The ripple effect from Grayscale’s landmark victory has not swayed the bearish Axie Infinity (AXS) long-term holders as the price remains rooted below $5. On-chain data analyses the chances for AXS bulls scaling the $5 sell wall in the coming days.

As the crypto market rebounded on Aug 29, Axie Infinity (AXS) price also scored a sizeable 4% bounce. However, the bears have made spirited efforts to resist a breakout, forcing a downswing below the critical $5 resistance level.

Can the bullish whale investors absorb the selling pressure from the Axie Infinity long-term holders in the coming weeks?

Whale Investors are Pushing for More Gains

On-chain data shows that Axie Infinity whales have made spirited efforts to scale the $5 resistance. In fact, they had started to stack up their bags weeks before the much-heralded Grayscale ruling flipped the market momentum.

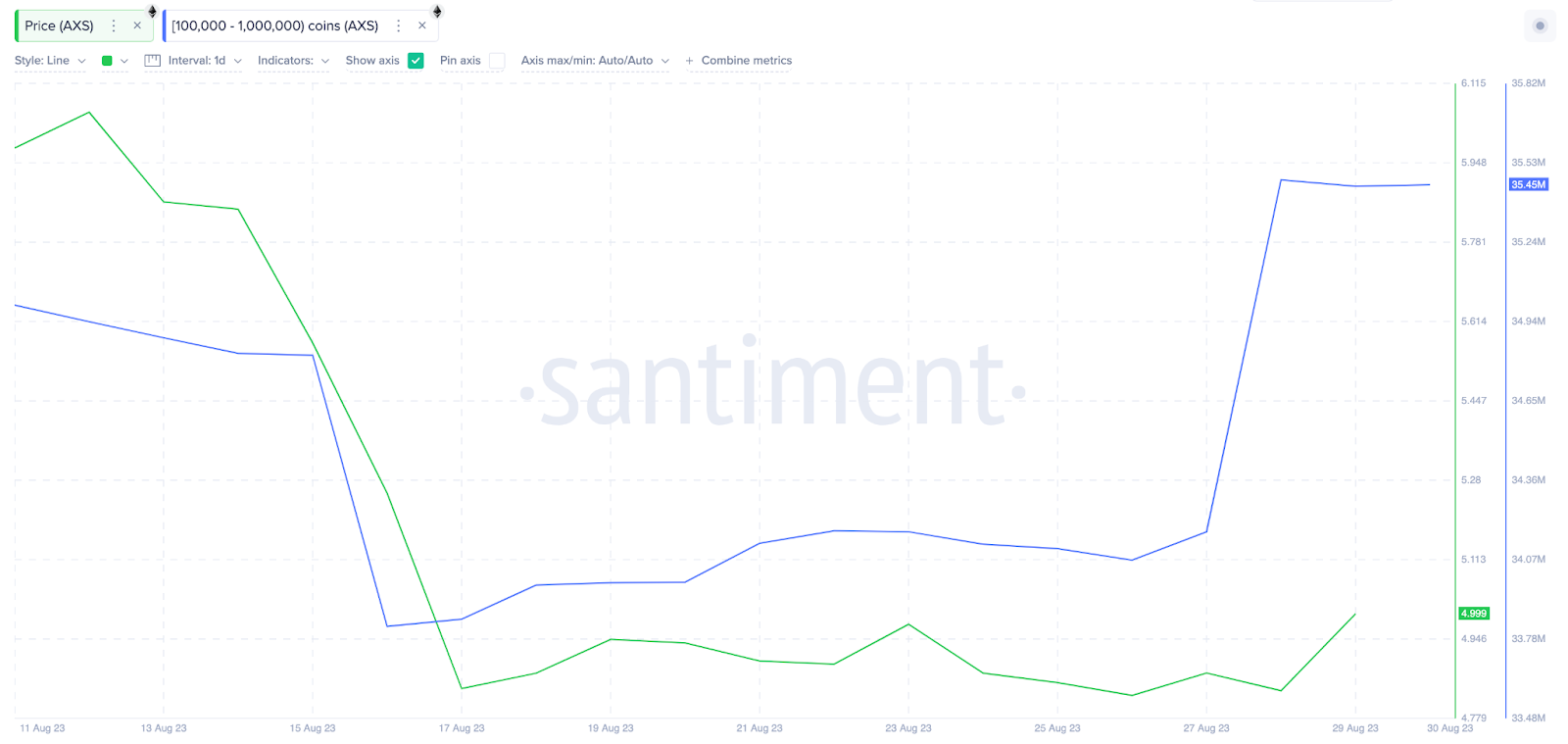

