Crypto whales have been capitalizing on the recent downturn in the altcoin markets to hunt down bargain deals worth millions. On-chain analysis beams the spotlight on 3 mega-cap altcoins that have been rescued from historic lows by timely whale inflows.

Crypto whales have been making some shrewd deals in September. As bearish headwinds heightened, Polygon (MATIC) and two other top-ranked altcoins have received significant inflows after falling to historic lows.

Will these 3 discounted altcoins deliver significant gains for investors in the coming weeks?

Whales Stepped in After Polygon (MATIC) Dropped to New 2023 Low

MATIC is the governance token of the Polygon Network —a smart contract platform and prominent Ethereum Layer-2 (L2) Scaling solution. The rise of rival L2s, like Base and Optimism (OP), has seen market demand for MATIC dwindle in recent months.

And when Binance announced the delisting of the support form Polygon assets from its native NFT Marketplace, MATIC price dipped below $0.49 for the first time since May 2022,

But this week, a cluster of whale investors have made timely capital inflows, triggering an instant rebound toward $0.52. On-chain data shows that whales holding 10 million 1 billion MATIC have acquired 17 million new coins since MATIC’s price dropped below $0.53 on September 10.

The chart above illustrates how the whales intensified their buying pressure once MATIC’s price dropped to historic lows around $0.50. At the current price of $0.52, the newly acquired 17 million MATIC tokens are worth approximately $9 million.

However, it remains to be seen if the whales will keep buying or book profits on the MATIC coins they purchased at discounted prices this week.

Crypto investing, simplified. Get MATIC price predictions here.

Large Investors Swooped in to Prevent Litecoin ($LTC) Dropping to $50

Litecoin’s ($LTC) price has been in a freefall ahead of the recent halving event on August 2. Since the halving, $LTC miners and paper hand traders continued to pile on sell-pressure. But as $LTC tumbled to a 2023 bottom this week of $58, crypto whales were spotted capitalizing on the discounted prices to stack their bags.

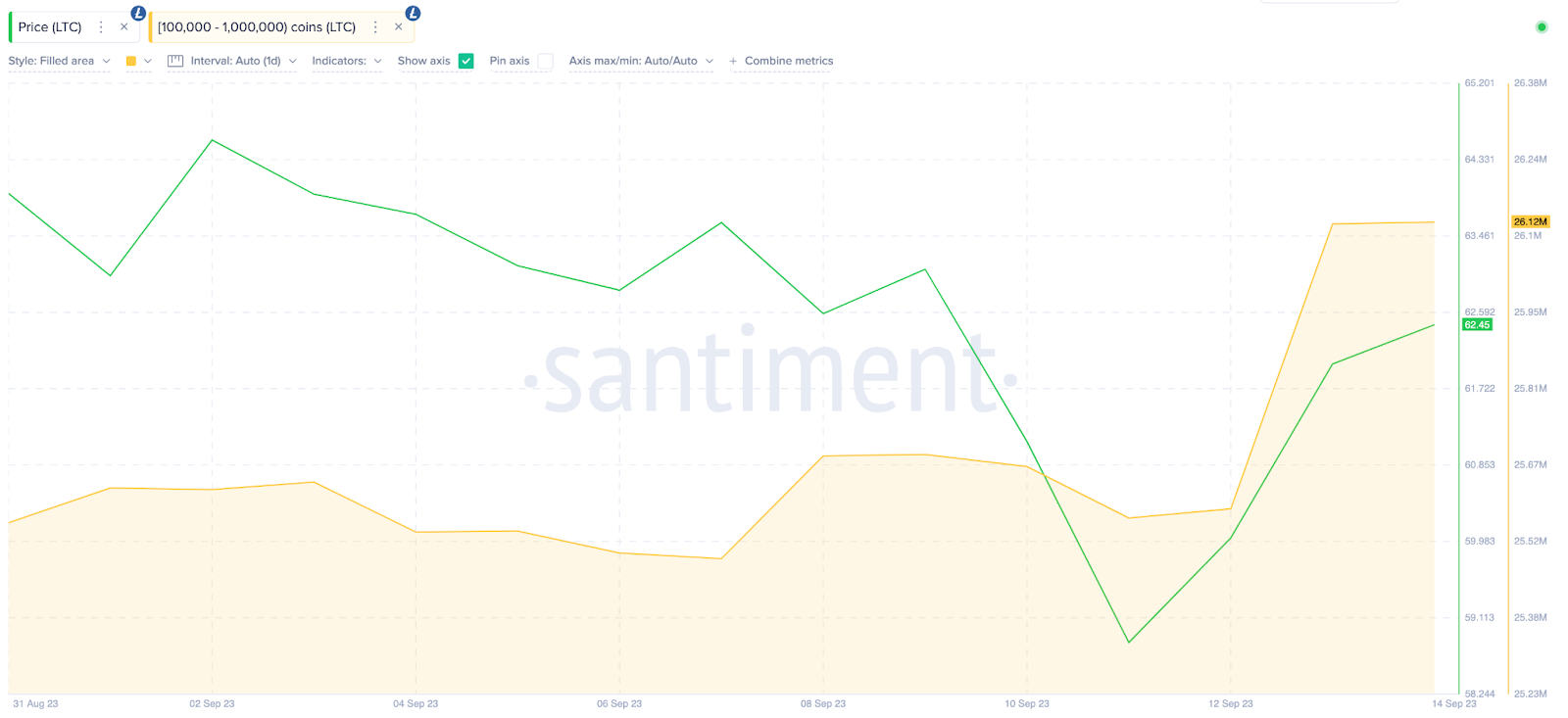

The Santiment chart below shows that the whales holding 100,000 to 1 million $LTC coins intensified their buying pressure once the price hit $58 on September 12.

