposals includes Lido requesting 1.5 million DAI to fund the operations of 12-month p2p development participants on Solana. This funding aims to cover various aspects of Lido’s development, including a development fee of $200,000 per quarter. These initiatives are designed to expand Lido’s token and usability. However, the proposal also outlines an alternative in case of an unsustainable financial situation or low fee generation.