Uniswap ($UNI) bulls have fiercely defended the $4 price support level over the past week, but the bearish pressure is growing. Will the Uniswap bears seize control in the coming days?

Uniswap ($UNI) price made a solid start to September, rallying towards $4.50. But some critical on-chain metrics suggest that the bulls may soon run out of steam.

Uniswap Holders are Loading Up Exchange Wallets

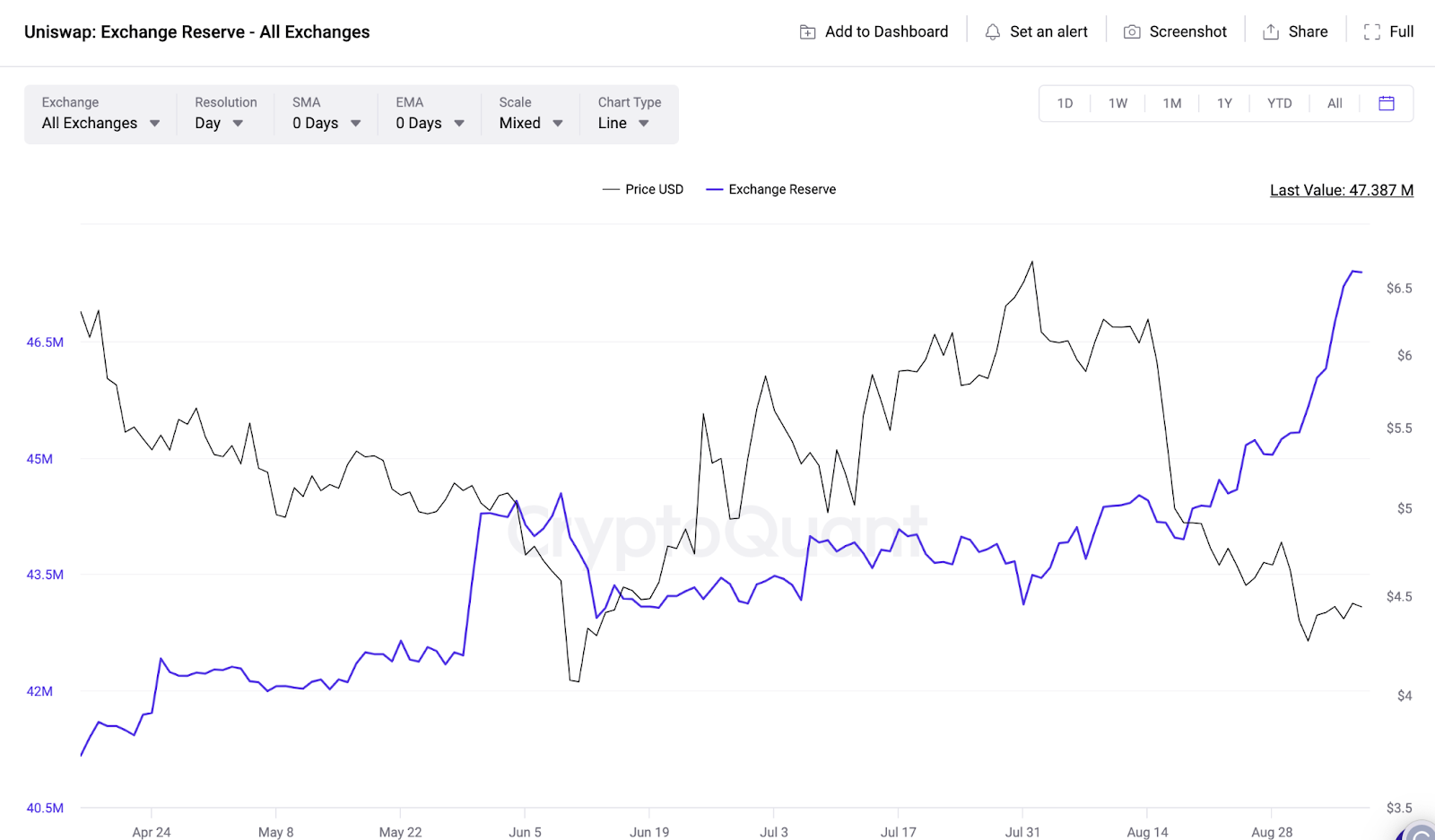

Uniswap price has gained 7.14% in the first week of September, but $UNI is in danger of hitting a massive sell-wall in the coming days. According to data from CryptoQuant, Uniswap bears have been depositing to their exchange wallets since the altcoin market crash on August 17.

