As the disappointing month of August due to a close, the month of September gave crypto investors much more reasons to be positive going forward.

September saw most of the laggards of August spring back to life and turn their favor around. While truly sublime performances were few and far between, dozens of currencies managed to post double-digit growth in September.

With the Federal Reserve slowing down its interest rate hikes, the market has managed to take a breather last month. However, the Crypto Fear and Greed Index has shown an increase of fearfulness in the market, dropping from 52 by the start of the month, to 42 by the tail end.

Investors are fearful that this may not be the last interest rate hike coming from the Fed.

The primary source of bullish sentiment on the market lies in more mainstream institutional acceptance of crypto, such as by major forex brokers that accept Bitcoin as well as other crypto currencies as a deposit method.

Top 5 Gainers

September ended strongly for the broader crypto market, with the likes of MKR and LINK leading the charge among the top gainers.

The market had shed some value in August, but the month of September turned out to be a different story. With less immediate fears of interest rate hikes and a decline in stock market performance, the crypto market capitalized on the opportunity.

Maker (MKR) +36.26%

Maker was one of the highlights of the crypto market in September. The Maker DAO, the project behind the DAI stablecoin, managed to break above the $1,500 level during the month, adding to an already impressive bull run in 2023.

While the coin returned slightly above 36% over the past 30-day period, its annual performance is even more notable, with MKR returning over 100% during the past 12 months.

Whether MKR manages to maintain its bullish momentum going forward is questionable, but some analysts have suggested that the price could break above $1,700 by the end of 2023.

Chainlink (LINK) +36%

Another notable winner in September was Chainlink. LINK managed to gain 36% in market value over the past 30 days, which has done a lot for long-term investors, turning their fortunes around and posting an annual gain of 7% in what has been a year to forget for LINK hodlers.

September showed a gradual increase in the price of Chainlink, as opposed to a sudden bullish outburst, which may suggest that Chainlink’s bullish momentum could be more sustainable towards the tail end of 2023. Whether this turns out to be true remains to be seen, but Chainlink investors will nonetheless be happy with the month of September.

Solana (SOL ) +16.40%

Solana has been a problematic holding for many crypto investors in 2023, with the currency consistently underperforming throughout the year. Not even a positive month of September has been enough for the currency to turn its fortunes around, with SOL still being down roughly 30% over the past 12 months, despite a 16.4% gain in September alone.

It is also important to note that Solana’s price remained largely stagnant in September, before rapidly pumping towards the last week of the month.

It is unlikely that Solana will be one of the gainers of the year, but investors should remain hopeful of the project reclaiming more of its lost ground in 2023.

TRON (TRX) +15.60%

September has been a positive month for Tron as well, with the coin gaining over 15% over the past 30-day period, which further adds to an already respectable annual return of 45%.

Tron, which is a popular decentralized digital ecosystem for decentralized applications, has been one of the top performers among the largest cryptocurrencies in terms of market caps this year.

Tron’s gradual increase in September has investors hopeful of TRX maintaining the momentum going into October, with the $0.1 price mark firmly in sight.

Bitcoin Cash (BCH) +15.16%

Bitcoin Cash has also enjoyed a fruitful month in September, gaining over 15% over the past 30-day period, which makes its annual returns equal to over 100%, making BCH one of the best-performing large-cap cryptocurrencies on the market.

Investors in Bitcoin Cash will be eyeing a break over the $250 resistance level sometime during the month of October, with $300 also a possibility by the end of the year.

However, much of this depends on the actions of the Federal Reserve, as well as the market sentiment among crypto investors as a whole.

Top 5 Losers

Despite the broadly positive market performance, some cryptocurrencies had a difficult time in September.

The likes of GALA, APE, and MNT showed double-digit decline in price over the past 30 days.

As the Crypto Fear and Greed Index stands at 42, investors are likely to remain cautious in the months to come, with sudden bullish runs being less of a probability.

Gala (GALA) -21.72%

Gala has been the worst-performing cryptocurrency on the market in September, losing just under 22% over the past 30 days.

This is compounded by even worse annual returns, which puts GALA at a 64% loss annually.

GALA investors may have little hope to grasp on going forward, as the crypto market is still a ways off from a fully fledged bull run, which could help GALA investors immensely.

ApeCoin (APE) -12.70%

ApeCoin, which lost over 12% of its market value in September, has only recently managed to bounce back and recoup some of its losses in the month.

