Amidst the rollercoaster of cryptocurrency prices, stablecoins promise stability. Yet, with varying levels of resilience and recent depegging events causing concern, the question arises: Are all stablecoins really that stable?

In the ever-changing world of digital assets, cryptocurrencies like Bitcoin (BTC) were pioneering, bringing decentralization into the spotlight. However, the potential of these initial cryptocurrencies has often been clouded by their stark volatility.

This is where stablecoins come in. They aim to bridge the gap by pegging their value to more stable assets like the U.S. dollar or gold, promising a blend of stability and reliability in a turbulent market.

Not all stablecoins are equally stable. Some are better at handling the ups and downs of the crypto market, while others can be risky. Crypto.news talked to experts to understand how such crypto assets behave and how to invest in stablecoins more effectively.

You might also like: Stablecoins: why they may be better than altcoins

Stablecoin types and volatility trends

By examining the four primary types of stablecoins, we can better understand their role and significance in the digital financial landscape.

Fiat-backed stablecoins

Fiat-backed stablecoins, true to their name, have their value tethered to traditional fiat currencies like the US dollar, euro, or the yen.

The core attribute of fiat-backed stablecoins lies in their backing: for every coin issued, there is an equivalent amount of fiat currency held in reserve, purportedly cementing a foundation of trust for their value.

While this is the claim laid out by their creators, it has occasionally been met with scrutiny and calls for more transparent regulatory oversight to ensure ongoing stability and trust in these digital assets. Popular coins in this category are Tether (USDT), USD Coin (USDC), and Binance USD (BUSD).

Although designed to maintain a 1:1 peg with the fiat currency, they can sometimes experience minor fluctuations due to market dynamics. Moreover, geopolitical events or significant policy changes by governments can indirectly influence their stability.

In totality, their volatility is considerably lower than other stablecoin assets but isn’t entirely negligible.

You might also like: USDC and DAI more susceptible to de-pegging, say analysts

Commodity-backed stablecoins

Commodity-backed stablecoins are essentially tied to the value of tangible commodities, predominantly gold.

Commodities like gold have historically been stable, making these stablecoins a potentially safer harbor during turbulent market conditions.

These stablecoins can witness volatility correlating to the price fluctuations in the commodity market. Factors such as changes in economic conditions, supply and demand shifts in the commodity markets, and geopolitical events can significantly influence their volatility.

Coins such as Paxos Gold (PAXG) and Tether Gold (XAUT) provide an opportunity to indirectly invest in commodities, potentially safeguarding investors from the erratic nature of the crypto market to an extent.

Crypto-backed stablecoins

Crypto-backed stablecoins operate with cryptocurrencies as their collateral. Coins like DAI or sUSD function through smart contracts mainly on platforms like Ethereum (ETH), utilizing various cryptocurrencies to back their value.

However, since they are backed by assets with higher volatility (cryptocurrencies), their stability can sometimes be compromised, particularly during a market downturn. Hence, these stablecoins potentially are more volatile compared to fiat and commodity-backed stablecoins.

Algorithmic stablecoins

Navigating into the futuristic sphere of stablecoins, algorithmic variants operate without tangible backing. They are orchestrated through algorithms and smart contracts that fine-tune the coin’s supply according to the demand dynamics, carving a path of decentralization in its truest form.

These coins, though innovative, are still in their experimental phases. As the collapse of TerraUSD (UST) in May 2022 showcased, they are susceptible to extreme volatility, navigating through dramatic highs and lows based on market reactions, making them a risky venture for those who are not attuned to high volatility in investments.

Hence, they are considered to be the least stable among the stablecoin categories due to the experimental nature of their underlying technology.

