Arbitrum (ARB) price has failed to reclaim the critical $1 territory in September despite attracting significant network demand. On-chain data examines if the network activity spikes can impact ARB price positively in October 2023 and beyond.

Arbitrum price has rebounded 20% to reclaim $0.90 after dropping to an all-time low of $0.75 on September 11. Can the growing network activity propel ARB price above the vital $1 resistance in the coming weeks?

Arbitrum Whales Spent $126M Buying the Dip in September

Arbitrum started this month negatively, as the bears drove the price to an all-time low of $0.75 on September 11. But interestingly, a cohort of smart-money whales were spotted buying the dip aggressively.

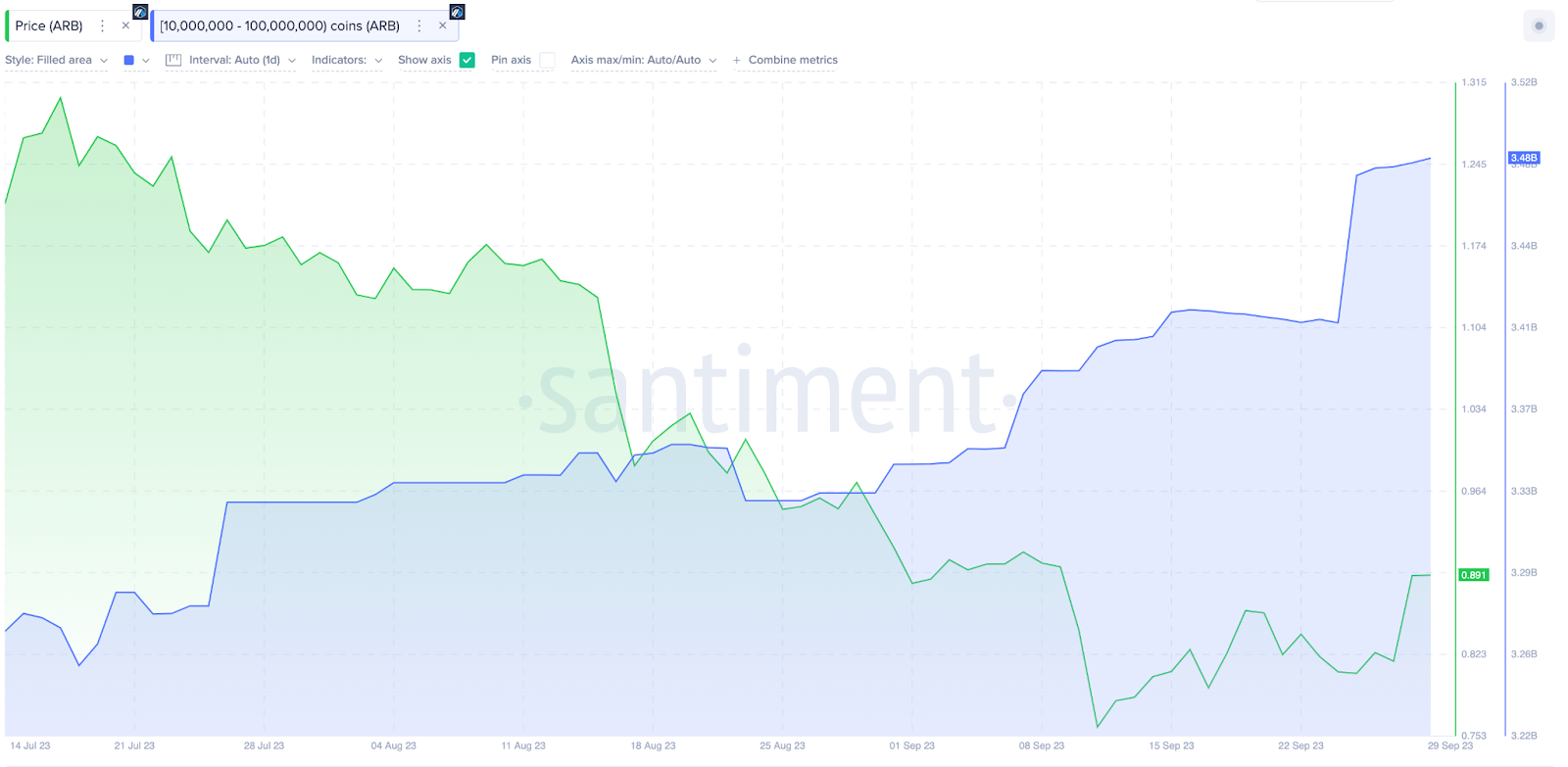

Indicatively, whale investors holding 10 million to 100 million ARB had 3.34 billion tokens in their wallets as of August 31. But the chart below shows how that figure has surged to 3.48 billion as of September 29.

This implies that the whales have capitalized on the low prices to accumulate 140 million coins in September.

