The cumulative Bitcoin Cash deposits in recognized Miners’ Reserve wallets have dropped below 6 million BCH for the first time since November 2018. On-chain analysis examines how the growing bearish pressure puts the $150 BCH price support level at risk.

As of September 6, 2023, Bitcoin Cash balances in recognized Miners’ Reserve wallets are 5.9 million BCH, the lowest in 5 years. What implications could this have on BCH’s price in the coming weeks?

Miners Have Offloaded $225M Since BCH Price Hit 2023 Peak

Bitcoin Cash’s price reclaimed $300 on June 30, 2023, after spending 14 months below the mark. BCH miners have taken advantage of that price rally to offload their reserves at favorable prices.

According to data from IntoTheBlock, the Miners held 7.16 million coins when BCH hit the 2023 price peak of $329 on June 30. But as of September 6, only 5.99 million BCH is left in their cumulative balances, showing a decline of 1.17 million.

Miners Reserves tracks the balances of wallet addresses belonging to recognized miners and mining pools. When benchmarked to the current market prices, the 1.17 million BCH drop means that the miners have offloaded coins worth $225 million since the June 30 local top.

The miners had initially accelerated the selling pressure when the BCH price broke above $140 on June 21. This suggests that with BCH trading around $192, the miners still consider the current prices favorable.

From an on-chain perspective, they would likely keep selling until the Bitcoin Cash price retraces below $150 again.

Are Large Institutional Investors Running Out of Gas?

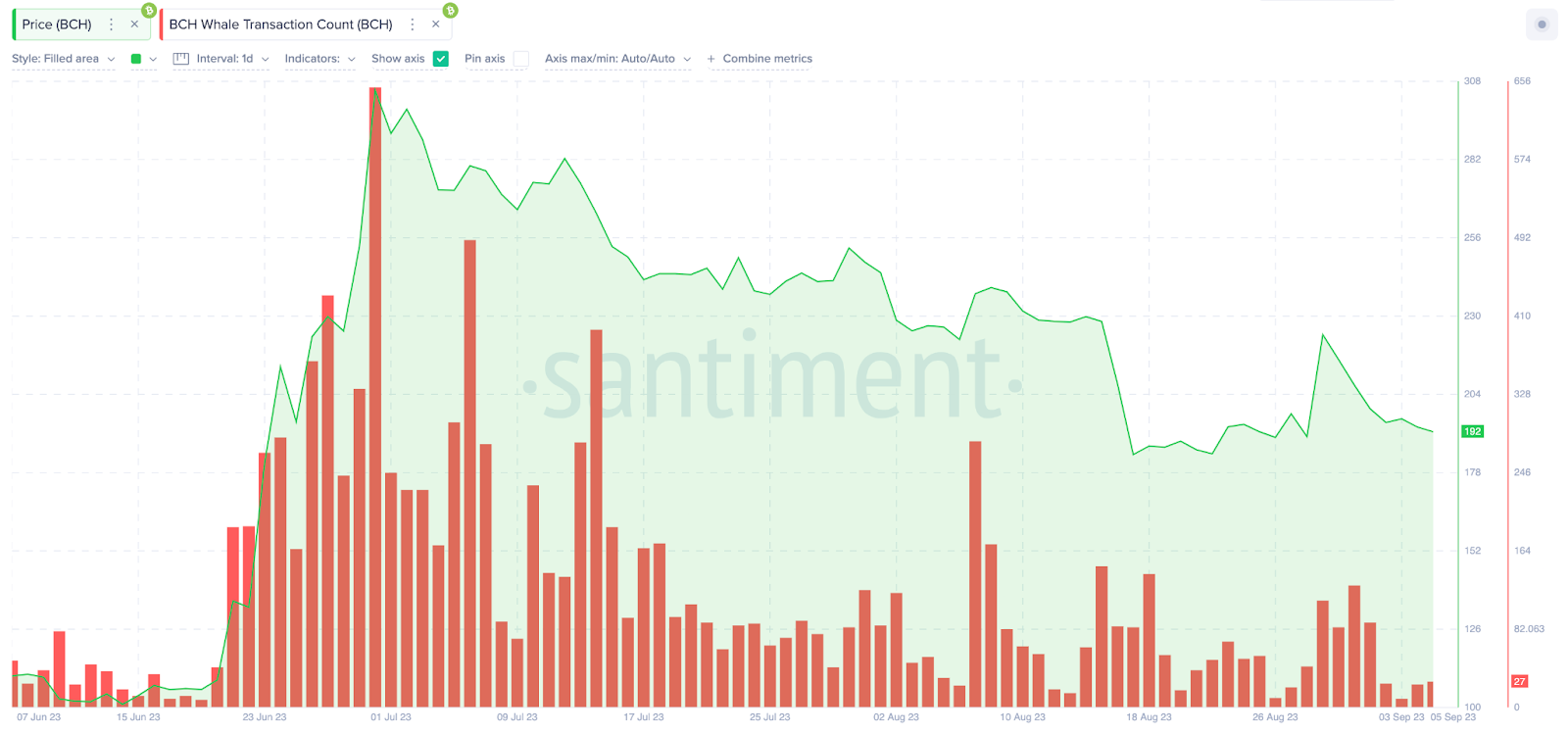

The rapid decline in whale transactions has recently become another worrying trend for Bitcoin Cash holders. Santiment data shows that the recent BCH price movements over the past two months have been closely correlated to the changes in Whale Transaction Count.

