This week, Uniswap ($UNI) has recorded a mild price upswing Uniswap ($UNI) has recorded a mild price upswing this week as bullish sentiment returns to the global crypto markets. Will the lag in market liquidity slow down the Uniswap price rally?

Recent reports have highlighted how Binance dominance of the crypto spot trading markets has waned for the second consecutive month. On-chain indicators have now revealed that Uniswap has benefited from Binance’s waning traction, along with popular Centralized Exchanges (CEXs) like Huobi (HTX) and Coinbase.

Uniswap ($UNI) price made another attempt at the $4.50 territory on Sep 20. But despite the growing network demand, a lag in market liquidity threatens to hamper the $UNI price rally.

Uniswap Network Has Attracted a Flurry of New Users as Binance Loses Traction

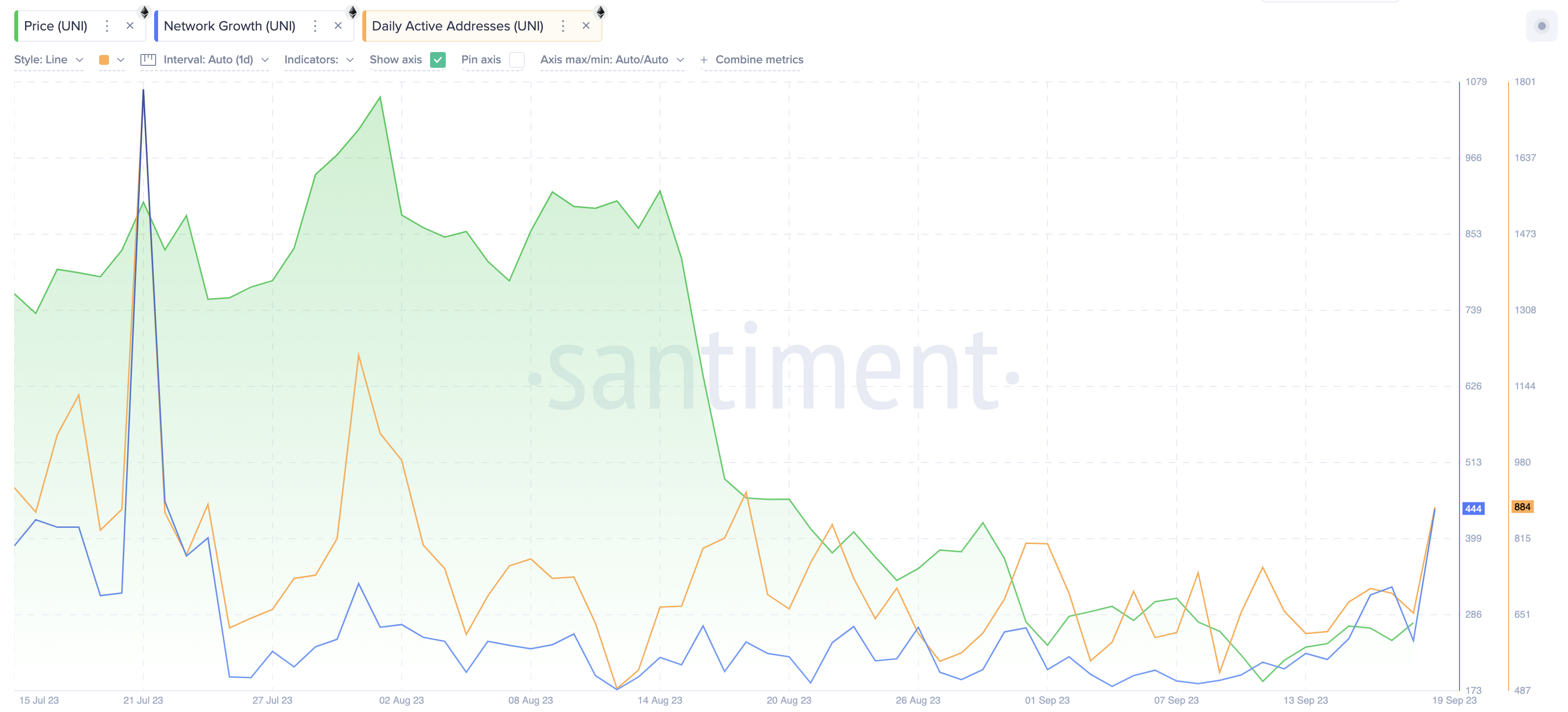

In recent weeks, Uniswap has gained a flurry of new users and network traction. On-chain data compiled by Santiment shows that 444 new $UNI wallet addresses were created on September 19.

