BitMEX co-founder Arthur Hayes predicted that Bitcoin (BTC) will hit $750,000 to $1 million by 2026. However, a financial crisis will start after the bull market, which is predicted to be as bad as the great depression.

It is proven that there is a bear cycle after every bull cycle and vice versa. Arthur Hayes claims that during the next three years, the markets will witness one of the largest bull markets in human history, which will top in 2026.

Bitcoin Will Top at $1 Million by 2026: Arthur Hayes

In an Impact Theory podcast, Arthur Hayes discussed his theory on the upcoming Bitcoin bull market. He believes that BTC will stay sideways between $25,000 to $30,000 in 2023. And then, some financial disturbance will cause the interest rates to again go to zero in 2024.

The decreasing interest rate, crypto halving event, and the launch of spot Bitcoin ETFs would push Bitcoin to $70,000 by the end of 2024. Arthur Hayes said:

“That’s when the real fun starts. That’s when the real bull market starts.”

Read more: Bitcoin Halving Cycles and Investment Strategies: What To Know

For 2026, he further elaborated:

“I think we are going to go somewhere between $750,000 to $1 million in Bitcoin by 2026. Just because again I believe this is going to be the largest bull market in financial assets we have ever seen in the human history.

Not only will Bitcoin be at a ridiculous price, NASDAQ will be at a ridiculous price, S&P will be at a ridiculous price, pick your stock indices wherever you are, that will be at a ridiculous price.”

What Will Fuel The New Bull Market?

In 2023, the Fed interest rates are around their 22-year high. Of course, the market has a liquidity crunch due to the soaring interest rates. However, Hayes believes that the central banks will start decreasing the interest rates and restart the quantitative easing, igniting a bull market.

In an October 6 essay titled “Double Happiness,” Arthur Hayes wrote:

“The world’s major central banks – the US Federal Reserve (Fed), the People’s Bank of China (PBOC), the Bank of Japan (BOJ), and the European Central Bank (ECB) – will collectively print the most fiat in a 2-3-year window in human history in order to “save” their government’s respective bond markets.”

The BitMEX co-founder expects the freshly printed money to flow into new technology such as Artificial Intelligence (AI) and blockchain technology.

Read more: AI Stocks: Best Artificial Intelligence Companies To Know in 2023

He explains that in the 1920s, the companies building around technology like radio attracted investors’ money. And in 2008, the money flowed into Web 2.0 advertising, social media, and sharing economy startups. Now, AI and blockchain will be the most favorite destination for investors to park their money.

Why Filecoin (FIL) is Arthur Hayes’ Favorite Altcoin?

Hayes believes computing power and cloud data storage are necessary infrastructure for AI development. However, he argues that decentralization is necessary for AI to thrive.

“An AI faces existential risks if human-controlled, centralised companies decide to restrict access to their services (due to coercion by governments, for example).”

Arthur Hayes says he has not yet discovered a decentralized solution for sharing computing power. Hence, for him, decentralized data storage is the only option left among the two. Particularly, he is attracted to Filecoin (FIL) and calls it his “shitcoin of choice” for the bull market. He elaborates:

“The largest decentralised data storage project by storage capacity and total bytes of data stored is Filecoin (FIL). Filecoin is particularly appealing because it has been around for a few years and is already storing a large amount of data.”

Read more: The Economics of Decentralized Storage Protocols

Is FIL Poised For a 180% Surge?

