The Polkadot ($DOT) price has broken down from a 250-day horizontal support area, reaching the lowest daily close since November 2020.

The weekly and daily timeframes both provide a bearish outlook, suggesting that the downward movement will continue toward new lows.

Polkadot Price Reaches Lowest Close Since 2020

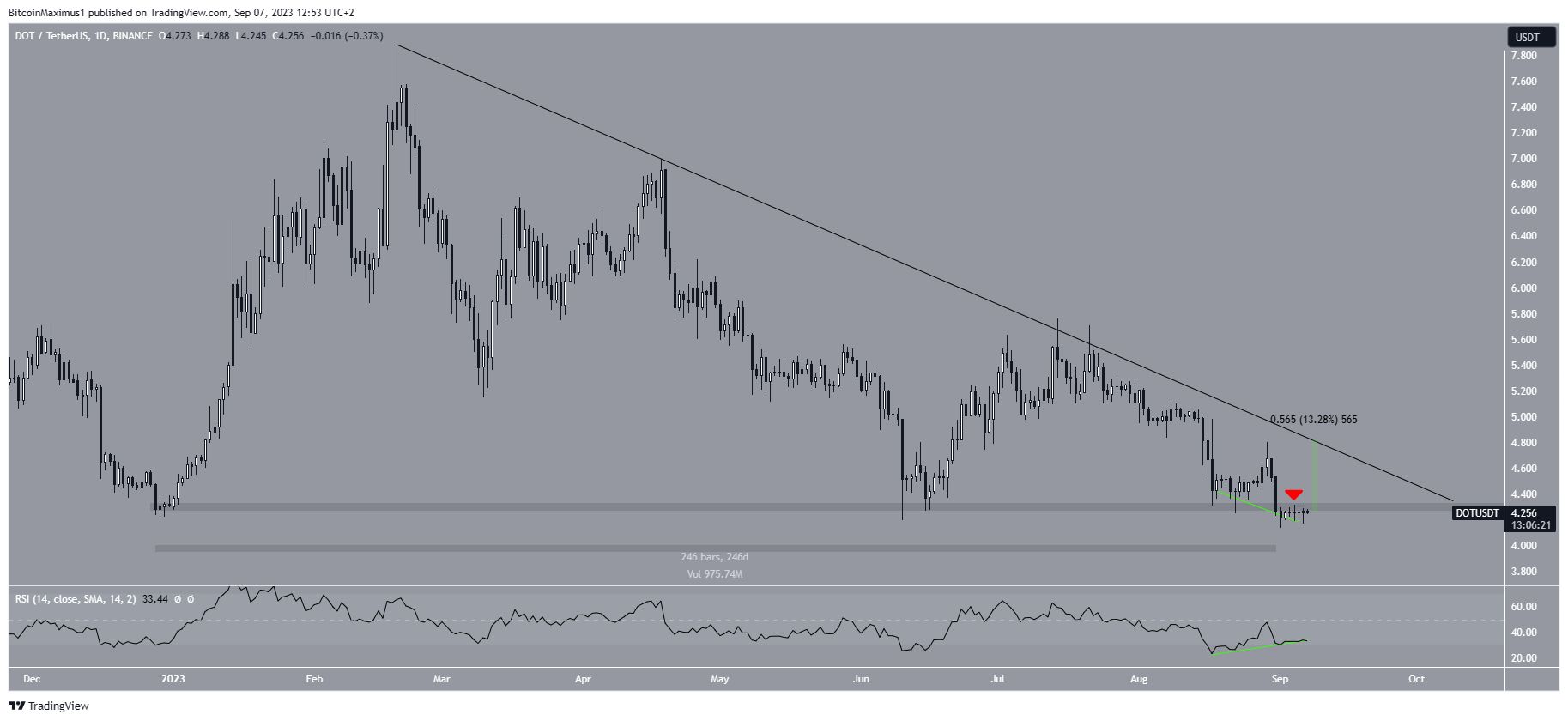

The technical analysis for the daily timeframe shows that the $DOT price has fallen under a descending resistance line since Feb. 19. While doing so, the price also bounced at the $4.30 horizontal support area.

Combining this line and the support area creates a descending triangle, considered a bearish pattern.

Crypto investing, simplified. Get $DOT price predictions here.

On September 1, the $DOT price finally fell and closed below the $4.30 support area. At the time of the breakout, the area had been in place for 246 days.

The daily close of $4.21 was the lowest since November 2020. Even though the price has not accelerated its rate of decrease yet, it is validating the $4.30 area as resistance (red icon).

The daily RSI offers hope for a bullish trend reversal despite this bearish price action. Market traders use the RSI as a momentum indicator to identify overbought or oversold conditions and to decide whether to accumulate or sell an asset.