Remarkably, between September 11 and September 14, they added their 55,000 $LTC coins to their cumulative wallet balances at bargain prices.

With the $LTC price currently hovering around $63, the 55,000 coins acquired in the last 3 days are now worth $3.5 million. With such a large inflow of funds, it appears the crypto whales have now staved off what could have been a Litecoin reversal toward $50, last seen during the FTX crash in November 2022.

Check Out the 7 Best Litecoin ($LTC) Wallets for 2023

Bargain Hunting Whales Keeping Apecoin From Going to Zero

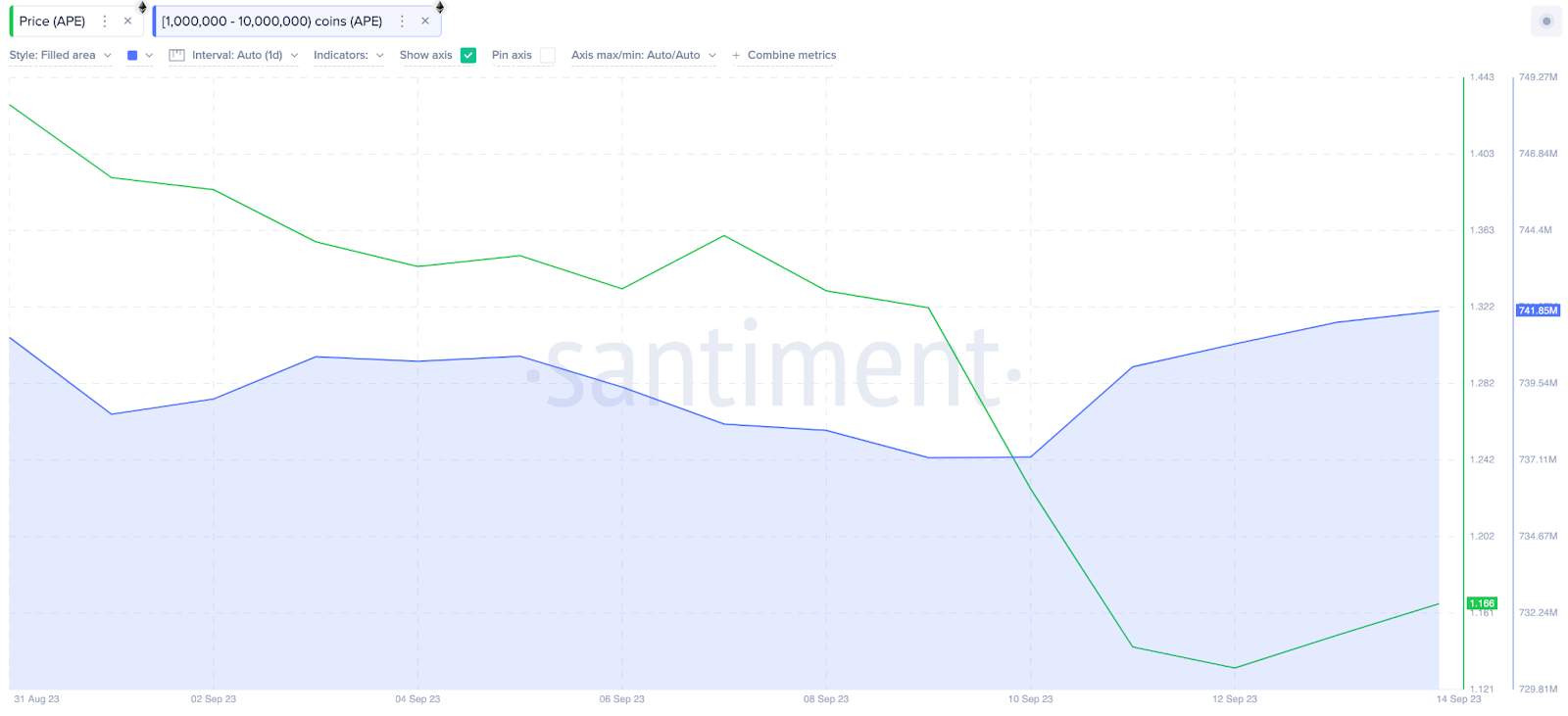

Apecoin ($APE) is the native token that underpins the Bored Ape Yacht Club (BAYC) ecosystem. This week, the $APE token fell to an all-time low price of $1.12. And like Polygon (MATIC) and Litecoin ($LTC), a cluster of millionaire crypto whales also swooped in to accumulate $APE tokens at bargain prices.

Santiment data reveals investors with balances of 1 million to 10 million Apecoin have collectively increased their holdings by another 4.65 million tokens between September 10 and September 14.

With Apecoin prices still hovering around $1.16, it appears that the fresh whale inflows of $4.65 million have not entirely swayed other investors. However, Apecoin has now moved further away from going to zero, as initially feared. Also, outcomes of ongoing Apecoin community proposals will likely impact price action in the coming weeks.

In summary, due to their financial muscle, institutional entities and high-net-worth holders wield significant influence in a blockchain ecosystem. Hence, crypto whales buying Polygon (MATIC), Litecoin ($LTC), and Apecoin ($APE) at discounted prices this week could boost other investor’s confidence in the projects’ long-term viability.

This positive perception can also attract new participants and deepen adoption amid the current bearish headwinds.

Hot Wallets vs. Cold Wallets: What’s the Difference?

beincrypto.com

beincrypto.com