Worryingly, peak whale activity on the Bitcoin Cash network has been steadily declining for 3-months consecutively. BCH Whale activity peaked at 650 transactions for June. But only mustered a peak of 490 and 279 in July and August, respectively.

Whale Transaction summarizes the number of confirmed trades exceeding $100,000 during a given period. A decline in whale activity not only sends a bearish signal to other investors but it also reduces market liquidity.

Some traders may be forced to lower prices without sufficient liquidity to fulfill trades efficiently. Hence, it ruffled a few bullish feathers when BCH recorded only 9 Whale Transactions on September 3, its lowest since June 19, when prices were around $105.

In summary, miners cashing out and the declining whale activity could combine to trigger a bearish reversal below $150.

How to Day Trade Crypto with the Supertrend Indicator

BCH Price Prediction: Possible Reversal Below $150

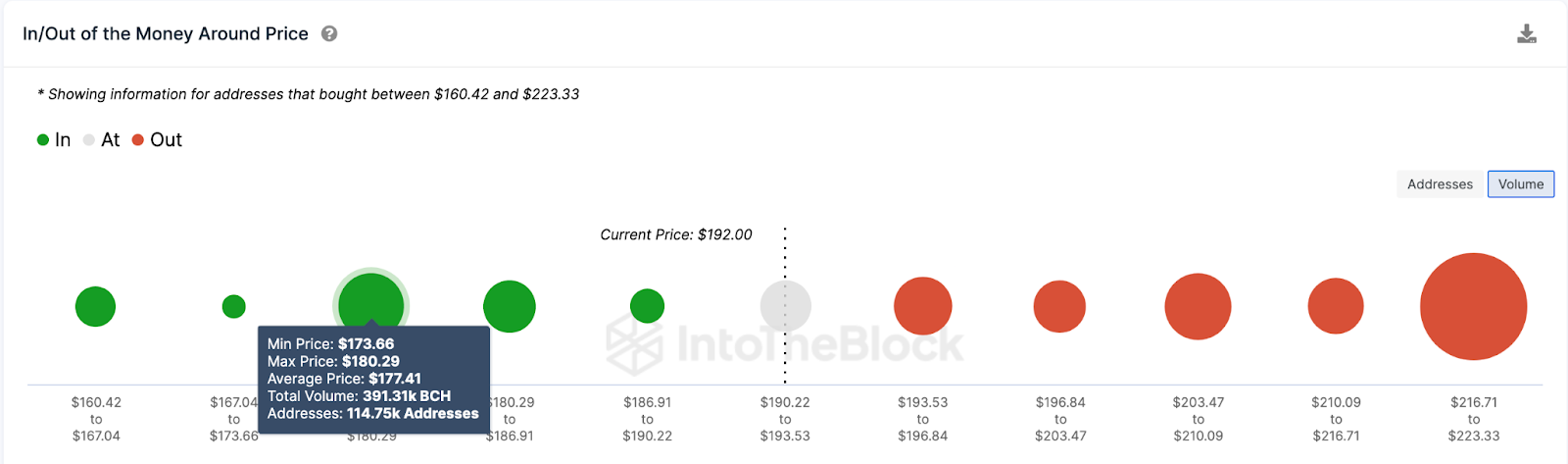

From an on-chain perspective, the mounting bearish pressure could spark a prolonged Bitcoin Cash price reversal toward the $150 range. The In/Out of Money Around Price data depicts the entry price distribution of the current BCH holders also validates this thesis.

It, however, highlights that bears will face considerable challenges around the $170 territory. As shown below, the 114,750 addresses had bought 391,300 BCH at the minimum price of $173. If they defend their positions, it could trigger a rebound.

But if the bearish miners keep selling, the Bitcoin Cash price could drop toward $150.

Conversely, the bulls could invalidate that pessimistic Bitcoin Cash price prediction by reclaiming $250. However, 60,120 addresses had bought 1.5 million BCH coins at the average price of $220. If they chose to sell at that level, that $220 resistance level could prove daunting for the bulls.

Although unlikely under the current on-chain circumstances, Bitcoin Cash’s price could eventually hit $250 if that resistance level does not hold.

On-Chain and Off-Chain Privacy in Web3: Differences Explained

beincrypto.com

beincrypto.com