The cluster of Axie Infinity whales holding 100,000 to 1,000,000 coins has been buying since August 16. As shown below, between August 16 and August 30, they added 1.63 million tokens to their cumulative AXS balances.

With AXS currently trading around $4.91, the newly-acquired 1.63 million tokens are worth nearly $8 million. Notably, the recent trading patterns of this whale cohort have been closely correlated to price action.

Hence, if they can keep up their positive disposition, AXS price could deliver more gains in the coming weeks.

Empower your investments with AXS price predictions.

Axie Infinity Long-term Holders are Capitalizing on the Price Bounce to Book Profits

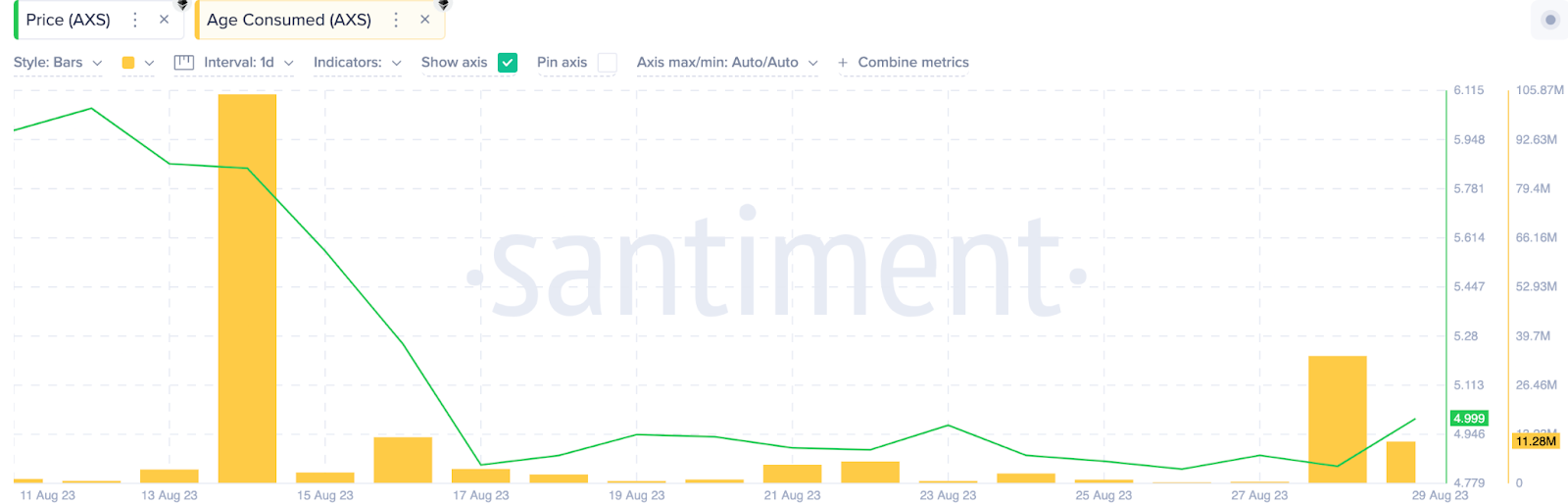

The bearish trading activity among AXS long-term holders has the bullish whales’ efforts this week. As seen below, Axie Infinity has recorded noticeable spikes in Age Consumed in the last few days. AXS Age Consumed exceeded 34 million on August 28. This is the highest since the 104.82 million recorded on August 14 which triggered a 20% price correction.