Valued at the current market price of $0.90, the 140 million coins recently sold by the whales are worth approximately $126 million. For several reasons, such intense buying activity from whale investors could positively impact ARB price.

Firstly, a large volume of whale inflows could put upward pressure on the price if the market supply cannot catch up. Also, due to their financial power, the whales could inadvertently influence other strategic retail investors to take bullish positions ahead of October 2023.

Read More: How To Make Money in a Bear Market

Arbitrum Network Activity Has Hit a New Peak for H2 2023

On September 21, Beincrypto’s on-chain analysis predicted that the recent launch of Post.Tech – an emerging SocialFi platform, could impact Arbitrum network demand positively.

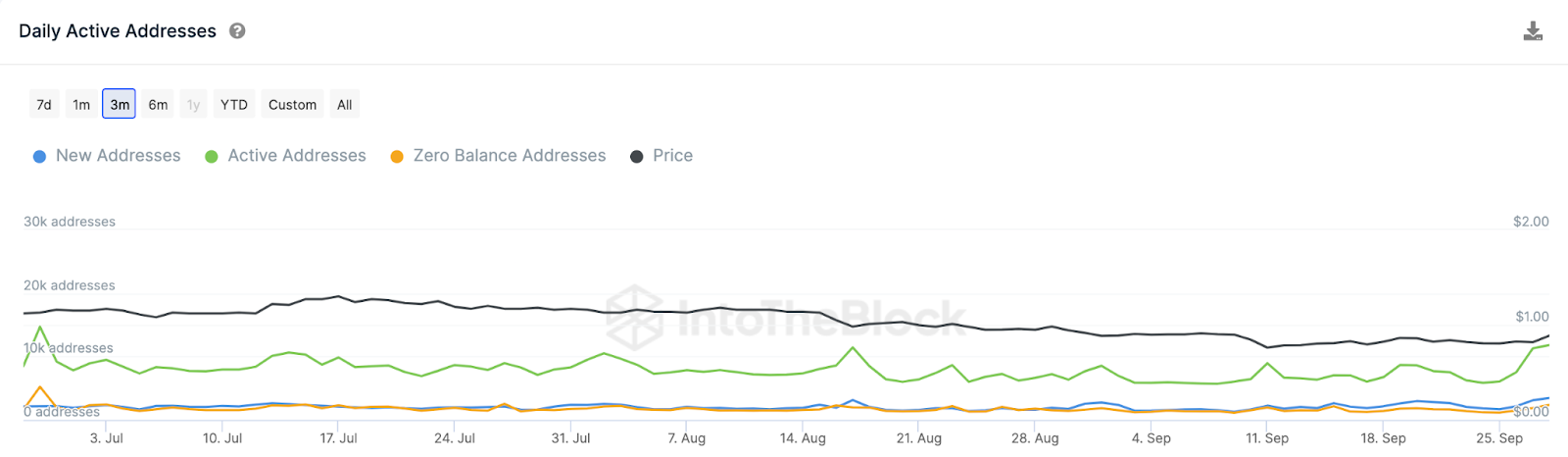

Unsurprisingly, this week, Arbitrum network activity hit a new peak for H2 2023. The chart below illustrates how ARB network demand rose rapidly to reach 11,810 Active Addresses on September 28.