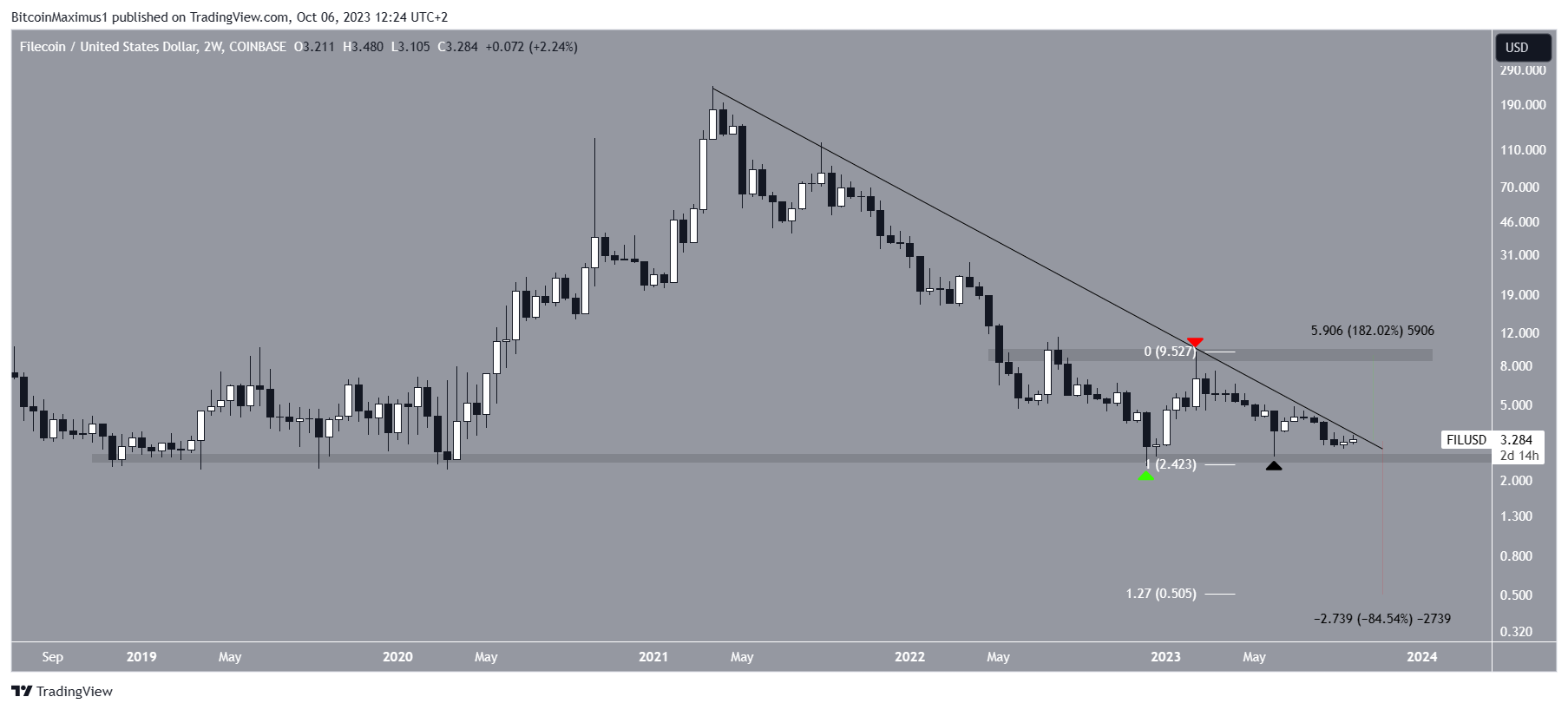

The monthly chart shows that the FIL price is quickly approaching the all-time low horizontal support area at $2.60.

FIL reached this level in December 2022 and bounced almost immediately afterward, creating a long lower wick (green icon). This is considered a sign of buying pressure.

After a new yearly high of $9.50 in February, FIL began another decrease (red icon). Despite the decrease, FIL created a higher low inside the $2.60 horizontal area and another long lower wick (black icon).

Creating a higher low was expected to start a bullish structure and lead to an upward movement. But, this was not the case since FIL has fallen since and is now trading only slightly above the $2.60 area.

Filecoin has nearly reached a long-term descending trendline that has been in place since the all-time high. Whether the price breaks out from the trendline or below the $2.60 area will likely determine the future trend’s direction.

A breakout could lead to a 180% increase to the $9.20 resistance area, while a breakdown can cause an 85% drop to $0.50. Since there is no other support below the $2.60 area, the 1.27 external Fib retracement is used to determine the next potential low.

The Great Depression Post 2026 Bull Market?

While Arthur Hayes is bullish until 2026, he has predicted that the bull market will end with a great financial crisis fueled by rising debt and excessive money printing. He explained:

After the crazy money printing, the governments are going to find out that they cannot save everything, they cannot print the unlimited money and fix the price of the yield of their bonds and we are going to get a generational collapse.

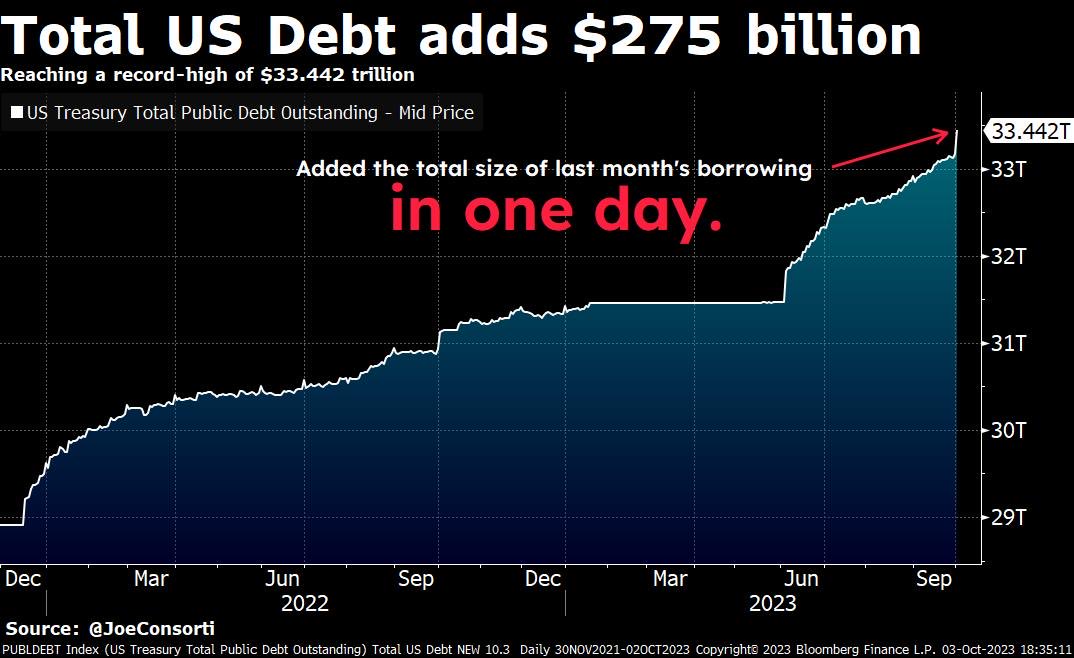

In fact, on October 4, BeInCrypto reported that the US added more debt than the market capitalization of most crypto assets in a single day. On September 18, the US National debt crossed $33 trillion for the first time ever.

beincrypto.com

beincrypto.com