Bitcoin cash (BCH) price has reversed 10% to hit $225 on October 9 after conspicuously failing to clear the $250 resistance last week. With Bitcoin miners and crypto whales taking opposing positions, here’s how BCH price could react in the weeks ahead.

Bitcoin Cash raced up the 2023 top gainers’ charts after a rare 150% rally in June sent BCH price above $300. Vital on-chain indicators reveal how BCH miners capitalized on the rally to liquidate reserve block rewards worth millions.

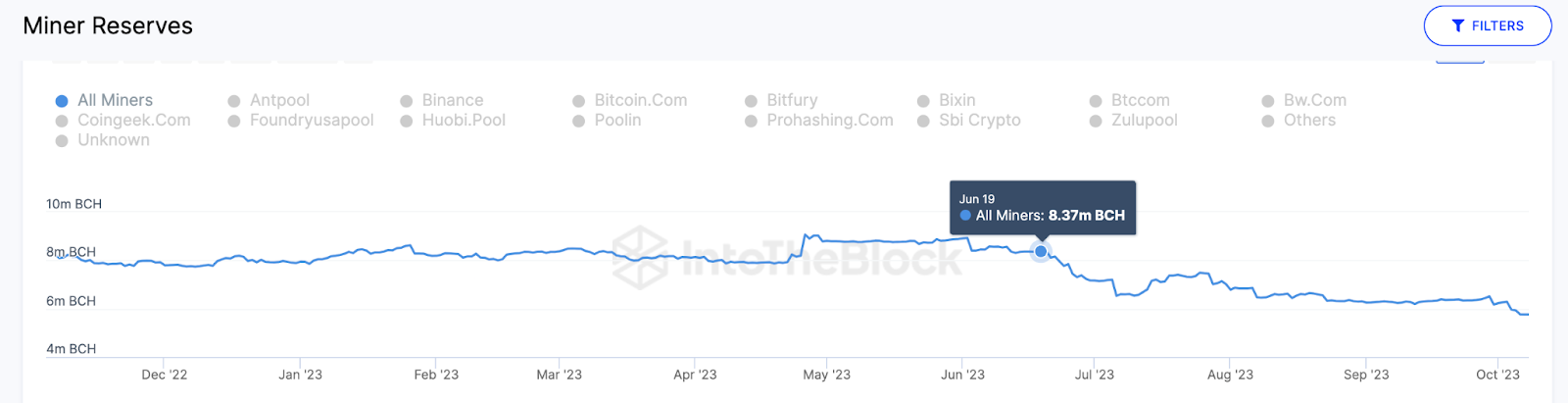

BCH Miners Reserves Drops Below 6M For The First Time Since 2018

Bitcoin Cash’s price hit a 15-month peak when it reached $329 on June 30, 2023. But as crypto whales and strategic retail investors aped-in on the price rally, BCH miners have been offloading their block rewards behind the scenes.

The BCH price rally began around June 19. Conspicuously, the IntoTheBlock chart below illustrates how the miners began a sell-off almost instantly.

Between June 19 and October 9, the Miners depleted their reserves as their cumulative balances dropped from 8.37 million to 5.76 million BCH.

This is the first time Bitcoin Cash miner reserves have dropped below 6 million since 2018.

Crypto miners deploy computing power to validate transactions and secure the blockchain network. In return, they receive units of the native coin as block rewards.

Miner Reserves tracks the real-time balances in crypto wallets controlled by recognized large-scale miners and mining pools.

Valued at the current market price of $225, the 2.61 million BCH sale means the miners have withdrawn approximately $590 million within the last 3 months. Notably, $106.2 million of that was offloaded after the BCH price hit $250 on October 1.

A persistent decline in miner reserves means that the node validators are liquidating block rewards rather than HODLing for future gains. Typically, this increases market supply and puts downward pressure on prices.

The Bitcoin Cash miner selling frenzy has contributed significantly to the BCH price reversal from $250 to $225 between October 1 and October 5.

However, it remains to be seen if key stakeholders and bullish market participants on the Bitcoin cash network can crowd out the bearish miners.