Age Consumed is a critical on-chain metric that tracks changes in the trading activity of long-term holders. It is derived by multiplying recently traded coins by the number of days since they were last moved. Typically, spikes in Age Consumed means that many long-held tokens have been traded during that period.

Multiple spikes in AXS Age Consumed this week, mean that many long-term holders are taking advantage of the price bounce to cash out.

In summary, the long-term holders cashing out will pose significant resistance to the bullish whales’ efforts. If neither group lets off on their current stance, the AXS price trend will likely remain neutral in the coming weeks.

Looking For a New Exchange? These Are the Best Crypto Sign-Up Bonuses in 2023

AXS Price Prediction: Consolidation Around the $4.80 Range

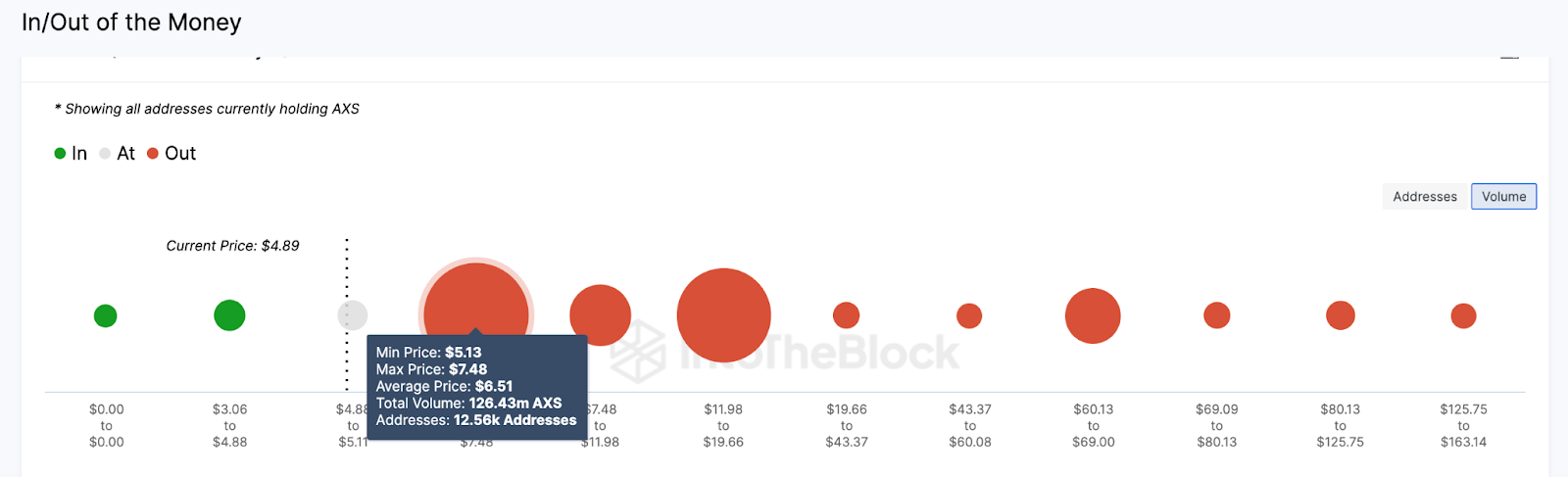

Unless whales enter another buying frenzy, chances of a significant break out above $7 are quite slim.

The In/Out of Money Around Price data, which depicts the entry price distribution of the current AXS holders, also emphasizes this prediction. It depicts that 12,560 wallet addresses had bought 126.43 million AXS tokens at the minimum price of $5.13.

They could pose significant resistance, especially if the long-term investors continue to cash out. But if the bulls push past that resistance level, Axie Infinity’s price could hit $7.

Yet, the bears could seize control if Axie Infinity’s price drops below the $4 range. Although, the 849 addresses had bought 1.04 million AXS at the average price of $4.66. If they hold their positions, AXS price could enter a rebound.

But if that support level cannot hold, AXS’s price could eventually drop below $4. Currently, bears appear to remain in control.

beincrypto.com

beincrypto.com