Readings above 50 and an upward trend indicate that bulls still have an advantage, whereas readings below 50 suggest the opposite.

The indicator has generated significant bullish divergence (green line). However, reclaiming the $4.30 area is required to confirm the divergence and cause a trend reversal. In that case, the descending resistance line will be at $4.80, 13% above the current price.

What Happens if Breakdown Gets Confirmed?

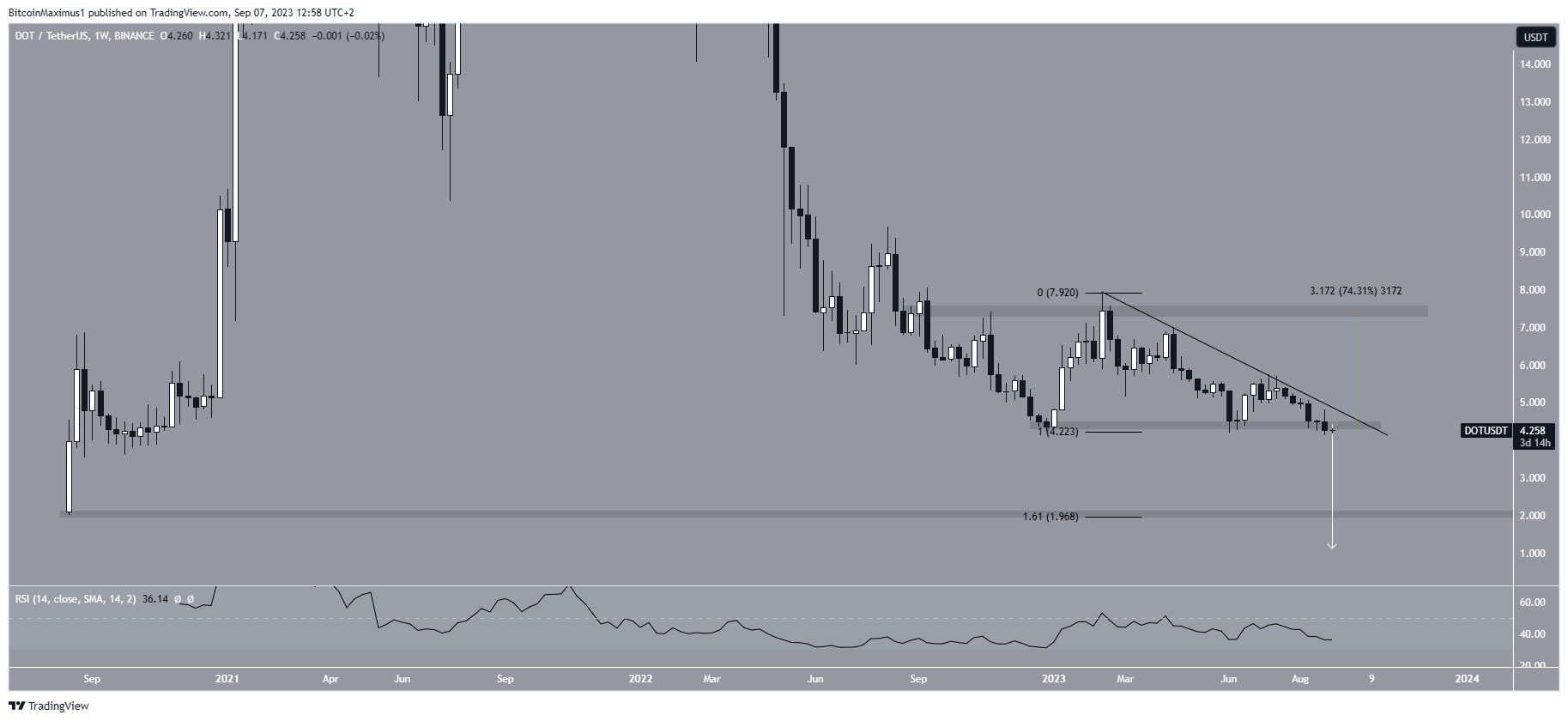

If the breakdown gets confirmed in the weekly timeframe, the $DOT price could quickly fall to $1. This would break the all-time low support region of $2. The target of $1.20 is found by projecting the triangle’s length to the breakdown point (white).

However, the $DOT price could bounce at the $2 region before it arrives. Besides being the all-time low support, the area is created by the 1.61 external Fib retracement level of the most recent upward movement.

Check Out the Best Upcoming Airdrops in 2023

The weekly RSI supports the continuation of the decrease. The indicator is below 50 and falling, both considered signs of a bearish trend.

Despite this bearish $DOT price prediction, a breakout from the long-term descending resistance line will invalidate the ongoing drop and could cause a 75% upward movement to the $7.40 resistance area.

beincrypto.com

beincrypto.com