Read More: : Best Cloud Mining Sites 2023: A Beginners Guide

Bullish Whale Investors Have Depolyed $4.5 Million in Fresh Capital Inflows

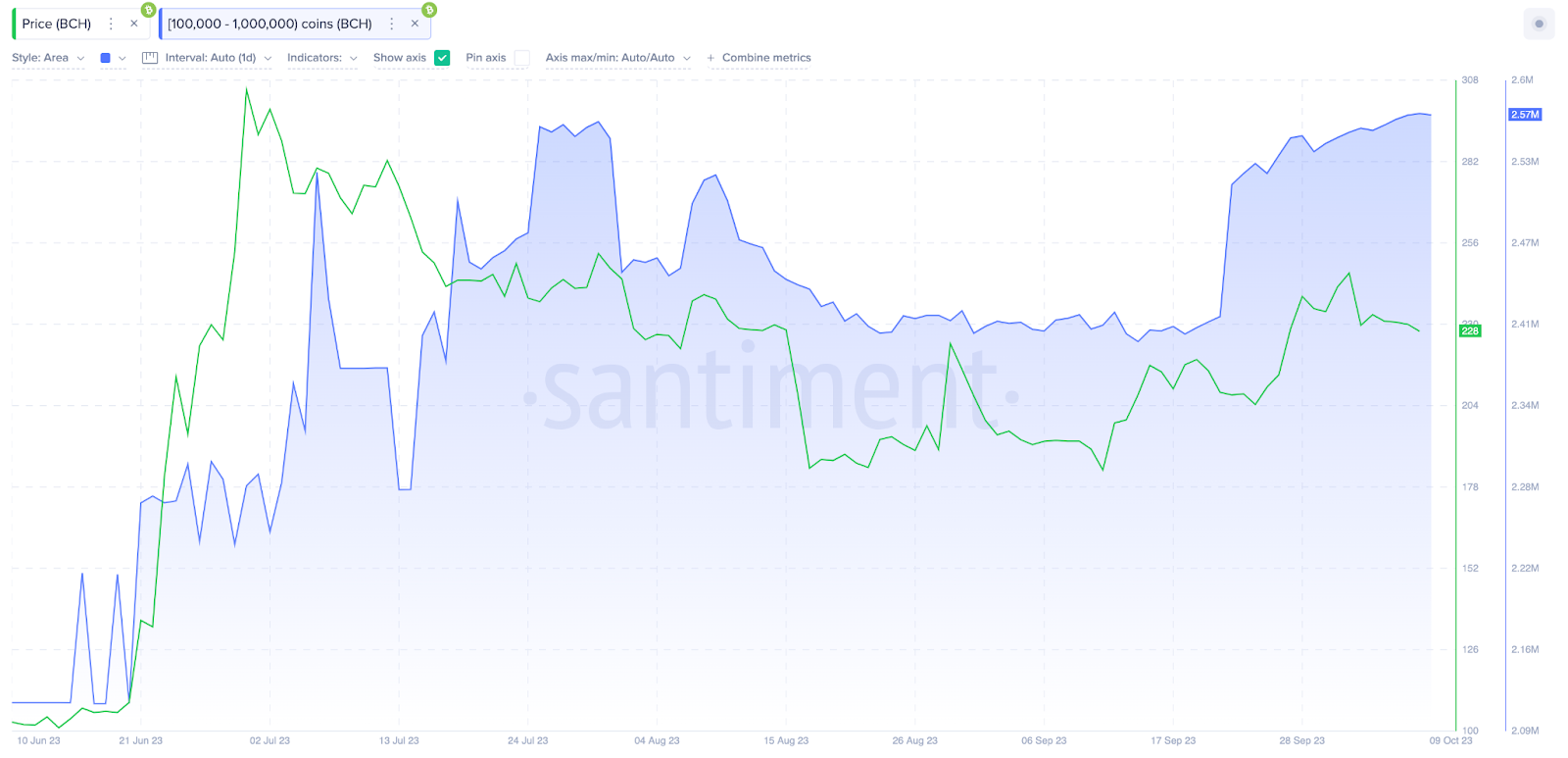

In a move that could counter the bearish impact of the BCH miners’ historic sell-off, bullish crypto whales made significant BCH accumulations in recent weeks.

