The Trust Wallet Token ($TWT) price broke out from a 130-day descending resistance trendline on October 4.

$TWT reached a high of $0.97 before falling slightly to its current level of $0.90.

$TWT Clears Descending Resistance Trendline

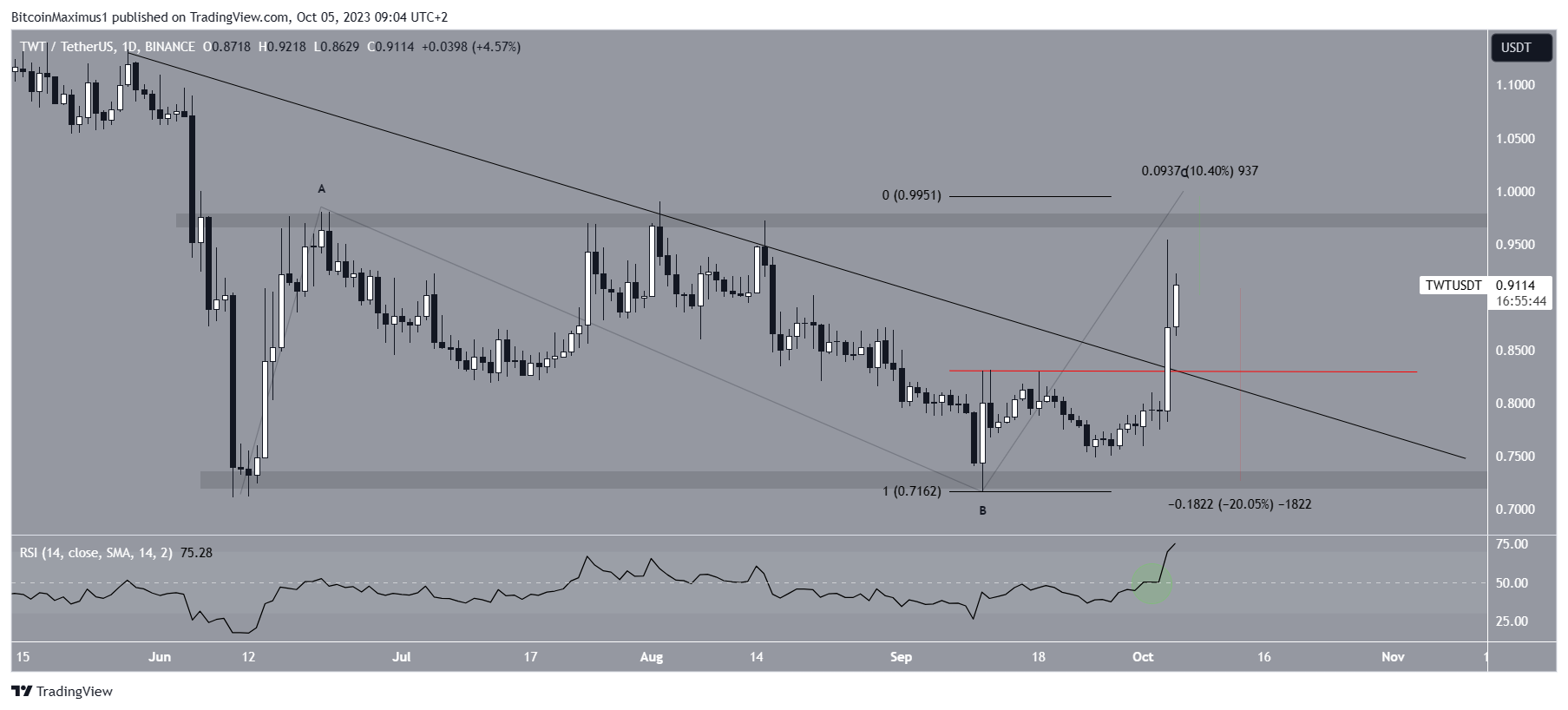

The $TWT price has fallen under a descending resistance trendline since May 28. The line caused several rejections, the most recent on August 15. This caused the cryptocurrency to fall to a low of $0.71 on September 11.

The ensuing bounce created a long lower wick (green icon) and created a bullish engulfing candlestick. This is a type of bullish candlestick when the entire previous period’s decrease is negated in the next one.

After the candlestick, the altcoin created a higher low on September 25 and accelerated its rate of increase 9 days later, reaching a high of $0.95. This contrasts starkly with the rest of the crypto market, which has been bearish since October 2.

The increase caused a breakout from the descending resistance trendline. At the time, the trendline had been in place for 130 days.

The price sometimes returns after breakouts from such long-term lines to validate them as support. However, it is also possible for the upward movement to continue without a retracement.

$TWT Price Prediction: Will Price Reach $1?

Technical analysts employ the Elliott Wave theory as a means to identify recurring long-term price patterns and investor psychology, which helps them determine the direction of a trend.

A closer look at the Trust Wallet Token wave count supports the ongoing increase’s validity. This is visible in the distinct, three-wave structure of wave B. It makes it likely that the price is in either wave C, or has begun a new bullish impulse.

Giving waves A:C a 1:1 ratio would lead to a high of $1, slightly above the main horizontal resistance area at $0.97. This is 10% above the current price.

Read More: 9 Best Crypto Demo Accounts For Trading

The RSI also gives a bullish sentiment. Market traders use the RSI as a momentum indicator to identify overbought or oversold conditions and to decide whether to accumulate or sell an asset.

Readings above 50 and an upward trend indicate that bulls still have an advantage, whereas readings below 50 suggest the opposite. The indicator broke out above 50 (green circle) and is increasing, both signs of a bullish trend.

Despite this bullish $TWT price prediction, a decrease below the September 12 high or $0.83 (red line) will mean that the local top is in.

In that case, a 20% drop to the $0.72 area will likely be the future price outlook.

For BeInCrypto’s latest crypto market analysis, click here.

beincrypto.com

beincrypto.com