Maker (MKR) price crossed the $1,500 mark on October 1 for the first time since May 2022. On-chain analysis examines two vital indicators that could accelerate the current price rally.

MKR is the native token of MakerDAO — the decentralized finance protocol that issues the $5 billion market cap $DAI stablecoin. Courtesy of the recent spikes in network demand, MKR price has reclaimed the $1,500 spot for the first time since the TerraUST algorithmic stablecoin crashed in May 2022.

Technical Modifications Have Seen MKR Global Adoption Reclaim 2021 Peaks

MKR was one of the worst-hit cryptocurrencies during the TerraUST-induced market crash in May 2022. At the time, $DAI was one of the most prominent stables built on the algorithmic mechanism, a characteristic shared with the ill-fated UST stablecoin.

In the aftermath of the systemically bearish event, the MakerDAO team took frantic steps to modify the $DAI stablecoin collateral mechanism. In effect, it switched to a hybrid mechanism, with a mix of mega-cap cryptos, collateralized stablecoins, and US Fed-issued debt instruments now backing $DAI.

Ride the crypto wave with confidence. Predict MKR prices here.

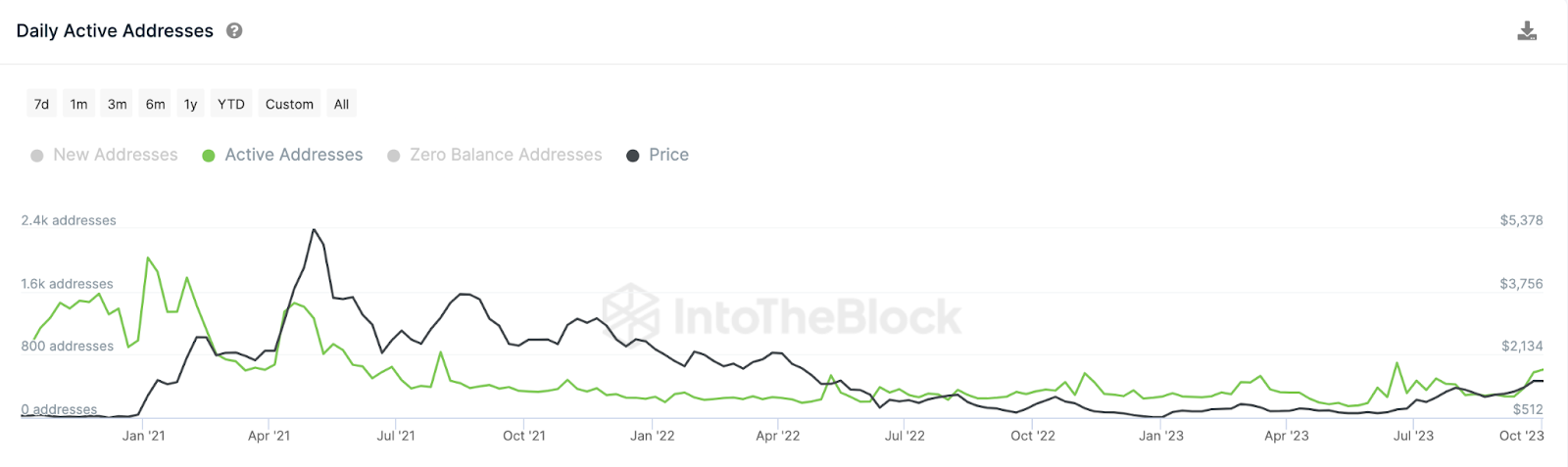

On-chain data shows that those efforts have yielded desired dividends, as MKR tokens deployed in daily transactions are now approaching peaks last seen during the 2021 bull market.

As seen below, MKR Daily Active Addresses hit the 2-month peak of 761 on October 2. But more importantly, it has scaled the 400 mark for 1 consecutive week, dating back to September 26.

Notably, this happened last in May 2021 when MKR hit its all-time high price of $6,290.

The Daily Active Addresses metric tracks a blockchain network’s prevailing user participation rate. It is derived by aggregating the number of unique addresses interacting on a given day.

When daily network activity thrives at historical peaks for an extended period, as observed above, it suggests healthy organic growth within the ecosystem.

Going by historic trends seen in 2021, it’s only a matter of time before the network participants drive MKR prices to new heights.