The chart below depicts that the $UNI Exchange Reserves stood at 43.97 million tokens on August 17. Since then, it has risen rapidly, hitting 47.4 million $UNI on September 7, the highest ever since Uniswap was launched in 2018.

Exchange Reserves tracks the total balances that investors currently hold in recognized crypto exchange wallets. Typically, when exchange deposits increase, it suggests that holders are looking to sell or swap for other assets in the short term.

In fact, the chart above shows that the $UNI price has dipped by 29% since the Exchange Reserves began to rise on August 17. If the bulls do not up the ante, further increase in $UNI sell-pressure will likely lead to another price correction.

8 Best P2P Crypto Exchanges You Need To Know About in 2023

Market Demand Remains Flat as Bearish Headwinds Intensify

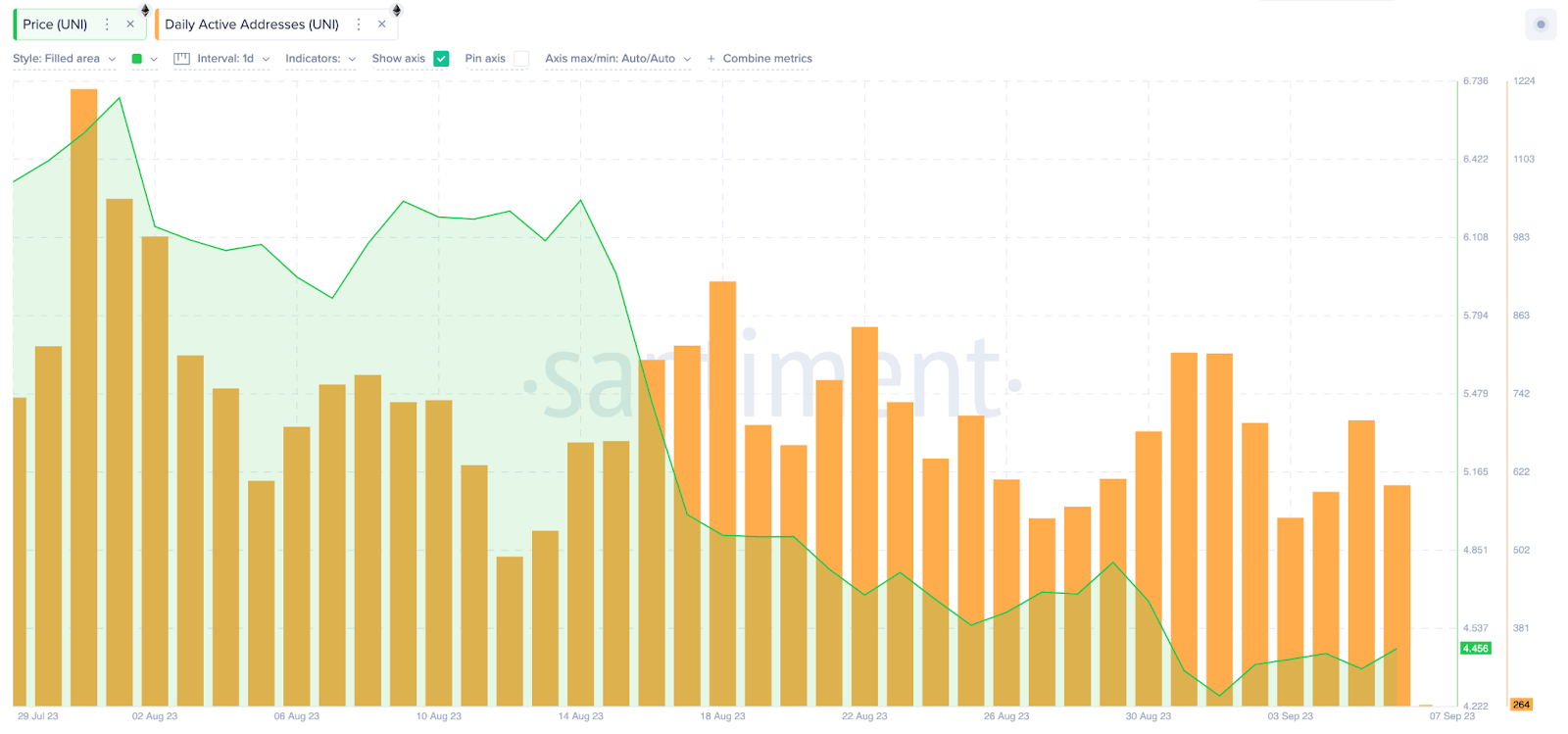

While market performances have held steady, thanks to price speculators, Uniswap has struggled to attract network demand in recent weeks. According to Santiment, the last time Uniswap attracted up to 1,200 active users was around July 31.

