- ApeCoin price has been on a downtrend, falling almost 85% from its yearly high of $6.437 recorded in January.

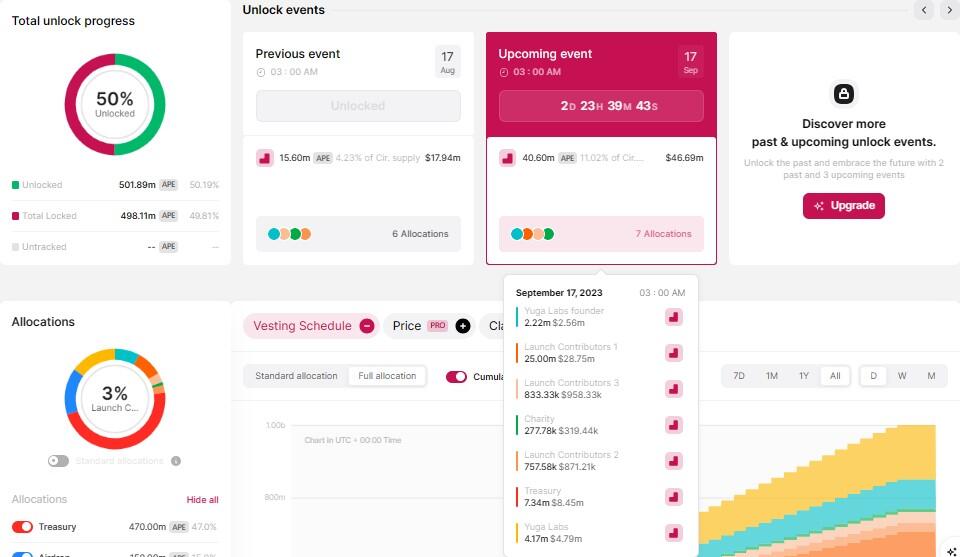

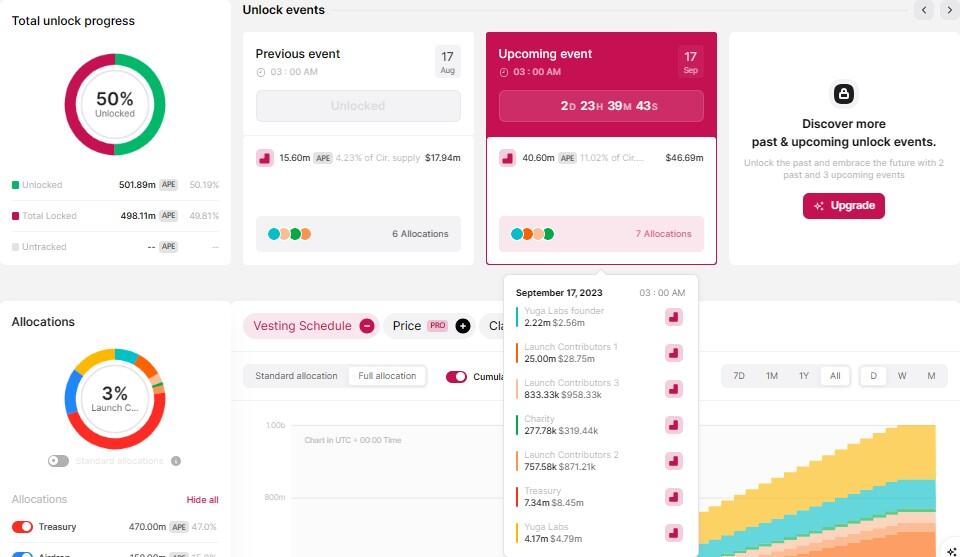

- 40.60 million tokens worth $46.69 million will be added to its circulating supply on September 17.

- Most of the tokens will go to launch contributors, treasury, and Yuga Labs ecosystem.

- In the previous sequence on August 17, ApeCoin dipped around 15% on the unlocks date, down 35% from August 15.

ApeCoin ($APE) price remains on its bearish streak after a sloppy multi-month fall since early in the year. After hitting what appears to be rock bottom for the altcoin, $APE is attempting to recover, with the ecosystem's token unlocking event likely to deter it.

Also Read: Solana price readies for a fall after FTX gets approval to dump $3.4 billion worth of crypto.

ApeCoin token unlocks 40.60 million tokens to be unleashed

The ApeCoin ecosystem has a cliff token unlocks event slated for September 17. As reported, unlike in the linear method, cliff token unlocks see a specified amount of tokens unlocked after a specified duration and is expected to disturb market stability. For its counterpart, the linear option, tokens are paid out on a linear schedule, say monthly or yearly, thus delivering some level of price stability.

Up to 40.60 million $APE tokens are due for unlocking, with their value totaling approximately $46.69 million at current rates. The tokens will be allocated to the Yuga Labs ecosystem and its founder, the treasury, and the launch contributors, as indicated in the chart below.

$APE token unlocks

With these recipients, selling pressure is anticipated to be huge, particularly for launch contributors who are likely the early entrants or investors, as they may be looking for a quick profit out of the allocation. The same can be said for allocations involving community members, investors, airdrops, and rewards. The selling pressure comes as token holders escape being caught in the exit liquidity. The possibility of investors offloading the reward allocations for immediate selling sets the price up for imminent selling pressure.

ApeCoin price forecast ahead of cliff token unlocks

In the last sequence of cliff token unlocks on the $APE network, August 17, ApeCoin price fell 15% on the D-day. Cumulatively, it dipped around 35% between August 15 and 17. If history repeats itself, the altcoin could fall below its debut price of around $0.957.

The Ichimoku Clouds continue to track ApeCoin price from above, a clear indication of bearishness that adds to the downside potential for $APE. The overall outlook is also hard to ignore, with the altcoin recording an endless streak of lower highs and lows.

The position of the Relative Strength Index (RSI) at 21 is also worrisome, worsened by the negative Awesome Oscillator, making the case for the bears.

$APE/USDT 3-day chart

Conversely, with investors looking to buy the dip, the RSI could tip north to show rising momentum. A sustained accumulation pattern could bode well for ApeCoin price, with a possible confirmation above the Ichimoku indicator's conversion line (blue band) and the baseline (red band) at $1.371 and $1.718 levels, respectively.

Cryptocurrency metrics FAQs

What is circulating supply?

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. Since its inception, a total of 19,445,656 BTCs have been mined, which is the circulating supply of Bitcoin. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

What is market capitalization?

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value. For Bitcoin, the market capitalization at the beginning of August 2023 is above $570 billion, which is the result of the more than 19 million $BTC in circulation multiplied by the Bitcoin price around $29,600.

What is trading volume?

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

What is funding rate?

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.

fxstreet.com

fxstreet.com