- Arbitrum price fall led the crypto market crash as the altcoin marked fresh all-time lows for the third time this month.

- Naturally, almost all of ARB’s 619k investors are presently underwater, with losses extending to 62% from the all-time high.

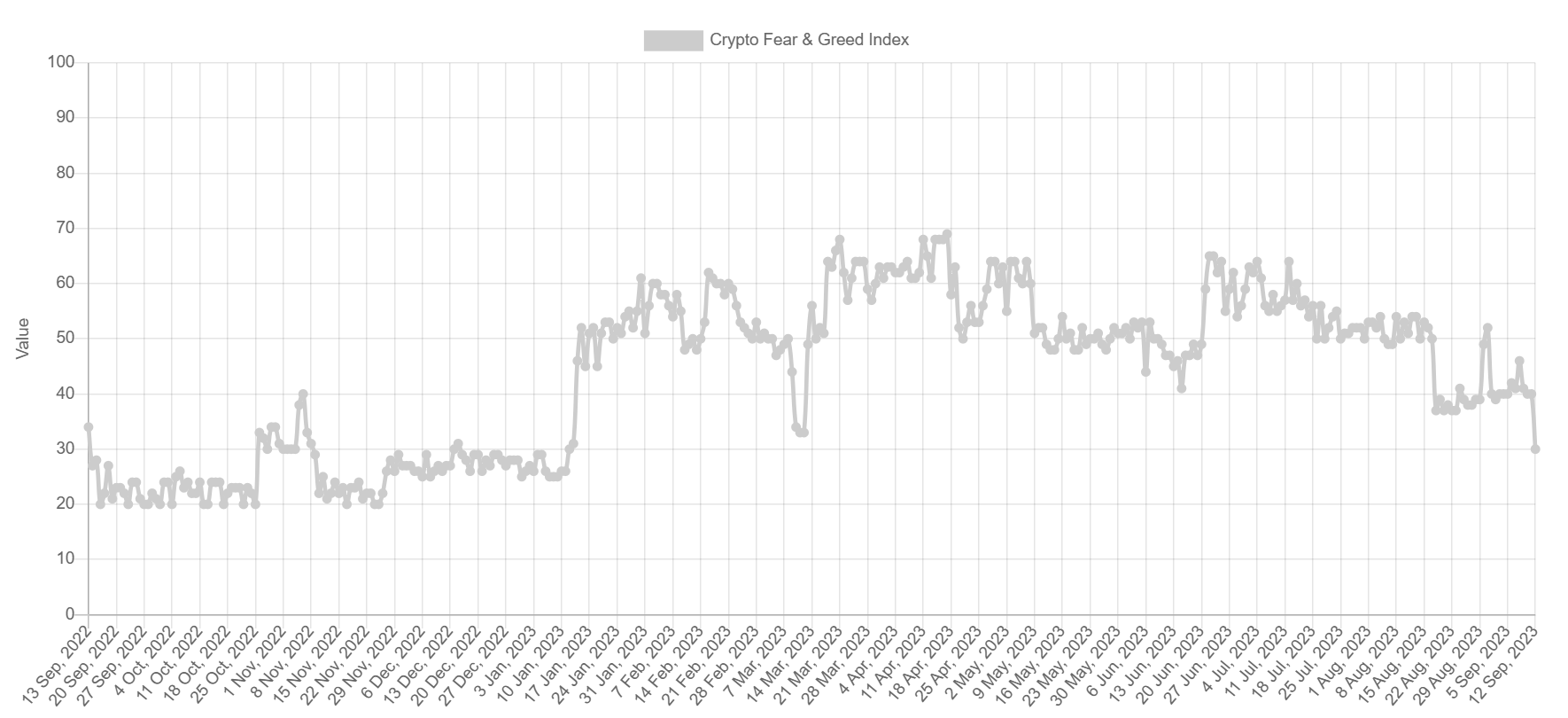

- At the time of writing, the crypto market’s fear is the most intense it has been in nearly eight months.

Arbitrum price faced the brunt of the bears as the cryptocurrency took the most damage. The resultant value of the altcoin has left its investors with severe losses that could take a while to recover.

Arbitrum price forms new lows

Arbitrum price trading at $0.76 has established fresh all-time lows, marking a new low for the third time since the beginning of this month. Falling by 10%, the altcoin became a target of the bears after whales began dumping millions of dollars worth of ARB in the past 24 hours. This included a trading company, Wintermute Trading, which deposited over 4.35 million ARB into Binance.

The recovery target for Arbitrum price now stands at reclaiming the resistance level marked at $0.94, which has been tested as support multiple times in the past three months. This is crucial in bringing the value of the altcoin back above $1.

ARB/USD 1-day chart

A recovery would also encourage ARB holders to keep their hopes of profits up, which have been certainly destroyed following the recent crash.

ARB holders' losses match price action

According to data analysis firm IntoTheBlock, almost everyone holding an amount of ARB is facing losses as the altcoin is forming all-time lows. Those who bought around the all-time high price of $1.69 are suffering the most, with a loss percentage of 62% based on unrealized losses.

Arbitrum investors at a loss

Till now, this has not driven selling in the market, nor has it caused a mass exit of investors as the total addresses with a balance remain unchanged. However, if the altcoin does not witness a recovery soon, a sell-off from investors may not take long.

As it is, the fear in the crypto market is alarmingly high. According to the Crypto Fear and Greed Index, the intensity of fear in the hearts of investors is the highest it has been in eight months since January this year, surpassing even the mid-August crash.

Crypto Fear and Greed Index

If this sentiment further intensifies, it could lead to more offloading of assets than accumulation, which generally is the sentiment of investors. People would pull away from buying at cheaper prices and instead offset their losses as much as they could by dumping their holdings.

Thus, investors looking to scoop ARB right now are advised to watch the market for further drawdown to prevent unprecedented losses.

fxstreet.com

fxstreet.com