Notably, the last time Uniswap Network Growth hit this level was 2-months ago, on July 21. Simultaneously, $UNI daily Active Addresses also increased to a 1-month peak of 884.

Network Growth estimates the rate at which new investors join a blockchain network by summing up the number of new wallet addresses created. When a rapid increase in Network Growth coincides with a sharp rise in daily active addresses, it indicates that the new joiners are not merely passive account holders. Instead, they have already been performing economic activity on the Uniswap network.

This level of network activity boost typically yields increased demand for the project’s underlying native token. But surprisingly, Uniswap has only scored a mild price bounce of 4%, moving from $4.30 to $4.45, in the week between Sept 12 and Sept 20

Read More: 8 Best P2P Crypto Exchanges You Need To Know About in 2023

Market Liquidity Remains Flat Despite Growth in Network Demand

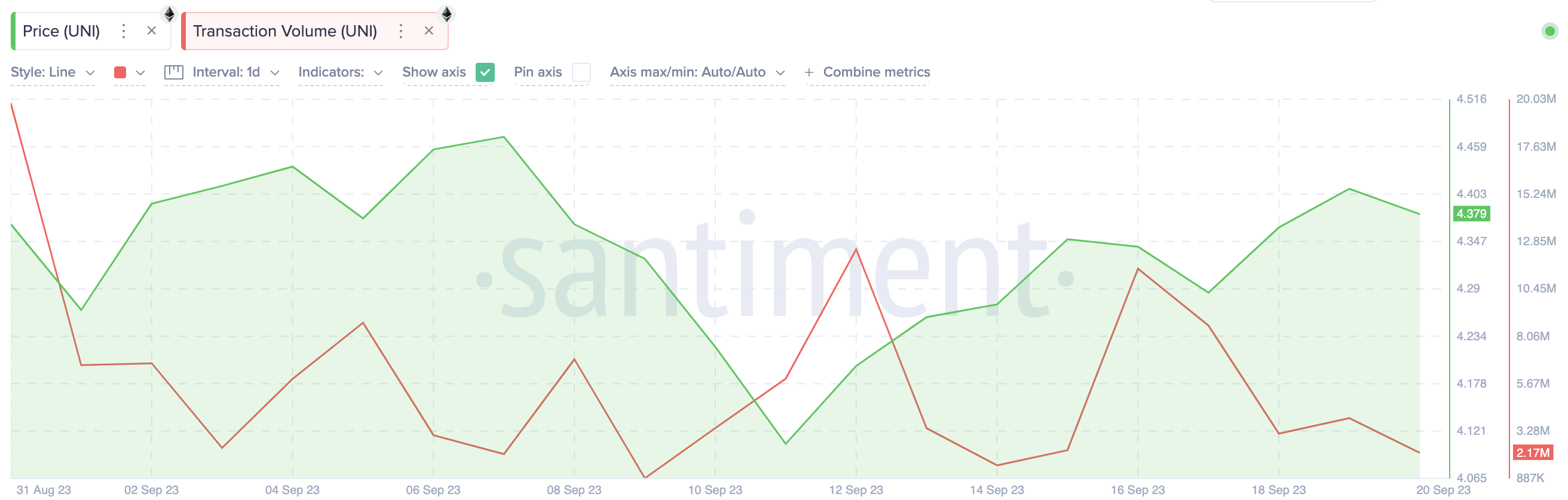

While Uniswap network demand has increased to a two-month peak, the liquidity traded across $UNI spot markets has not quite matched up. Curiously, on-chain data shows that the $UNI Trading Volume has remained relatively flat since the start of September.