Read More: 6 Best Copy Trading Platforms in 2023

Network Participants are Performing Economically Viable Transactions

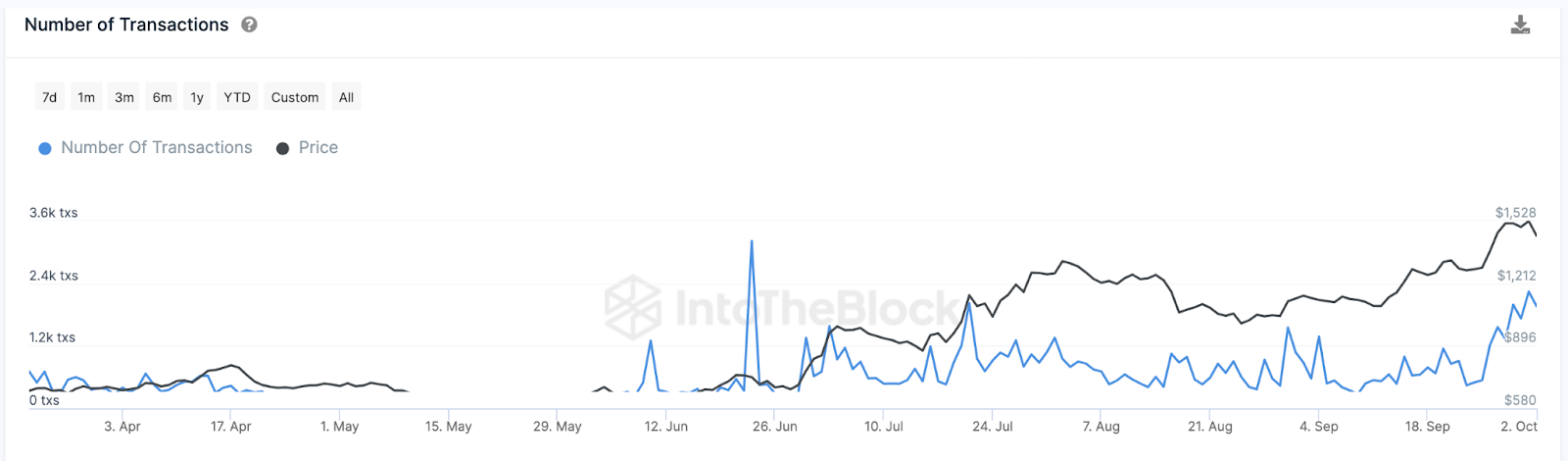

Furthermore, there has been a comparable increase in MKR daily transactions in recent weeks. After the US Fed announced a rate pause on September 20, the number of daily transactions on the MakerDAO network has increased considerably as investors increasingly pile on the attractive 8% $DAI savings rate.

The chart below shows that the Maker network recorded 2,240 confirmed transactions on October 1. Similar to the DAA count, it has consistently recorded transactions greater than 1,200 since September 26.

By tracking the daily number of confirmed transactions, the Transaction Count metric gives a clear estimate of the economic activity levels on a blockchain network.

Typically, when Daily Active Addresses coincides with network demand it suggests that users perform economically viable transactions.

Such a consistent rise in network activity means that the underlying native token is now in demand. Unsurprisingly, the Maker token price has witnessed a 15% price bounce between September 25 and October 3.

Hence, this confirms the prediction that the renewed Maker network user engagement rate could propel MKR price further upwards in the coming weeks.

MKR Price Prediction: $2,000 Could Be the Next Target

The critical on-chain data points analyzed indicate that sentiment surrounding the MakerDAO ecosystem is predominantly bullish. Hence, the price will likely continue to rally toward $2,000 if the bulls remain in control.

The Global In/Out of Money Around Price (GIOM) data, which depicts the entry price distribution of current MakerDAO network participants, also validates this bullish prediction.

It shows that if MKR price can scale the initial resistance at $1,800, the bulls could potentially drive a price rally above $2,000

As shown below, the 7,930 addresses bought 74,650 MKR tokens at an average price of $1,813. If they book early profits, they could trigger a momentary pullback.

But if the network activity intensifies, the price rally could eventually hit a new 2023 peak of $2,500.

Yet, the bears could invalidate this optimistic prediction if Maker’s token price backtracks below $1,200. However, as shown above, 9,250 addresses had bought 238,700 MKR tokens at the maximum price of $1,199.

If they HODL, MKR could avoid the bearish downswing.

But if the bull cannot defend that vital support level, the MKR price could drop and eventually slide below $1,200.

beincrypto.com

beincrypto.com