Since then, the daily network activity rate has gradually dwindled. The 805 addresses on August 31 is the highest it recorded in the last two weeks before dropping as low as 502 on September 3.

The Active Addresses metric tracks retail participation rate by aggregating the number of unique wallet addresses carrying out transactions daily. Typically, the higher the number of users deploying transactions, the greater the demand for the underlying $UNI token.

Without a significant increase in Uniswap network demand, Exchange reserves rising to an all-time high raises the risk that the Uniswap bears could seize control.

What Is a Token Generation Event (TGE)?

$UNI Price Prediction: Bears Could Target $3

From an on-chain perspective, the mounting Exchange Reserves could spark a significant price reversal toward the $3 range.

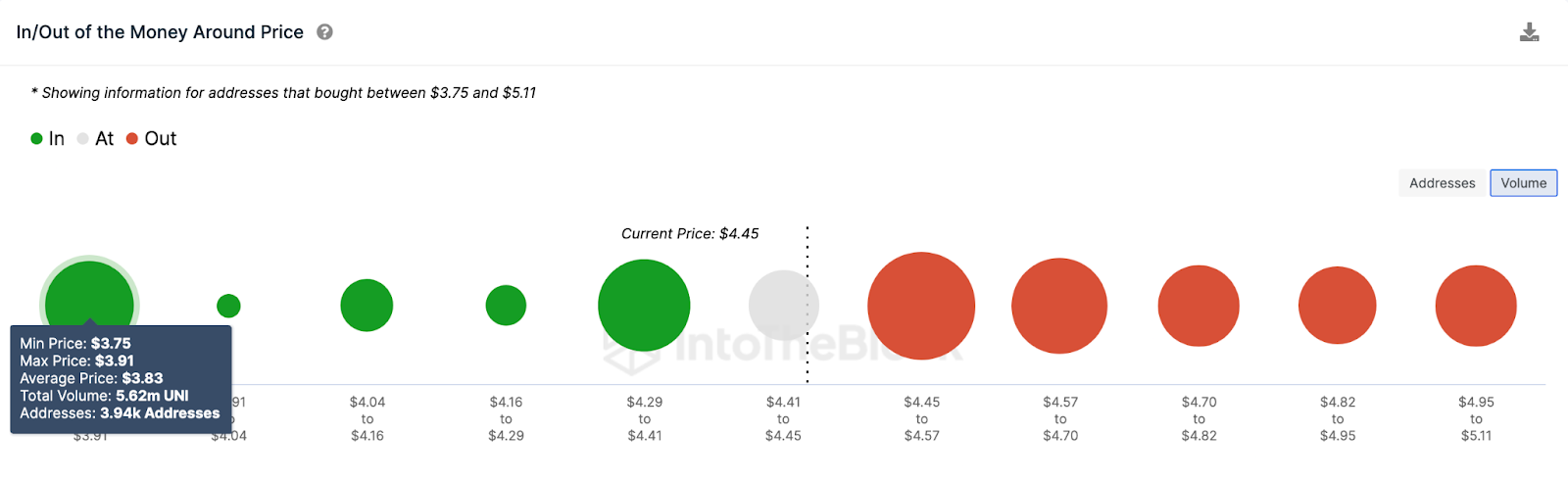

The In/Out of Money Around Price data depicts the entry price distribution of the current Uniswap holders and also supports this prediction. It, however, highlights that bears will face considerable challenges around the $3.75 territory.

As shown below, the 3,940 holders had bought 5.62 million at the minimum price of $3.75. If they defend their positions, $UNI could enter rebound mode.

But if the bearish holders keep mounting sell pressure, the price could drop below $3 as predicted.

Conversely, the bulls could seize control and invalidate the negative Uniswap price prediction by reclaiming $6. However, 1,200 addresses had bought 9.58 million $UNI tokens at an average price of $4.57.

That $4.60 resistance level could prove daunting if they chose to sell.

Although unlikely under the current on-chain circumstances, $UNI price could eventually hit $6 if that resistance level does not hold.

beincrypto.com

beincrypto.com