As depicted below, while there has been a noticeable 4% price uptrend (green line) since September 12, $UNI trading volume entered a series of new lows. Indicatively, 12.45 million $UNI tokens were traded on September 12, and by September 19, that figure had dwindled by 68% to just 3.93 million tokens

Typically, spot Transaction volumes decrease in bear markets as beleaguered investors close their positions. Hence, the negative divergence between the Uniswap price uptrend and Trading volume decline raises red flags.

Without sufficient market liquidity, traders could struggle to get orders filled efficiently. Hence, the $UNI price rally could be shortlived.

$UNI Price Prediction: Bears Could Target $3

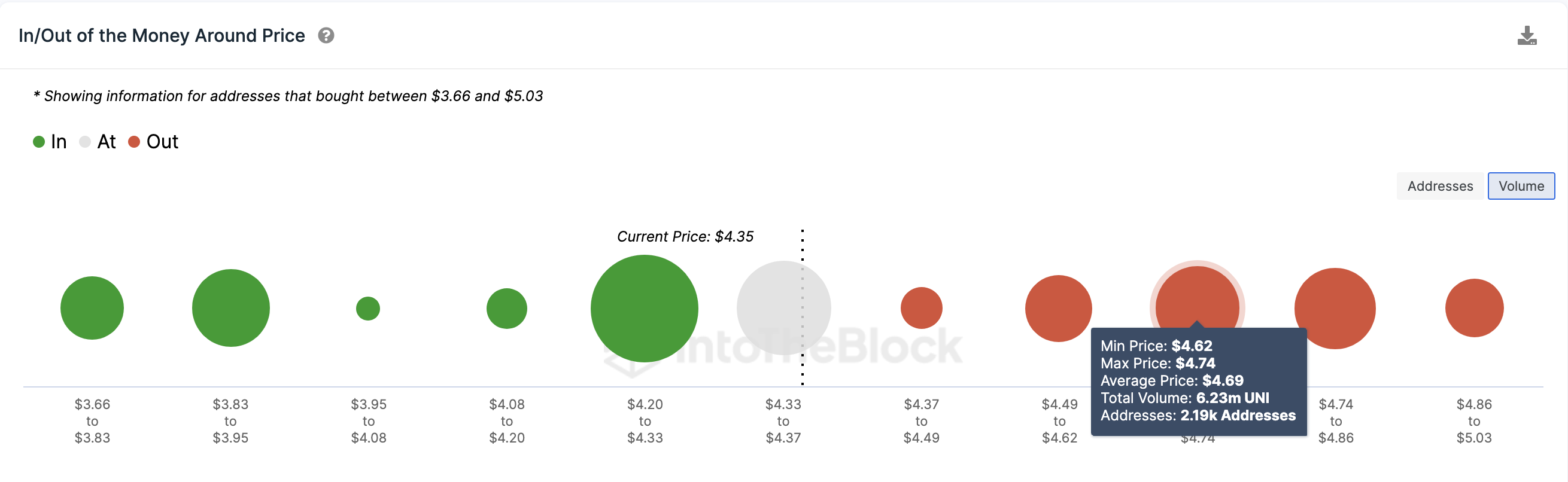

Without a significant increase in market liquidity, $UNI price will likely hit a wall around the $5 range. The In/Out of Money Around Price data, which depicts the purchase price distribution of the current $UNI holders, also supports this prediction.

It highlights that 2,190 investors had bought 6.23 million $UNI tokens at the maximum price of $4.74. They could pose considerable resistance, especially if the trading volumes remain flat.

But if the bulls can push past that resistance level, Uniswap price could swing toward the $5 range.

Conversely, the bears could seize control by forcing a downswing toward $3.50. However, 4,500 addresses had bought 11.05 million $UNI tokens at the minimum price of $4.20. That support level could prove daunting for the bears, especially amid the growth in network demand.

Although, unlikely under the current on-chain circumstances, $UNI price could eventually hit $3.50 if that support level does not hold.

Read More: Crypto Signals: What Are They and How to Use Them

beincrypto.com

beincrypto.com