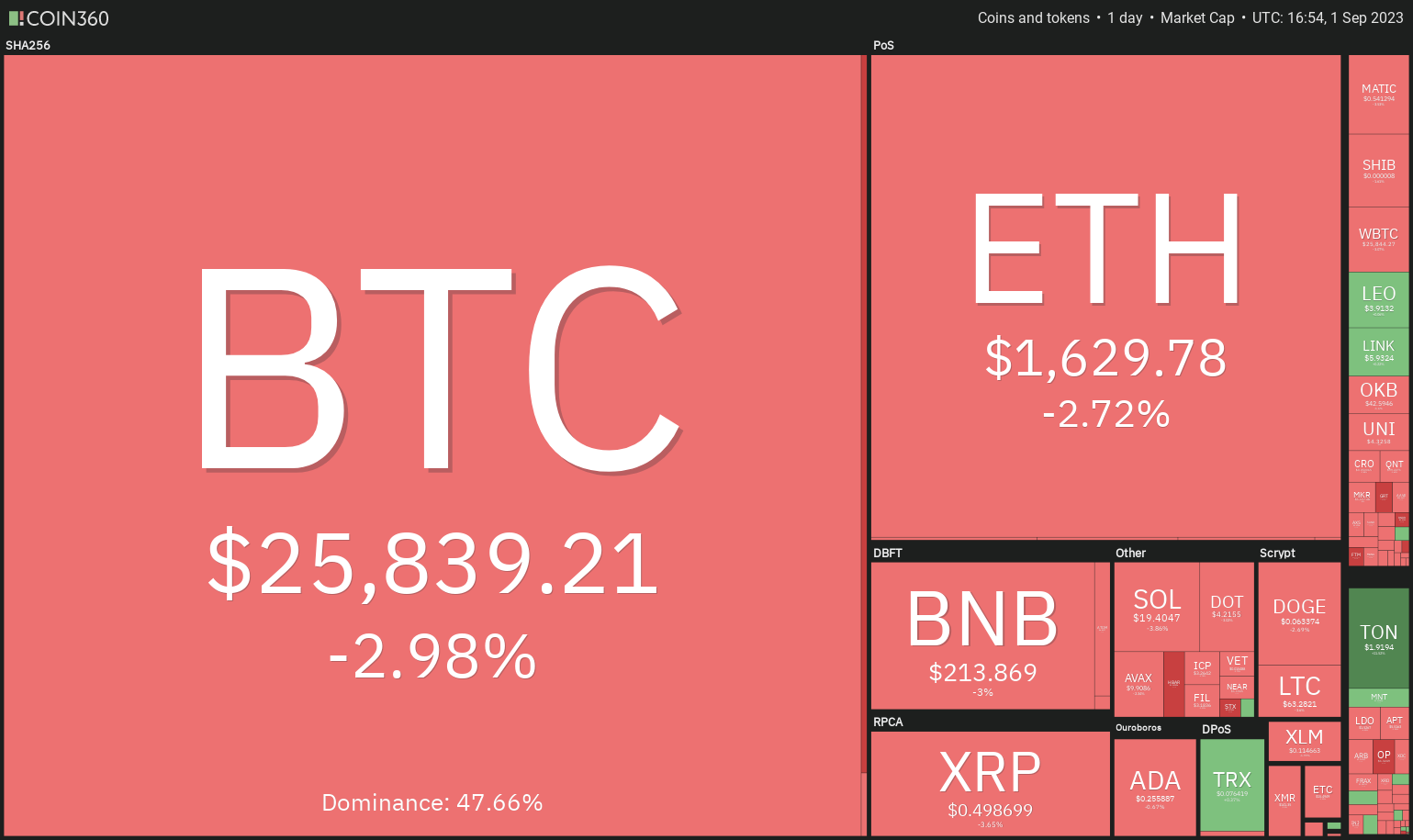

Bitcoin’s (BTC) volatility has increased over the past few days. The price soared on Aug. 29 after Grayscale scored a victory over the United States Securities and Exchange Commission (SEC). However, the euphoria was short-lived as the price gave back all the recent gains on the news that the SEC delayed the decision on all seven spot Bitcoin exchange-traded fund applications.

News related to Bitcoin ETFs has been the major trigger for the markets in the past few days. Bloomberg ETF analysts remain upbeat over the possibility of the ETFs being approved by the regulator in 2023. In an Aug. 30 post of X (formerly Twitter), Bloomberg senior ETF analyst Eric Balchunas bumped up the approval possibility of a spot Bitcoin ETF from 65% to 75%.

In the near term, the bulls face an uphill battle as September has traditionally favored the bears. According to CoinGlass data, Bitcoin has seen negative returns in September for the past six consecutive years. Will the trend continue in 2023?

The weakness in Bitcoin is affecting several major altcoins, which have dropped close to their strong support levels. Will the decline extend further or is it time for a bounce to happen? Let’s study the charts of the top-10 cryptocurrencies to find out.

Bitcoin price analysis

The bulls failed to defend the 20-day exponential moving average ($26,947) on Aug. 31. That started a sell-off which pulled Bitcoin below the breakout level of $26,833.

The price action of the past few days shows that the BTC/USDT pair has been oscillating inside the large range between $24,800 and $31,000. Typically, traders buy the dips to the support of the range and sell near the resistance. The same is expected from the bulls at $24,800.

If bears want to seize control, they will have to sink and sustain the price below $24,800. If that happens, the pair may extend the fall to $19,500. There is a minor support at $24,000 but that may not hold for long.