The annual performance of the crypto is not confidence-inspiring for investors, having lost over 76% during the past 12-month period. Whether the remainder of 2023 has anything special in store for APE investors remains to be seen, but the overall consensus for the coin is far from bullish. Investors could see APE drop even lower this year, breaking the $1 support level in the process.

Mantle (MNT) -11.87%

Mantle, the titular cryptocurrency of the Mantle Network, is a relatively new addition to the crypto market, having made its ICO in mid-July of this year.

The currency has since lost 15% of its market value, with the performance for September coming in at a roughly 12% loss. However, MNT has managed to slightly rally from the lows of $0.387 to $0.397 towards the end of September, recouping some of its losses.

Much like ApeCoin, it is difficult to paint a bullish picture for Mantle in the short term, but its novelty on the market could be an important catalysts for price action in the coming months.

Quant (QNT) -8.48%

The month of September has been one to forget for Quant investors. While the coin only lost around 9%, its year-long struggle for gains makes it difficult for long-term holders to be optimistic about the remainder of the year.

Over the past 12 months, QNT has lost 36% of its market value and investors may see the coin drop below the $80 support level by the end of the year. While the 12-month performance has not been great, QNT has largely traded sideways since the start of 2023, signaling indecision among QNT investors.

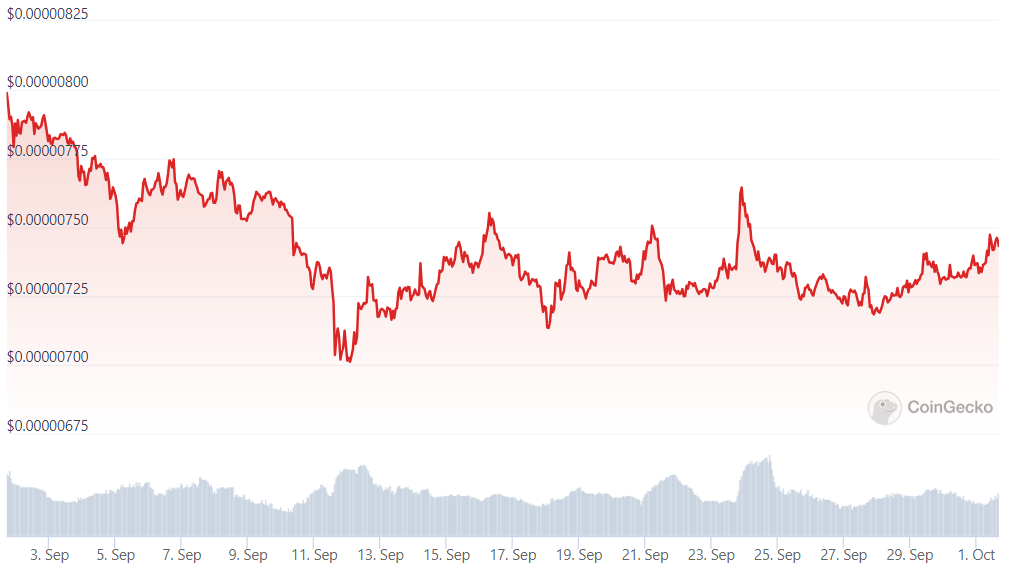

Shiba Inu (SHIB) -6.36%

Shiba Inu, the ERC-20 meme-coin, has been one of the laggards in 2023. September saw the coin lose roughly 6.5% of its market value, which amounts to an annual loss of roughly 34%.

In broad terms, Shiba Inu benefits from bullish sentiment on the market, which has been absent for the past few months. This is causing most crypto investors to shy away from meme coins, which results in the likes of Shiba and Doge performing poorly.

The remainder of the year 2023 is unlikely to become a source of major bullish runs for the crypto market. Therefore, investors could see SHIB fall firmly below the $0.000007 support level by the end of the year.

Final Thoughts

After a drowsy month of August, the crypto market has bounced back in style. September has seen double-digit growth figures for a variety of currencies, such as MKR, LINK, SOL, and others.

On the other hand, GALA, APE, and MNT were some of the worst-performing cryptocurrencies on the market during the month.

Going forward, the short-term bullish trend is expected to continue, with stock performances slumping and the Federal Reserve slowing down its tightening of the monetary policy, the market has a narrow window of opportunity to bounce back and reclaim some of the losses incurred in prior months.

cryptonews.net

cryptonews.net