Stablecoins market shifts

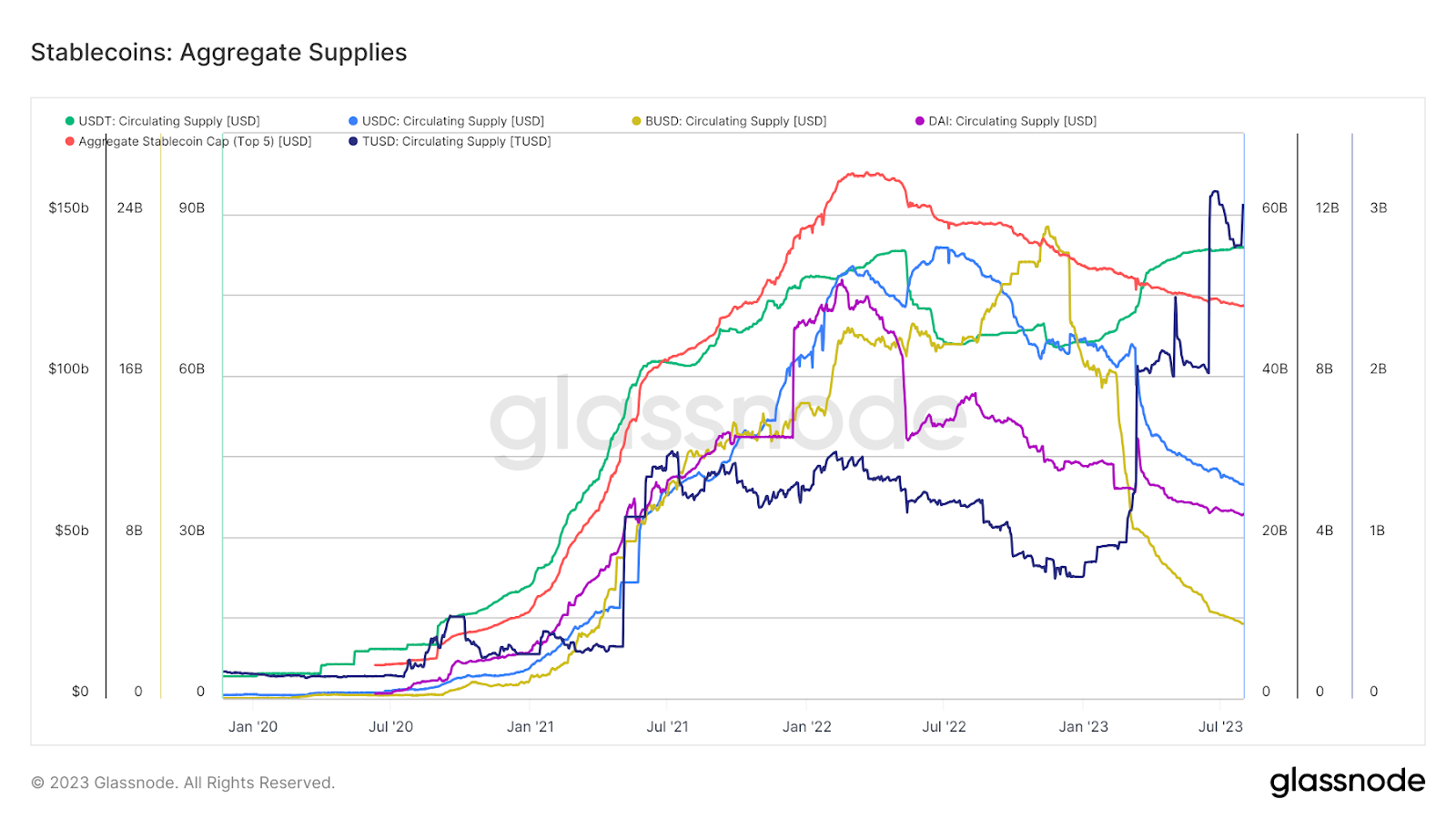

In the constantly changing world of cryptocurrency, the past year and a half saw big changes in the stablecoin area, with notable declines in market cap.

From March 2022 to September 2023, the stablecoin arena saw a significant shrinkage of about 22.8% in its total market capitalization, plunging from a robust $162 billion to a more restrained figure of approximately $125 billion.