The Daily Active Addresses metric tracks the user engagement rate on a blockchain network. It is derived by aggregating the number of unique addresses carrying out economic transactions daily.

As observed above, the last time Arbitrum Daily Active Addresses hit this level was three months ago, on June 29.

In summary, as the retail network demand now coincides with the whales’ buying pressure, Arbitrum’s price looks set to make significant gains in October and beyond.

Read More: 11 Best Sites To Instantly Swap Crypto for the Lowest Fees

ARB Price Prediction: Is $1.50 the Next Target?

From an on-chain perspective, Arbitrum is in a prime position to reclaim the $1.50 territory in the coming weeks.

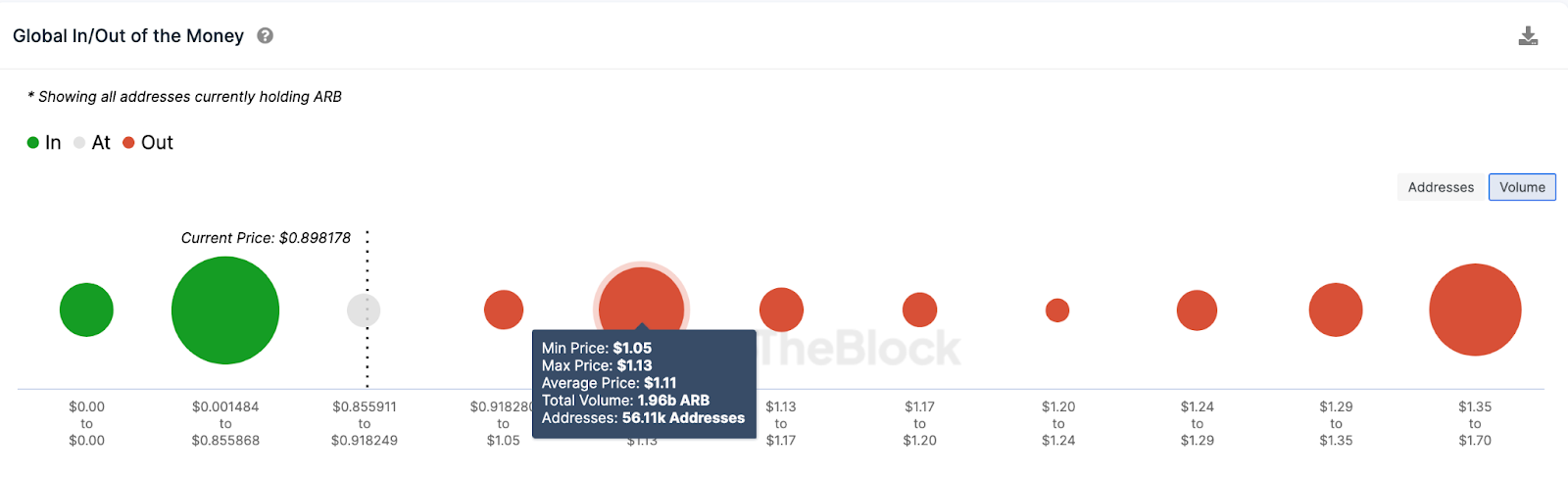

The Global In/Out of Money Around Price (GIOM) data, which depicts the purchase price distribution of current Arbitrum holders, also validates this bullish thesis.

It shows that if Arbitrum can scale the initial resistance at $1, the bulls could potentially ride the wave toward $1.50.

As shown below, the 56,110 addresses bought 1.96 billion ARB tokens at the minimum price of $1.05. If they sell early, they could pose the most significant obstacle for the bulls.

But the Arbitrum price rally could eventually surpass $1.50 if the whales keep stacking their bags.

Conversely, the bears could regain control if the ARB price wobbles below $0.70. However, as shown below, 32,500 addresses had bought 3.74 billion Arbitrum tokens at the maximum price of $0.85.

Being the most influential cluster of current holders, they will likely avert the bearish downswing.

But if the ARB loses that critical support level, the price could eventually drop below $0.70.

Read More: 6 Best Copy Trading Platforms in 2023

beincrypto.com

beincrypto.com