Ether price analysis

Ether’s (ETH) rebound off the strong support at $1,626 fizzled out at $1,745 on Aug. 29. This indicates that bears remain active at higher levels.

The bears will try to build upon their advantage by pulling the price below the $1,626 to $1,550 support zone. If they are successful, it will signal the start of a new downtrend. The ETH/USDT pair could then nosedive to the next formidable support at $1,368.

Alternatively, if the price sharply rebounds off the current level, it will indicate that the bulls are fiercely defending the support. That could drive the price to the 20-day EMA ($1,702) and subsequently to $1,745 which may act as a resistance.

BNB price analysis

BNB’s (BNB) recovery halted at the 50-day SMA ($234) on Aug. 29 and the bears yanked the price below the important support at $220 on Aug. 31.

The moving averages are sloping down and the RSI is in the negative territory, indicating that bears have the upper hand. The bears will try to sink the price to the psychological support at $200. If this level collapses, the BNB/USDT pair could reach the next major support at $183.

If bulls want to start a relief rally, they will have to push the price back above the 20-day EMA ($222). The pair could then climb to the 50-day SMA and later to the resistance line.

XRP price analysis

The long tail on XRP’s (XRP) Aug. 31 candlestick shows that the bulls are trying to protect the support at $0.50. However, the price action on Sep. 1 shows that the bears are keeping up the pressure.

If the price plunges below $0.50, it will suggest that bears are back in control. That could start a downward move to the formidable support at $0.41. The bulls are likely to defend this level with vigor. A bounce off the support could keep the XRP/USDT pair range-bound between $0.41 and $0.56 for some more time.

If the price rebounds off $0.50, it will suggest that the pair may attempt a rally to $0.56. The bulls will have to overcome this roadblock to start a new up-move to $0.63 and thereafter to $0.73.

Cardano price analysis

Cardano (ADA) has been range-bound between $0.28 and $0.24 for the past several days. The bulls kicked the price above the range on Aug. 29 but could not sustain the higher levels.

That may have tempted the short-term bulls to bail out of their positions. The selling picked up further and the price slipped below the uptrend line on Aug. 31. The bears will next try to sink the ADA/USDT pair below the vital support at $0.24.

If the price rebounds off $0.24, the pair may continue to consolidate inside the range for a while longer. On the contrary, if the price dips below $0.24, it will signal the start of a down move to $0.22 and eventually to $0.20.

Dogecoin price analysis

The bulls are struggling to start a recovery in Dogecoin (DOGE), indicating that demand dries up at higher levels.

The DOGE/USDT pair could dip to the solid support at $0.06. Buyers are expected to defend this level with all their might because a break below it may resume the downtrend. The pair could first skid to $0.055 and then to the final support near $0.05.

On the contrary, if the price rebounds off $0.06, it will signal that the bulls are buying the dips to this level. The bulls will then again try to overcome the obstacle at the 20-day EMA. If they succeed, the pair may surge to $0.08.

Solana price analysis

Solana (SOL) returned from the 20-day EMA ($21.37) on Aug. 30, which shows that bears remain in command. The price has reached the vital support at $19.35.

The 20-day EMA is sloping down and the RSI is in the negative zone indicating that the path of least resistance is to the downside. If the $19.35 support gives way, the selling could intensify and the SOL/USDT pair may slide to $18.

Time is running out for the bulls. If they want to start a recovery, they will have to quickly shove the price above the overhead resistance at $22.30. If they do that, the pair may soar toward $26. The 50-day SMA ($23.42) may act as a hurdle but it is likely to be crossed.

Related: Bitcoin lines up RSI showdown as BTC price slips toward new 2-week low

Toncoin price analysis

Toncoin (TON) is in a strong uptrend. The bears tried to stall the rally near $1.77 but the bulls did not give up much ground. That shows that the bulls are in no hurry to book profits.

Buying resumed on Sep. 1 and the TON/USDT pair has reached the pattern target of $1.91. If buyers scale this level, the up-move may continue and the pair may skyrocket to $2.38. This level may witness profit-booking by the traders.

This bullish view will be invalidated if the price turns down and breaks below $1.66. Such a move will suggest aggressive selling at higher levels. That could then sink the pair to the breakout level of $1.53.

Polkadot price analysis

Polkadot (DOT) turned down from the 20-day EMA ($4.56) on Aug. 30, indicating that the sentiment remains negative and traders are selling on rallies.

The selling picked up further on Aug. 31 and the DOT/USDT pair dropped to the vital support at $4.22. This level is likely to witness a battle between the bulls and the bears. If the price plummets below $4.22, the pair could start the next leg of the downtrend to $4.

Buyers have their tasks cut out. If they want to make a comeback, they will have to quickly drive and sustain the price above the 20-day EMA. If they manage to do that, the pair could surge to the overhead resistance at $5.

Polygon price analysis

Polygon’s (MATIC) failure to maintain above the 20-day EMA ($0.58) on Aug. 29 may have attracted profit-booking from short-term traders. The bulls tried to push the price back above the 20-day EMA on Aug. 30 and 31 but the bears held their ground.

The bears will try to strengthen their position by pulling the price below the immediate support at $0.53. If they can pull it off, the MATIC/USDT pair may slump to the crucial support at $0.51.

If the price turns up from the current level, it is likely to face selling at the 20-day EMA and again at the 50-day SMA ($0.66). On the other hand, a break below $0.51 could resume the downtrend. The next support is at $0.45.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

cointelegraph.com

cointelegraph.com