The reasons for this decline might be multifaceted. It could be influenced by a combination of regulatory crackdowns, economic fluctuations, or shifts in investor sentiment.

Individual stablecoins mirrored this descending trajectory, albeit at different magnitudes. For instance, USDC’s market cap took a significant blow, witnessing a decrease of 53.3% from June 2022 to September 2023. This decline saw the cap shrinking from $56 billion to $26.13 billion.

BUSD, on the other hand, faced an even steeper descent, plummeting by 87.2% within less than a year. This precipitous fall, which brought the cap down from $23.5 billion in November 2022 to just under $3 billion by September 2023, signals a potential loss of investor confidence.

Contrary to the downward trend evidenced by its counterparts, USDT managed to weather the storm, carving out a substantial niche for itself in the market.

By September 2023, it constituted a dominant share of over 66% of the total stablecoin market cap, a testament to its perceived resilience amidst the broader market downturn.

The question that arises here is why? One plausible explanation could be Tether’s established reputation and widespread acceptance as a medium of exchange in the cryptocurrency market. Its perceived stability might have attracted investors seeking refuge from the volatility engulfing other cryptocurrencies, thereby cementing its position as a stable investment haven during turbulent times.

Looking at these recent patterns, it seems that the stablecoin market is becoming more streamlined and mature. Investors are gravitating towards well-established and stable coins such as USDT, avoiding others that appear to be riskier.

These changes are driven by a combination of regulatory updates, economic factors, and shifts in investor sentiment, highlighting the need for ongoing careful analysis.

Depegging of stablecoins

In recent years, the cryptocurrency sector has undergone notable shifts concerning the stability of stablecoins, which promise a safety net amidst the highly volatile crypto market.

The traditional viewpoint posited stablecoins like USDT and USDC as reliable, given their peg to established fiat currencies like the US dollar. However, recent events have showcased the vulnerability of this approach.

On Aug. 7, Kaiko data recorded a significant de-pegging event with USDT, where it experienced a 98% depeg severity, trading at a notable discount across various platforms.

Spurred by a rapid net sale of USDT amounting to $500 million across significant exchanges, this phenomenon did not garner substantial attention due to its lesser magnitude than past events.

Although recurrent USDT de-pegging is not uncommon, primarily attributed to factors implemented by Tether Holdings, Kaiko warns that the continuation of such incidents might gradually erode trust in the globally dominant stablecoin.

Meanwhile, USDC’s dip following the Silicon Valley Bank crash has raised significant doubts regarding the inherent stability of fiat-backed stablecoins.

