As the new trading week unfolds, Stellar (XLM) emerges as a standout asset, hinting at the potential for a mini breakout.

The digital currency has surged impressively, boasting a remarkable 10% increase today, firmly establishing itself at a trading price of $0.1254. With a total market capitalization of $3.4 billion, Stellar currently holds the 20th position in the hierarchy of cryptocurrencies by market worth.

In the highly dynamic world of cryptocurrencies, XLM is currently ranked third in terms of total gains over the past 24 hours, trailing only behind Rocket Pool (RPL) with a remarkable 15% increase and Synthetix (SNX) with a substantial 13% gain.

XLM’s recent surge is raising eyebrows among market observers and analysts. Notably, this digital asset has consistently faced bearish sentiment and shorting pressure from the crypto community.

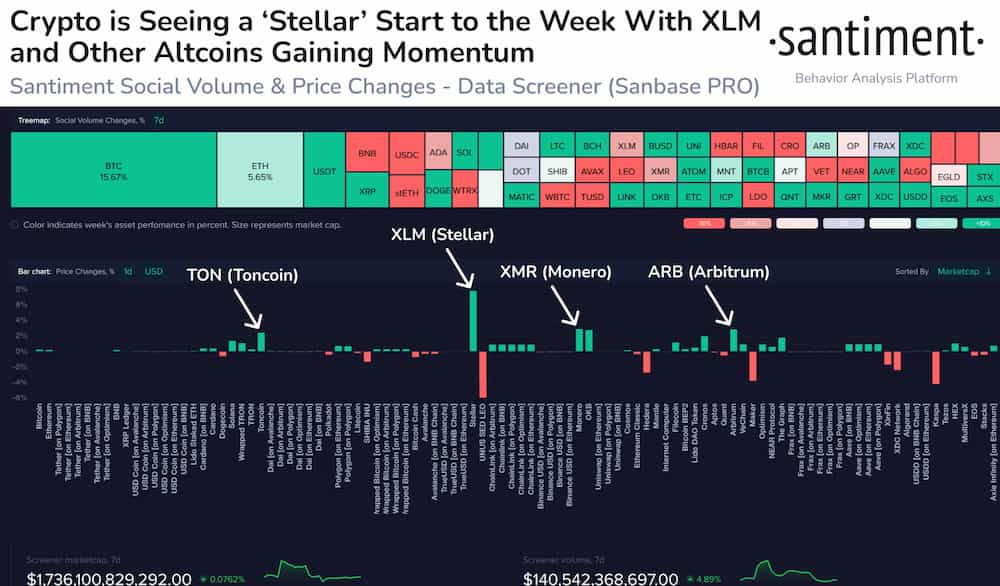

However, there are indications that liquidations in the market could contribute to a surge in the price of XLM. Santiment, a renowned crypto market intelligence platform, suggests that the ongoing liquidation activity could potentially act as a catalyst for an upward price movement.

“Stellar is the notable asset that is showing mini breakout potential. XLM is an asset that has been consistently shorted by the crowd, and liquidations could pump up the price”

Additionally, Santiment recommends keeping a watchful eye on other cryptocurrencies, including TON (TON), Monero (XMR), and ARBITRUM (ARB). These assets could potentially exhibit similar breakout potential or undergo significant market developments in the near future.

XLM price analysis

Stellar’s recent performance indicates that it may be on the cusp of a notable breakout. Currently, XLM is navigating between a support level at $0.11309 and a resistance level at $0.12926.

The $0.11309 support level serves as a critical threshold for XLM. Traders watching the $0.11309 support level closely will be monitoring for signs of XLM’s price bouncing off this level.

If XLM successfully holds above this support, it could signal a potential upward trend or a consolidation phase. However, if XLM breaches this support level, it may face additional selling pressure, potentially leading to further declines. Conversely, the $0.12926 resistance level is a key price point that has historically acted as a barrier for XLM’s upward price movement.

Breaking through the $0.12926 resistance level would be a significant achievement for XLM. It could signal a bullish sentiment in the market and potentially pave the way for further price appreciation. However, overcoming resistance levels can be challenging, and it often requires substantial buying volume and positive market sentiment.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com