The recent ETH Futures ETF approval and positive Non-Farm Payrolls (NFP) reports appear to have boosted corporate confidence in the crypto industry.

Indicatively, the cumulative balances of whales holding 100,000 to 1 million BCH stood at an aggregate of 2.41 million as of September 21. But remarkably, it has since gradually increased to 2.57 million at press time on October 9.

Valued at the current price of $225, the whales have made fresh capital inflows worth $36 million within the last three weeks. Importantly, $4.5 million of those purchases were made after BCH dropped from $250 on October 1.

In summary, with Bitcoin Cash miner reserves now at a 5-year low, their influence on the BCH price action could begin to wane. Hence, BCH could avoid a major price retracement if the bullish whale traders keep piling on fresh capital.

Read More: How To Make Money in a Bear Market

BCH Price Prediction: The $200 Support Could Prove Daunting for the Bears

With Bitcoin Cash whales going up against the bearish miners, the BCH price will likely find sufficient support to hold the $200 level.

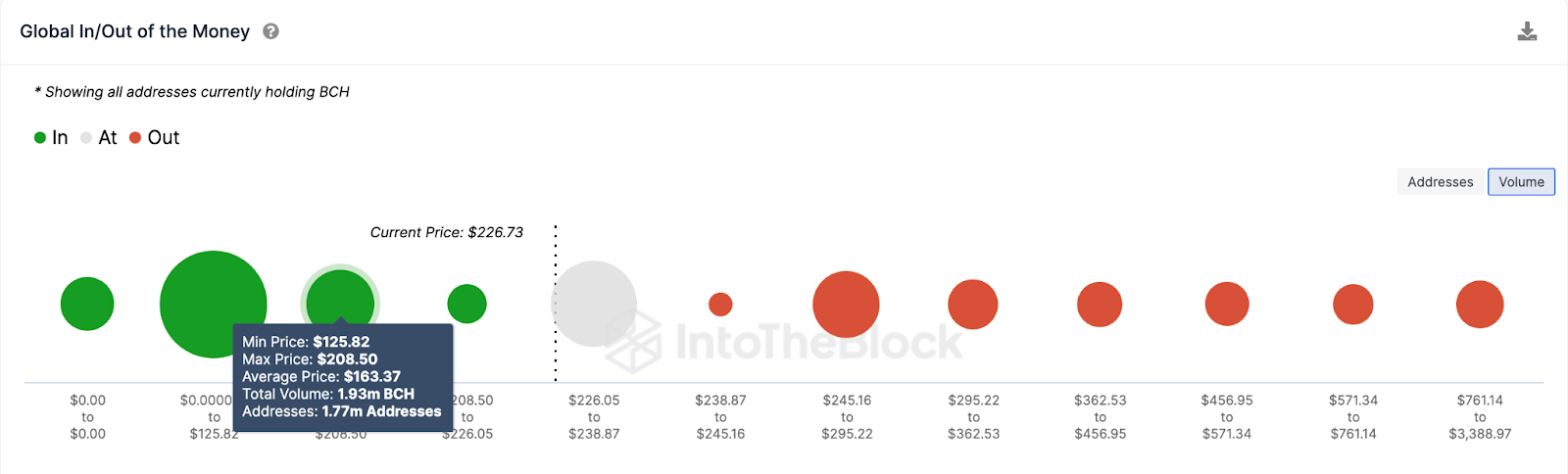

The Global In/Out of Money Around Price (GIOM) data, which depicts the entry price distribution of current BCH holders, also buttresses this prediction.

It shows that there’s a major support cluster of holders for BCH around the $210 level. As shown below, 1.77 million addresses had bought 1.93 million BCH at the maximum price of $208.

Even if the miners keep selling, that cluster could prevent the BCH price from breaking down further. But if that support cluster fails, BCH could eventually drop below $200.

Conversely, the bullish whales could turn the tide if the BCH price exceeds $250. But in that case, 1.16 million addresses had bought 1.9 billion BCH at the minimum price price of $245. If they book profits, it will likely trigger another reversal.

If the resistance cluster fails to hold steady at that vital level, BCH could edge closer to $250.

Read More: 11 Best Crypto Portfolio Trackers in 2023

beincrypto.com

beincrypto.com