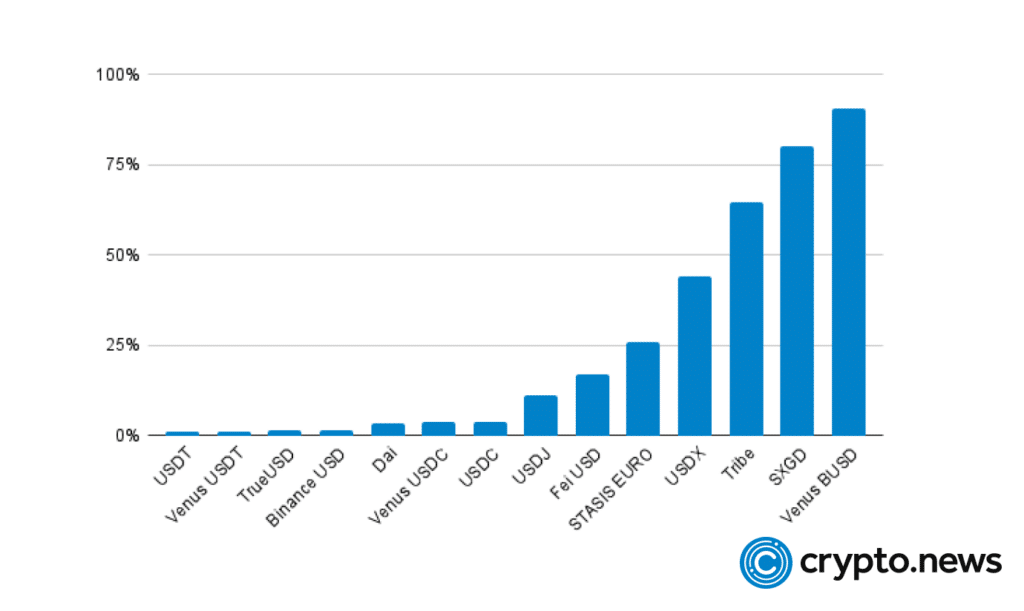

In a recent study commissioned by Coin Kickoff and produced by NeoMam Studios, the volatility ratings of various stablecoins were assessed to present a clear picture for potential investors.

At one end of the spectrum, we have USDT, showcasing a minimal annualized volatility of 0.88%, making it a considerably stable investment option.

However, even the most stable stablecoins can experience periods of fluctuation, as evidenced by Tether’s brief deviation from its dollar peg in August 2023.

At the other end of the spectrum lies Venus BUSD, with a striking annualized volatility of 90.7%, surpassing even Bitcoin’s 61.1% volatility rate.

This scenario illuminates that not all stablecoins offer the same stability, urging investors to tread carefully and make well-informed decisions.

Can metal-backed stablecoins be a solution?

The uncertainty surrounding traditional stablecoin has increased interest in exploring other more tangible options for stablecoin backing. One such approach that’s gaining traction is linking the value of stablecoins to precious metals such as gold and silver.

Finance Professor Alam Asadov from Prince Sultan University and Dr. Ramazan Yildirim from Upsite Consulting told Crypto.news that certain stablecoins do not maintain 100% fiat backing, which increases the risk of instability and vulnerability to inflation. Their research paper published in Borsa Istanbul Review suggests that a combination of gold and silver, in a ratio of 88:12, can form the backbone of a more resilient and stable currency system.

The idea is that these metals have historically demonstrated a steady increase in value and protection against the diminishing worth of regular currencies due to factors like inflation and economic downturns. They further mentioned that “the value of gold increased by over 47 times against the US dollar in real terms from April 1968 to December 2022”, indicating a significant resistance to inflation over the long term, mitigating bank default risk and inflation vulnerability.

However, transitioning to a metal-backed stablecoin system is more complicated. There are critical questions to address, including devising safe storage solutions for these metals and creating mechanisms to verify their authenticity. The experts further highlighted that “reputable gold-backed stablecoins often have certified and audited reserves that are 100% equivalent to the cryptocurrency’s total value”, and these reserves are stored in secure vaults, significantly reducing the likelihood of default.

However, implementing clear regulations is essential to avoid potential misuse and foster system transparency. Thus, detailed planning and robust regulatory frameworks are indispensable before this concept becomes a reality, offering a promising alternative for those concerned with the vulnerabilities of fiat-backed options.

Navigating stablecoin investments

Investing in stablecoins comes with its own set of pros and cons. They’re generally less volatile than traditional cryptocurrencies, making them a good choice for those who prefer stability. They also offer various uses, from buying goods to earning interest on certain platforms.

However, this stability often translates to lower returns. While some investors try to boost returns through yield farming—earning rewards or interest by using stablecoins—it also comes with added risks such as market volatility or smart contract vulnerabilities.

Security is another concern. Stablecoins aren’t federally insured, so if the issuing company faces problems, you could lose your investment. Asadov and Yildrim underscore the importance of conducting thorough due diligence before entering the stablecoin market.

They suggest understanding the type of stablecoin you’re dealing with, verifying the backing of the coin, and avoiding assets that can’t produce credible proof of being 100% backed, which are strategies that can “better manage risks and make informed choices in the volatile stablecoin market.”

In summary, stablecoins offer a mix of stability and utility but come with lower return potential and specific risks. A well-researched and balanced investment strategy, fortified with insights from market analysts, can help you navigate these waters more effectively.

Read more: PayPal’s stablecoin: potential impact and user reactions